Financing

Mortgages for vacation homes and investment properties: financing step by step

Which mortgage is right for your Swiss vacation home or investment property? What should you consider when taking out financing? Learn more here.

Content:

Content:

- The dream of owning your own vacation home requires more equity.

- You cannot use capital from pillar 2 or 3a pension funds.

- It is worth observing the price development to determine an ideal time to buy.

- The financing conditions are stricter than for a property you live in yourself.

- You should thoroughly examine the tax implications of a vacation home or investment property.

- To the conclusion.

Vacation homes and investment properties in Switzerland can also be financed with a mortgage. However, different rules apply than for financing property you live in yourself. Buyers must contribute a higher level of equity and cannot use capital from pension fund savings.

Observe the principles of financing for vacation homes

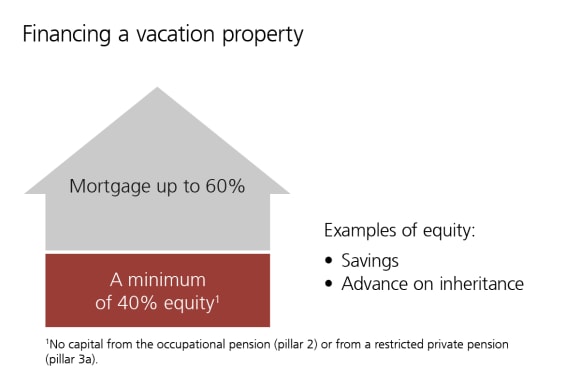

Different rules apply to the financing of vacation homes than for a property you live in yourself. You require a significantly higher proportion of equity, usually at least 40%. The lower loan-to-value ratio is due to the higher default risk for the bank. Owners part with their vacation homes first when they run into financial difficulties, often for less than the purchase price.

What’s more: In contrast to owner-occupied residential property, you cannot use capital from the occupational pension scheme (pillar 2) or the restricted pension plan (pillar 3a) for vacation homes. This makes financing a purchase more difficult. In the affordability calculation, the financing contribution is calculated with an imputed interest rate of 5% per annum, as in the case of owner-occupied homes. This is to ensure that the financing is on a solid footing in case interest rates jump upwards. Annual amortization, maintenance and incidental expenses are also taken into account.

Choose the right financing for your vacation home

Owners do not always remain enthusiastic about their vacation home. They are often resold sooner than owner-occupied homes. Ideally you should decide early on how long you want to use your vacation home. You can then determine the term of the mortgage. If the sale is made before the agreed end of the term, additional costs and fees are to be expected.

The right financing usually consists of a combination of mortgages with different terms that best suit your financial situation, property and goals.

How much will my mortgage cost?

How much will my mortgage cost?

With the mortgage calculator, you can easily and quickly find out whether you can afford your dream property.

Don’t forget about taxation

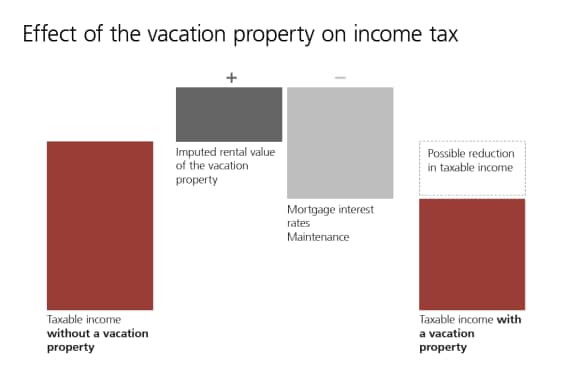

A vacation home will impact your income tax. Your vacation home is often located in a different canton to the one you reside in. You will therefore have to complete two tax returns: one in your place of residence and one in the location of the vacation home. If you own a vacation home, the tax authorities add an estimated imputed rental value to your income. This imputed rental value is taxable in the canton where the property is located. If you rent out your vacation home, the rental income is added to your income instead of the imputed rental value. However, the mortgage interest and maintenance costs are tax-deductible. If these costs are higher than the imputed rental value or the rental income, your taxable income is reduced.

Both the purchase and sale of your vacation property are subject to taxes and fees:

- notary and land registry fees

- property transfer tax

- property capital gains tax (if you earn a profit from the sale)

Get financing offers for your vacation home

We will calculate the optimal loan-to-value ratio, affordability and amortization for your desired property in consultation with you. As part of your comprehensive planning, we will work with you to find the right balance between your wishes, your financial situation and the current interest rate environment.

Volatile price development

Vacation property prices often develop more dynamically than those of residential property. They are subject to strong price fluctuations, especially in tourist regions. When the economy is weak, prices in trendy destinations usually fall sharply.

Impact of the Second Home Initiative

In 2012 the Swiss electorate approved the Second Home Initiative. Since then, no more than 20% of residential property in a municipality can be second homes. No further permits for second homes can be granted in locations where this percentage has been exceeded.

Amortization of the mortgage on your vacation home

The amortization conditions of a mortgage for a vacation home are stricter than for financing your main residence. In the case of vacation homes, at least 1% of the mortgage amount must be amortized annually and 1% of the property value must be calculated for maintenance and incidental expenses. When buying vacation homes, mortgage lenders often expect their customers to repay a large part of the mortgage within ten years or by the time they retire: In the case of owner-occupied homes, only the second mortgage has to be amortized, which accounts for about 33–34% of the market value.

Analyze the opportunities and challenges

Opportunities

Real estate that you purchase as a return-oriented investment can be a solid building block in your portfolio. This opens up the following opportunities:

- regular rental income

- diversification of your investments

- possible protection against inflation

- potential increase in the property’s value

Challenges

However, owning an investment property also comes with obligations and challenges, for example:

- management fees

- costs of repair and renovation

- risk of vacancies

- uncertain salability at a later stage

- uncertain resale value of the property

Observe the principles of financing for investment properties

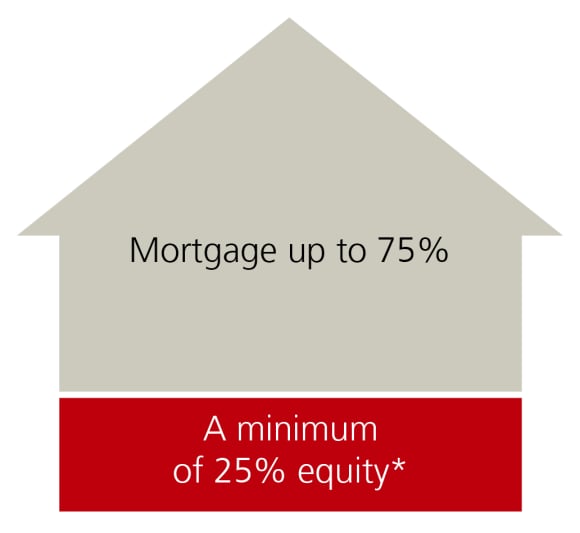

If you want to finance an investment property, different requirements apply than for owner-occupied homes and vacation homes. The equity ratio (at least 25%) is higher than for owner-occupied residential property, but lower than for a vacation home.

In addition, capital from pillar 2 and 3a pension funds cannot be used to finance an investment property. An exception may be made if you inhabit part of the property yourself.

The annual amortization must be at least 1% of the mortgage amount. The mortgage for the investment property must be amortized to at least two-thirds of the property value within the first ten years. We will check whether the financing of an investment property is affordable for you in a personal consultation.

What it the proportion of the equity to mortgage?

What it the proportion of the equity to mortgage?

Examples of equity:

- Savings

- Advance on inheritance

Don’t forget about taxation

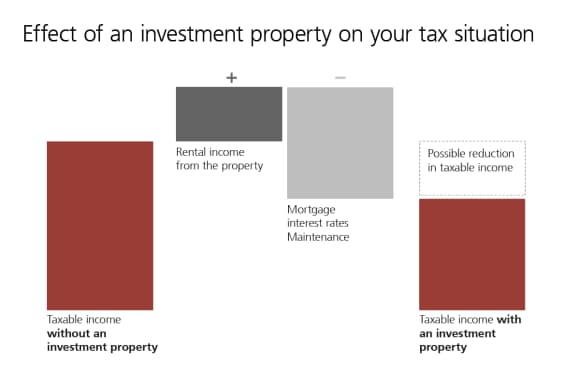

The investment property can have an impact on your income and asset situation. The tax administration adds the rental income from the investment property to the taxable income. Rental income is taxable in the canton where the property is located. By contrast, mortgage interest and maintenance costs are deductible from your taxable income. If these costs are higher than the rental income, your taxable income is reduced.

Plan your investment in detail

Plan your property investment carefully. We’re on hand to help with:

- analyzing and reviewing your risk profile

- analyzing and structuring your financial assets

- developing an investment strategy that takes your real estate investments into account

- calculating real estate income

- calculating changes in taxable income

- determining the imputed cost of renovation

- analyzing the financial impact of vacant homes

- market information and detailed information on the municipality of the real estate location

Vacation homes and investment properties have one thing in common – they each require a high level of equity. However, they differ significantly on one point: While yield considerations rarely justify the purchase of a vacation home, they are the main motivation for investment properties. The purchase decision requires a cool look at one’s own financial possibilities and life situation as well as weighing up the advantages and disadvantages of a purchase. Once you have gained a clear idea, we will advise you on the planning with concrete financing offers.