Chief Investment Office

Longer-term investments

Investing in structural trends through equities

![]()

header.search.error

Chief Investment Office

Investing in structural trends through equities

Recent history has shown that exposure to structural growth opportunities––those that categorize the equity universe in a less traditional way than by region or by sector––can improve the performance of equity portfolios. We believe that this will remain a feature of global markets in the years to come, for example in areas like AI, power and resources, and longevity.

In our equity framework, we focus on three pillars: the macro perspective, the micro fundamental perspective (idiosyncratic, company-specific analysis), and structural transformational changes. The importance of the structural transformation pillar has been evidenced by the concentrated rally in AI-exposed megacap stocks, which have driven a large part of the global market’s performance in recent years.

This is not a new phenomenon. Historically, structural transformations have had a major impact on market returns. In our equity framework report, “How we cover equities” (published on 17 October 2024), we presented a variety of examples showing the influence of transformational changes on equity markets over the past century.

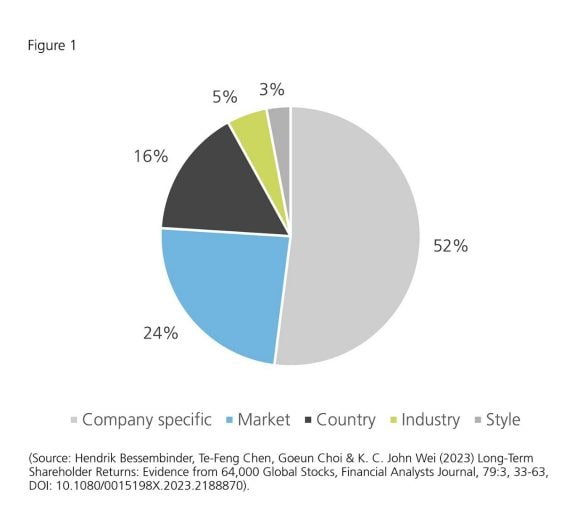

We also showed that since 2002, only 24% of equity returns have stemmed from country, industry, and style factors, while most of the stock performance has come from company-specific factors (see Fig. 1).

A 2023 CFA Institute research paper highlighted that between January 1990 and December 2020, just 2.4% of 64,000 global stocks accounted for all net wealth creation during this period. Outside the US, this figure drops to only 1.41%. (Source: Hendrik Bessembinder,Te-Feng Chen, Goeun Choi & K. C. John Wei (2023)Long-Term Shareholder Returns: Evidence from 64,000Global Stocks, Financial Analysts Journal, 79:3, 33-63, DOI:10.1080/0015198X.2023.2188870).

Region, country, and industry categorizations of equity markets are still commonplace in the asset management industry, and form the basis for the vast majority of global equity fund assets under management.

But we believe it is increasingly important for investors to not only understand structural transformational trends, but hold explicit exposure to them to benefit from their potential market performance.

Our framework for identifying structural trends categorizes opportunities into two areas:

Integrating structural trends into a portfolio

Most investor equity portfolios will already have some exposure to structural trends, intentionally or not. We estimate that a purely passive portfolio invested in the MSCI AC World already includes exposure of 39.4% to our TRIOs (as of the end of October 2025).

But for investors looking to increase their potential for outperformance by investing more specifically in structural trends, we see three ways to do so in diversified portfolios:

Adding exposure to structural trends needs to be done with care and in a portfolio context. Overly elevated or concentrated exposure to structural trends can result in overpronounced regional, style, or sectoral tilts without proper care to manage exposure. Individual investor preferences can vary in terms of the desire to outperform broad markets, and any conviction in structural trends.

Alexander Stiehler, CFA

Head of Longer Term

Investment Themes

UBS Global Wealth Management CIO

We believe it is increasingly important for investors to not only understand structural transformational trends, but hold explicit exposure to them to benefit from their potential market performance.

Our five profiles

We therefore present five model portfolios that show how investors can further increase their exposure to structural investment opportunities in a controlled way, tailored to their individual preferences.

A core-satellite approach

A practical way to think about integrating transformational opportunities into an overall portfolio is through a “core satellite” approach within a structural trends investing sleeve. Reallocating between 10% and 30% of the passive exposure of a broadly diversified equity portfolio toward a blend of strategies focused on structural trends can raise the structural growth exposure of a passive equity portfolio from 39% to between 45% and 58%.

Within this sleeve, investors can build “core” structural trends exposure by taking diversified positions across key meta-drivers: the multi-structural trends “all-in-one” strategy or the multi-structural trends sector titled strategies.

Next, investors can add “satellite” topics to tilt portfolios toward their own preferences through individual TRIOs and LTIs. To ensure diversification, we recommend investing in at least two to five topics in this “satellite,” depending on the profile described in the table below. In other words, this means allocating a maximum of 4%-5% of total equity exposure to each longer-term investment opportunity.

Volatility should still be expected over short-time horizons, but we strongly believe a diversified balanced portfolio will be best equipped to weather such swings. Selecting structural trends that complement one another, and avoiding extreme overweights, should help lessen volatility over shorter cycles. As allocations across and within categories shift due to market returns, we recommend that investors periodically rebalance their structural trend investments to maintain their desired portfolio profile.

Given the high degree of AI exposure in global indices today, considering individual trends with different drivers—such as the space economy, water scarcity, family businesses, or identifying the next frontier—could help enhance portfolio diversification.

Conclusion

Historically, equity markets have always reflected transformational changes. This is currently evident in the growing weighting of AI-exposed stocks within the S&P 500. To benefit from such shifts early, we believe investors should consider integrating additional, explicit structural trends exposure into portfolios. Incorporating TRIOs and LTIs can allow investors to capture both transformational innovation and broader structural trends. This approach is designed to build portfolios that are future-focused, resilient, and adaptable to changing market conditions, in line with UBS CIO’s latest transformational opportunity investment research.

See the fullLonger Term Investments report: Investing in structural trends through equitiesfor more.

Alexander Stiehler

Alexander is head of Longer Term Investment (LTI) themes in the UBS Global Wealth Management CIO, where he is responsible for our long-term thematic investment ideas. He holds a Master of Science in Economics (University of Konstanz), a Master of Science in Wealth Management (University of Rochester), and a Master of Advanced Studies in Finance (University of Bern). In addition, he is a CFA charterholder and a certified ESG analyst by the European Federation of Financial Analysts Societies.

Adding exposure to structural trends needs to be done with care and in a portfolio context. Concentrated exposure to structural trends can result in overpronounced regional, style, or sectoral tilts.