We’re here for you

Arrange an appointment for a non-binding consultation or if you have any questions, just give us a call.

![]()

header.search.error

Real estate financing

How much equity do you need to buy a house? Learn all about real estate financing, mortgage models and get important tips.

Content:

Owning a home is an important life goal for many people. But before you buy a property, you should take a close look at the financing options available to you. Equity capital is particularly important here: how much of it do you really need? What financing options are available, and what should you look out for to avoid risks?

This article provides a comprehensive overview of real estate financing in Switzerland. You will learn what counts as equity, how much you need to buy a house and what mortgage models are available. We also give you practical tips on how to make your financing secure and sustainable in the long term – so your dream of owning your own home can become a reality.

If you want to buy a property, the question quickly arises: what exactly counts as equity? The answer is more varied than many people think. In addition to traditional balances in savings and salary accounts, other assets can also be taken into account, including securities such as stocks or funds as well as valuables such as jewelry, paintings or classic cars. Even unencumbered building land or the repurchase of an insurance policy can be counted as equity.

There are also ways to increase your equity with support from your family, such as through advance inheritance payments or gifts. Funds from pillar 3a can also be used in full to finance your home and are also counted as equity.

A basic distinction is made between “hard” and “soft” equity when buying a house. “Hard” equity includes everything that is directly available, such as savings or gifts. “Soft” equity, on the other hand, refers to funds that must first be made available through certain steps, such as the early withdrawal of pension funds from pillar 2 (occupational pension plan). Under certain conditions, these funds can also be used to purchase real estate.

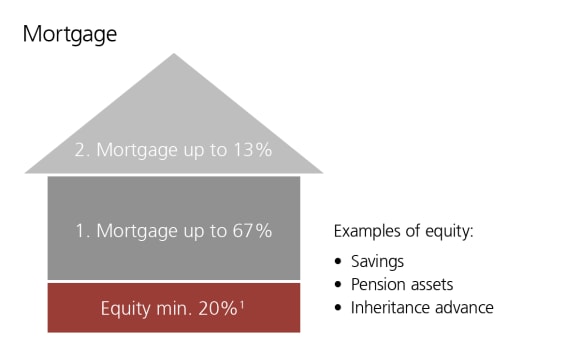

Those wishing to buy a home in Switzerland usually have to finance 20% of the market value of the property through equity capital. The remaining 80% can be covered by a mortgage. There are two types of mortgage: first and second mortgages.

The first mortgage covers up to two-thirds of the purchase price and does not have to be amortized, which means it does not have to be repaid as long as the property is owned. The second mortgage, however, is used to finance the remaining amount and must be amortized within 15 years – or by retirement – through regular repayments.

Important: At least 10% of the purchase price must come from “hard” equity, such as savings or gifts. The remaining 10% can be covered by an advance withdrawal from the pension fund (pillar 2). However, this “soft” equity capital cannot be used to reduce the size of the mortgage. Accordingly, the mortgage can be up to 90% of the purchase price in this case.

Different rules for vacation homes and investment properties

If you want to buy a vacation home or a luxury property, stricter requirements apply. As a rule, you must contribute 40% of the purchase price from your own funds. In addition, you may not use pension funds from pillar 2 or pillar 3 as equity for these properties.

Different rules apply to investment properties, i.e. properties that you rent out or use as a capital investment. In this case, you can borrow up to 75% of the property value. However, you must reduce the mortgage to two-thirds of the property value within 10 years. You may only use pension funds if you live in part of the property yourself.

Can you afford your dream home?

With our mortgage calculator, you can calculate the affordability, costs and your financial flexibility when buying real estate.

There are various mortgage models available in Switzerland for financing a home. Each model has its advantages and disadvantages, which you should weigh up carefully:

A fixed-rate mortgage offers you planning security because the interest rate is fixed for the entire term. You always pay the same interest rate regardless of market fluctuations. This model is particularly suitable for those who value stability and do not want to take risks.

A SARON mortgage is based on the SARON (Swiss Average Rate Overnight), a reference interest rate adjusted daily. This model combines flexibility with transparency and is often cheaper than a fixed-rate mortgage. It is suitable for people who are willing to take on a certain amount of interest rate risk in order to benefit from potentially lower interest rates.

Before taking out a mortgage, you should carefully analyze your financial situation and your long-term goals. Compare the advantages and disadvantages of each model and seek expert advice if necessary. Sound advice will help you find the right solution for you.

Financing a home offers many opportunities but also involves some risks that you need to understand. Careful planning can help you avoid unpleasant surprises. The most important challenges include:

You’ve found your dream property and would like to use part of your retirement savings to purchase it? That’s possible. You can use your pension fund (BVG) balance to purchase or build a home. An advance withdrawal is also permitted for refurbishments, renovations or to amortize existing mortgages.

You can find out how much money is available to you from pillar 2 on your pension statement. However, there are some important prerequisites that you should bear in mind:

Additionally, the following conditions apply for the early withdrawal of pension fund assets:

Withdrawing funds from your pension fund can help realize the dream of owning a home. Please consider that this has an impact on your retirement plan. It is therefore essential that you seek advice from a specialist in order to weigh up the long-term consequences and make the best decision for your financial future.

Do you have questions about mortgage interest rates?

Here you will find information about the current interest rate environment, interest rate forecasts and long-term interest rate trends. We also show you which economic factors influence mortgage rates.

Financing your own home offers a lot of opportunities but also involves risks, many of which you can insure yourself against. One option is to take out term life insurance, which protects your family against unforeseen financial difficulties. In the event of your death, your surviving dependents – such as your partner or children – will receive compensation that can be used in whole or in part to pay off the remaining mortgage. The amount of coverage depends on the type of insurance you choose.

In addition, it is advisable to build up financial reserves as a risk buffer before buying a home. Such reserves help you to cushion temporary losses of income – for example, due to unemployment, illness or an accident – without jeopardizing affordability. Accidents, illness or death can cause serious financial difficulties that affect the affordability of housing costs. Solid insurance coverage gives you the security you need to hold onto your home even in difficult times.

One of the most important questions in real estate financing is: can you afford your home in the long term? When granting a mortgage, the bank thoroughly checks whether the financing is viable in the long term. To do this, it compares the imputed costs of your home with your gross income.

The basic rule is: the total costs for your home should not exceed one-third of your gross income. This ensures that you can continue to finance your property even if your financial situation changes.

The monthly costs included in this calculation are:

Affordability is a crucial factor in ensuring you can finance your home not only today but also in the future. Careful planning and a realistic assessment of your financial capabilities are therefore essential.

How affordability is calculated

To calculate affordability, imputed interest rates are used rather than current market interest rates. These are fictitious interest rates that are deliberately set higher – usually at 5%. This is to ensure you can still finance your property even if interest rates rise in the future. In recent years, this value has always been above the market interest rates for mortgages.

In addition to imputed mortgage interest, other costs are also taken into account:

This conservative calculation method ensures you can keep your home in the long term, even if your financial circumstances change.

To better understand affordability and the role of equity, it is worth taking a look at concrete financing examples. In the table, various property prices are listed together with the corresponding financial requirements.

Real estate value (in CHF) | Real estate value (in CHF) | Minimum equity required (in CHF) | Minimum equity required (in CHF) | Annual imputed costs (in CHF)* | Annual imputed costs (in CHF)* | Required minimum gross income (in CHF)* | Required minimum gross income (in CHF)* |

|---|---|---|---|---|---|---|---|

Real estate value (in CHF) | 600,000 | Minimum equity required (in CHF) | 120,000 | Annual imputed costs (in CHF)* | 35,333 | Required minimum gross income (in CHF)* | 106,000 |

Real estate value (in CHF) | 800,000 | Minimum equity required (in CHF) | 160,000 | Annual imputed costs (in CHF)* | 47,111 | Required minimum gross income (in CHF)* | 141,333 |

Real estate value (in CHF) | 1,000,000 | Minimum equity required (in CHF) | 200,000 | Annual imputed costs (in CHF)* | 58,889 | Required minimum gross income (in CHF)* | 176,667 |

Real estate value (in CHF) | 1,250,000 | Minimum equity required (in CHF) | 250,000 | Annual imputed costs (in CHF)* | 73,661 | Required minimum gross income (in CHF)* | 220,833 |

Real estate value (in CHF) | 1,500,000 | Minimum equity required (in CHF) | 300,000 | Annual imputed costs (in CHF)* | 88,333 | Required minimum gross income (in CHF)* | 265,000 |

Real estate value (in CHF) | 2,000,000 | Minimum equity required (in CHF) | 400,000 | Annual imputed costs (in CHF)* | 117,778 | Required minimum gross income (in CHF)* | 353,333 |

The table helps you assess which financial obligations you will incur at different property prices. It illustrates how a higher property value affects the required equity, ongoing costs and necessary income. At the same time, it makes clear that higher equity can reduce your monthly payments and income requirements.

Purchasing a property from around the age of 45 brings special challenges, as affordability and long-term financing depend more heavily on your future financial situation. Imminent retirement plays a particularly important role, as your income usually decreases when you retire. The imputed costs (i.e. mortgage interest, amortization and maintenance costs) must still not exceed one-third of your gross income. In addition, the bank checks whether affordability is still guaranteed after retirement.

In order to keep ongoing costs affordable in old age, it makes sense to reduce the mortgage as much as possible before retirement. This can be done through higher amortization rates or additional repayments. Alternatively, pension fund assets or other retirement savings can also contribute to financing, but you should always keep an eye on the impact this will have on your retirement savings.

When financing real estate in old age, you should pay particular attention to the following:

The financing of a property is complex, and mistakes can easily happen, which can have long-term financial consequences. To ensure you are well prepared, here are the most common pitfalls – and how you can avoid them.

Buying your own home is a significant step that requires careful, far-sighted planning – especially when it comes to financing. In Switzerland, you usually have to contribute at least 20% of the purchase price as equity, with at least half of this coming from “hard” equity such as savings or pillar 3a assets. The remaining equity can be supplemented by “soft” equity, such as an advance withdrawal from pillar 2. Even stricter requirements apply to vacation or investment properties.

In addition to the amount of equity, choosing the right mortgage model, realistically assessing affordability and being aware of potential risks are also key. Common mistakes such as miscalculating affordability or misjudging the value of the property can be avoided with solid preparation.

Take your time for comprehensive planning, honestly assess your financial situation and seek advice from independent experts. This is how you create the best conditions to realize your dream of owning a home safely and sustainably.

Arrange an appointment for a non-binding consultation or if you have any questions, just give us a call.

Disclaimer