Pillar 3a

Take advantage of tax benefits and save for retirement

AHV and the pension fund will not usually be enough to maintain your accustomed standard of living in retirement. We offer two pillar 3a retirement solutions which benefit you now and later.

Tax advantages

Tax advantages

Tax deduction for pillar 3a deposits

Save for old age

Save for old age

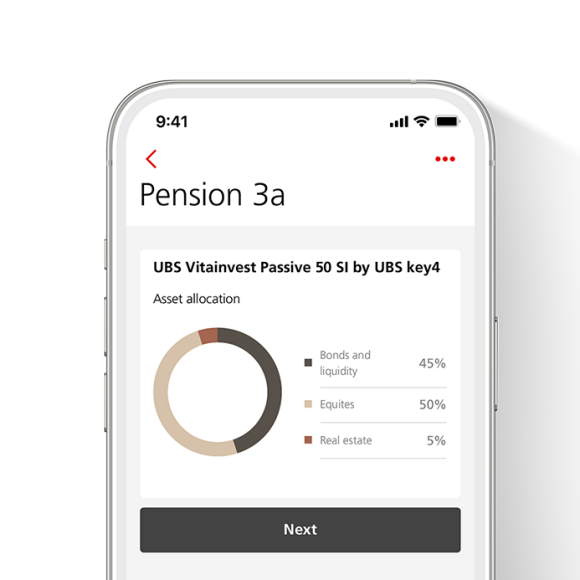

Additional investment for systematic wealth accumulation

Early withdrawal

Early withdrawal

To purchase residential property or repay a mortgage