Strategy Funds Sustainable

The foundation of your asset accumulation

With the investment strategy funds, you are opting for a globally diversified investment fund solution that considers environmental and/or social criteria while still meeting the standards of good corporate governance.

UBS Strategy Funds Sustainable at a glance

UBS Strategy Funds Sustainable at a glance

Sustainability

Investments in stocks and bonds

Individual

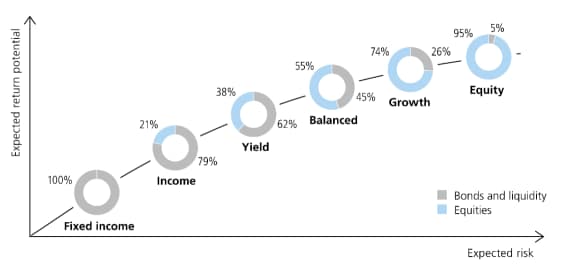

Strategy according to your risk tolerance

Controlled

Constant monitoring and supervision of your investments

- You have access to the strategic asset allocation of the UBS Global Wealth Management Chief Investment Office, based on sustainable asset classes.

- You benefit from the investment selection and implementation expertise of UBS Asset Management.

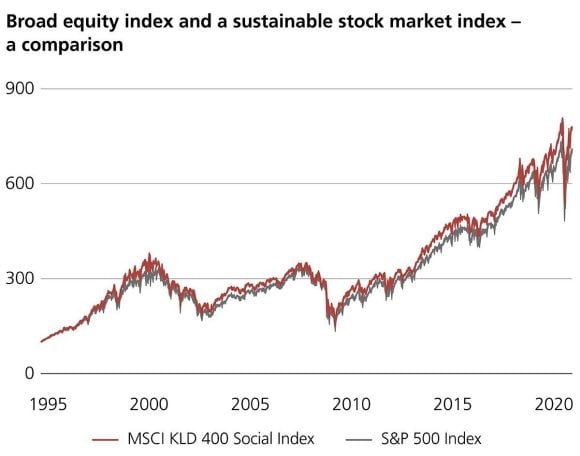

- Together, we will focus on sustainability in order to continue to earn sustainable, attractive and risk-adjusted returns for each risk profile.

Know your money is in safe hands

Know your money is in safe hands

Invest with UBS and decide how much advice you want from us and what decisions you’d rather make yourself. We look forward to assisting you

- Investment strategy development

- Suitable investment selection

- Portfolio monitoring

Strategy Funds Sustainable in detail

Strategy Funds Sustainable in detail

Also of interest to you

Also of interest to you