Planning your company’s succession is a major undertaking that you should not underestimate. One that requires time and patience. With our comprehensive, cross-sector knowledge, we guide you through various aspects of succession planning.

Why succession planning is important

Why succession planning is important

Where do you stand with regard to your succession planning?

Where do you stand with regard to your succession planning?

Please take a few minutes of your time to find out where you stand in relation to your business succession and what you should concentrate on next.

Talk to us about your business succession

Talk to us about your business succession

Our team of experts will be happy to assist you with:

- Actively supporting you throughout the entire succession process

- Finding the right buyer for your company

- We optimize the purchase price to best suit your needs

Tips for the successful handover of a company

What kinds of business succession are there?

Tips for the successful handover of a company

What kinds of business succession are there?

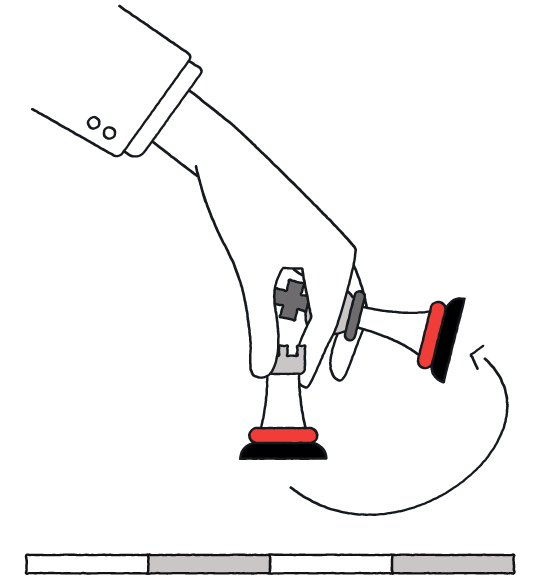

What are the phases of succession planning?

What are the phases of succession planning?

What else do you need to consider?

What else do you need to consider?