Investors

So your company grows successfully

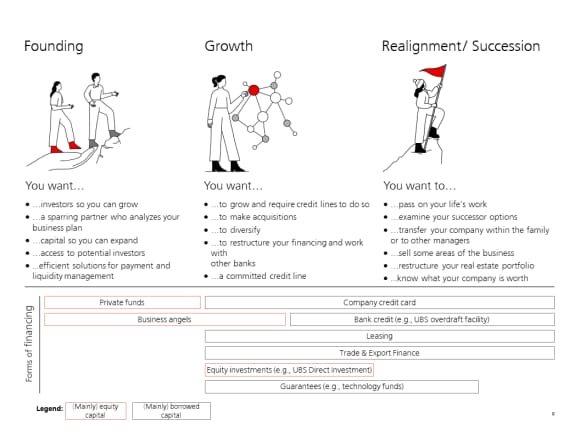

Equity for the start-up and growth phase, loan capital as soon as you’re profitable. Depending on what phase your company is in, you’ll need to rely on different investors. Get an overview.

What types of investor are out there?

What types of investor are out there?

The primary sources of funding in the development and growth phase are savings, private resources, subsidies and prize money and financing models in partnership with private investors. The doors to borrowing only open once your profitable.

Development phases | Development phases | Forms of financing | Forms of financing |

|---|---|---|---|

Development phases | Development | Forms of financing |

|

Development phases | Commercialization | Forms of financing |

|

Development phases | Legende | Forms of financing |

|

Development phases | Reife | Forms of financing |

|

Your benefits – from starting your company to planning succession

Your benefits – from starting your company to planning succession

- Proactive support when setting up your company

- Expert succession planning from A to Z

- Presentation of occupational pension solutions for you and your employees

Our experts are here for you – we look forward to seeing you.