Pillar 3a at a glance

Save on taxes

Deduct contributions from your taxable income and save on taxes.

Potential returns

Benefit from potential returns from Vitainvest investment funds while your 3a account offers stable interest rates.

Early withdrawal

You can make an early withdrawal, for example to purchase residential property or if you become self-employed or emigrate.

Pillar 3a in a nutshell

Our Fisca 3a retirement account

The UBS Fisca 3a retirement account is intended for all employed persons subject to OASI/IV contributions. You save flexibly for retirement with free account management and an annual account statement. You can deposit as much as you like up to the legal maximum amount.

With the UBS Fisca 3a retirement account, you can invest sustainably and benefit from higher potential returns. The investments remain tax-free during the savings phase and can be transferred to your free assets upon retirement, except for certain passive funds.

When is the right time to save for your retirement? Right now!

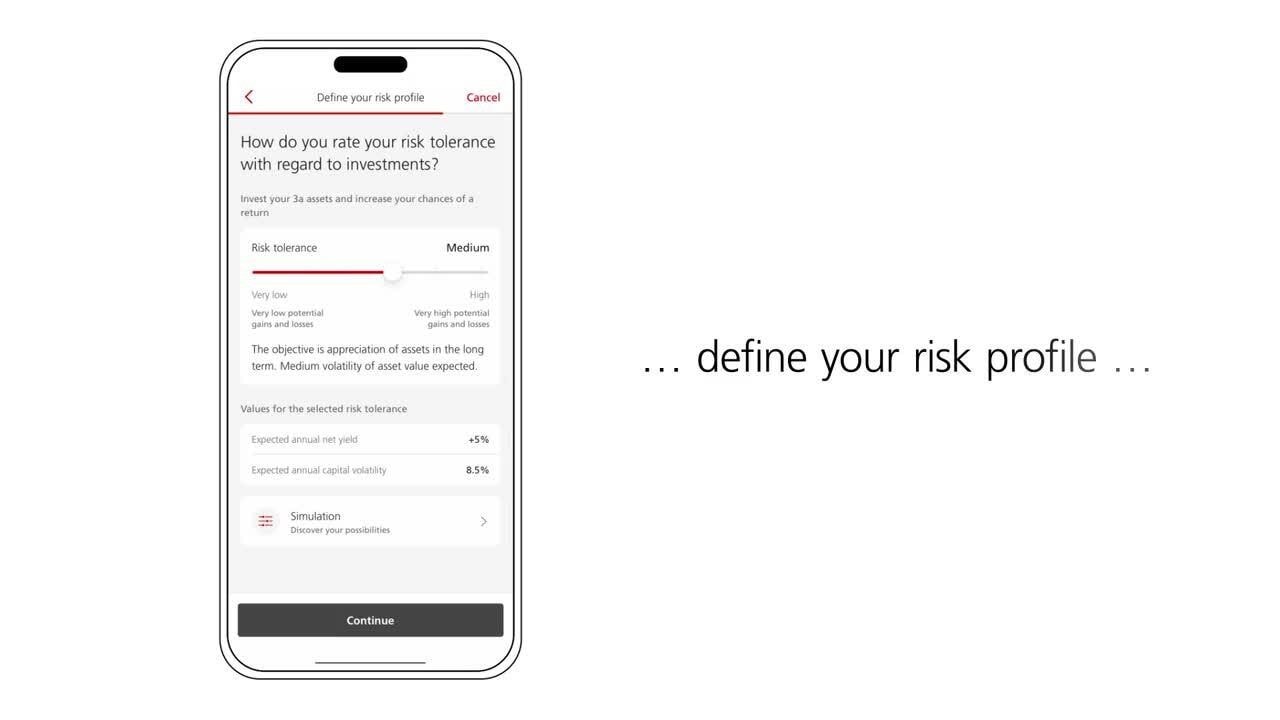

- 01

Define your risk profile

Answer just a few questions to find out which 3a pension solution suits you best.

- 02

Discover our recommendations

We propose different pension solutions, and you choose the one that suits you and the way you live your life.

- 03

Open your 3a pension solution

Open the 3a pension solution directly in the Mobile Banking App and choose how much and how often you would like to deposit for your future.