The most important information at a glance

The most important information at a glance

- A home ties up a lot of capital and represents a cluster risk for asset growth.

- Using excess cash to amortize your mortgage in full is not a worthwhile strategy, even if interest rates go up.

- A moderate loan-to-value ratio on your property will allow you to invest liquidity in real assets such as equities or real estate investments with higher expected returns.

- However, this also entails risks: Investment portfolios are always subject to fluctuations in value. In addition, rising interest rates can push up financing costs, depending on the term of the mortgage.

Although real estate is not a savings account, it’s a good way to build up wealth when combined with a mortgage. Let’s take a real-life scenario to illustrate this.

The Muster family owns a home worth one million francs. The value of the property has increased in recent years, and at the same time, the family has been paying off part of the mortgage each year. Mortgage debt currently accounts for only around 60 percent of the property value.

Let’s also assume that the family holds 600,000 francs of liquidity. The money is currently parked in a bank account where it earns virtually no interest at all. Now, a significant increase in inflation rates is causing the family to rethink their finances. The analysis is clear: inflation is eating up some of their cash. As property owners, they have three options to choose from:

- Amortize their mortgage: As interest rates rise, many property owners and occupants consider additional amortization. This is because mortgages cost more today than during a low-interest period. But if they opt for the seemingly simple repayment option, their assets will be invested in their home – making the family highly dependent on the future performance of the property market.

- Don’t change anything: Inflation and mortgage interest rates are rising, with no returns on abundant liquidity. This means that when adjusted for inflation, the family is losing wealth.

- Invest money: The family could decide to maintain a moderate loan-to-value ratio and opt for longer-term investments such as equities with high dividends, a mixed international equity portfolio or Swiss real estate funds.

Keeping hold of a mortgage, especially in periods of inflation, can help build up wealth much faster than with a perceived safe repayment strategy.

Wealth accumulation tool

Wealth accumulation tool

For option three, it is important to remember that every household should keep some cash in reserve. This means that the free funds of 600,000 francs are not available in their entirety. The family can however make use of a large proportion of this amount. The economists on the UBS CIO team (Chief Investment Officer) have done a number of calculations for each option and come to a clear conclusion: “Keeping hold of a mortgage, especially in periods of inflation, can help build up wealth much faster than with a perceived safe repayment strategy.” The economists recommend conserving a moderate loan on the property and not amortizing the mortgage any more than necessary. Debts, i.e. a mortgage, lose value due to inflation, while the value of property increases in nominal terms.

By investing the money cleverly, it is possible to generate an increase in wealth, especially with tangible assets such as equities. What really makes a difference is the long-term yield. For it to be really worthwhile, the income generated should of course be higher than the interest on the mortgage. With option three, there is a high probability of achieving a significant advantage in terms of returns. According to the CIO study, the current expected long-term returns on a diversified model portfolio denominated in Swiss francs are around 4.5 to 5 percent. This is well above the current mortgage cost of around 2.5 to 2.7 percent for a 10-year fixed-rate mortgage.

The conclusion is obvious: Anyone who remains passive and leaves their liquidity lying in an account earning more or less no interest has to be prepared to accept value losses. However, if the family in our case study invests a large part of their assets, they will achieve a larger increase in wealth even after deducting all the costs. Incidentally, taxes do not change this finding. It is common knowledge that homeowners must pay tax on the imputed rental value of their property, and can deduct mortgage interest in return. However, owner-occupied rent tax is incurred either way, and should not be a criterion for how a household uses its cash.

Investing – what generates returns?

Investing – what generates returns?

A strategy with a large proportion of Swiss equities is the obvious choice. People under the age of 50 may consider investing in a high share of equities because the investment horizon can be assumed to be longer. Equities are attractive simply because of the dividend yield of over 3 percent. As a tangible asset, they also promise longer-term capital appreciation in excess of inflation. The alternative to equities is a Swiss real estate fund. Here, too, it is the comparatively good returns that make the investment so attractive – at around 2.8 percent, the distribution is currently about the same as the interest rate for mortgages. In a similar way to equities, real estate funds are expected to grow in value over the longer term. What’s more, they offer tax advantages. This is because the distributions from real estate funds with direct property holdings are tax-free for investors.

Investments always involve a certain degree of risk. According to the CIO study, there is a 26 percent likelihood that the anticipated additional revenues will not be achieved after all. This has to do with the fact that stock markets are fundamentally volatile and carry the risk of “underperformance”. For example, 2022 was a poor investment year, but it is very rare that this occurs to such an extent. Having a longer investment horizon and implementing a strategy are always the decisive factors.

What are the risks?

What are the risks?

“One of the risks related to the capital investment strategy could be significant interest rate increases,” explains Matthias Holzhey, an economist at UBS and one of the authors of the study. If the Swiss National Bank (SNB) raises key interest rates more than expected in the coming months and years, this would of course increase the interest costs of the mortgage in our case study. At the same time, higher interest rates generally mean value adjustments on investments in equities or real estate funds. Although this scenario is unlikely, certain precautions can be taken. “You can hedge risks well with fixed-rate mortgages,” says Matthias Holzhey. Anyone who takes out a 10-year fixed-rate mortgage will be capable of weathering any interest rate increases, for instance.

Conclusion

Conclusion

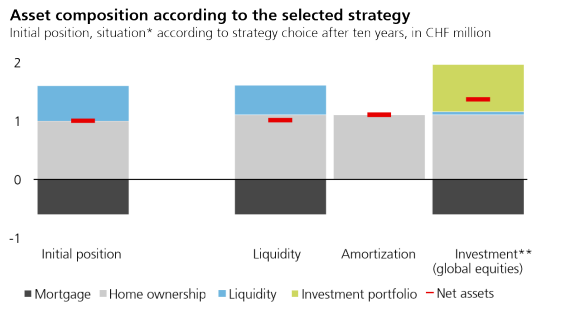

The figures from the CIO study for the next ten years speak for themselves (see graphic): Anyone who keeps hold of their mortgage and invests in a global equity portfolio will fare much better. The household’s total assets – after deducting mortgage costs, of course – will be more than a third higher than without investment.