Human capital

Building effective governance

Guidelines for family office success

![]()

header.search.error

Human capital

Guidelines for family office success

Only 63% of family offices have formalized governance structures in place, despite findings that reveal the importance of effective governance in driving outcomes across a family enterprise.*As a family’s wealth grows, so too must its governance structures to ensure alignment across generations. At the same time, families must remember it is individuals who bring governance to life.

Family offices often manage substantial wealth, complex investments and family legacies that span decades. Yet, the cornerstone of every family office is not solely financial expertise; it is effective governance fostered by professionalization.

Governance, in the context of a family office, forms the framework that supports strategy, accountability and long-term sustainability. It is the mechanism through which decisions are made transparently, effectively and with foresight.

In this article, we explore why governance remains one of the most critical and often underestimated pillars of a successful family office.

What is governance in a family office?

In its simplest form, governance is the system by which an organization is directed and controlled. In the family office setting, this involves determining the purpose of the entity, defining who makes decisions, how those decisions are made, and how performance and compliance are monitored.

Unlike corporations that are driven primarily by shareholder value, family offices are driven by family or personal wealth and values. Decisions are therefore shaped not only by financial and operational considerations, but also by family priorities, culture and other objectives such as wealth preservation or philanthropic goals. This unique context makes governance both more complex and more vital.

Notably, in the UBS and Agreus Family Enterprise Governance Report 2025, we found that 44% of family offices lack a formal mission, vision or values statement, and a striking 68% have no family office council in place. These findings reveal that many have yet to formalize their values and goals into structured, operational governance.

The role of professionalization

Family offices have traditionally been characterized by weak governance due to their unique personal nature and the lack of governance awareness in the industry. However, in recent years, we have seen a change in the family office space as more families have become aware of the importance of good governance practice. Here is where professionalization comes into play. Professionalization is the process that marks the transition from an informal, relationship-driven structure to one with clear roles, responsibilities, processes and accountability.

In practice, professionalization can involve:

The journey to professionalization

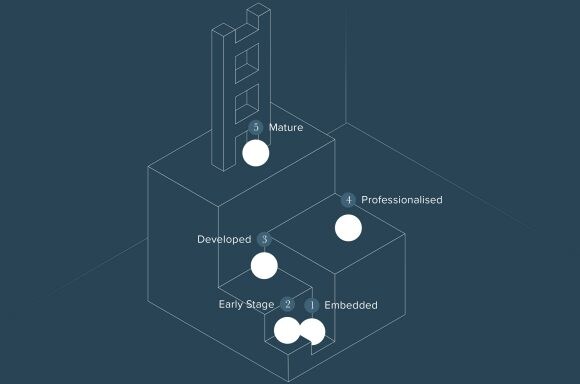

In a previous report designed to assist family offices embarking on the professionalization journey, we identified five stages of professionalization: Embedded, early stage, developed, professionalized and mature. (See the graph below.) Each stage reflects an evolution in structure, governance and mindset—a gradual transition from informal, relationship-driven management to institutional-level professionalism.

Fig. 1 The five stages of professionalization

Paul Westall

Tayyab Mohamed

Co-Founders

Agreus

Professionalization marks the transition from an informal structure to one with clear roles, responsibilities, processes and accountability.

Embedded and early stage: Governance is often implicit and mirrors family leadership. Decision-making tends to be centralized, informal and guided more by personal relationships than by structured processes. In the early stage, the family office would begin to become a standalone entity, moving away from the initial embedded structure with clear demarcation.

However, governance and reporting remain largely unprofessionalized in these two stages. Reporting is done in-house and is often inconsistent, with no clear or consolidated financial picture. While this intimacy reflects a high level of trust, it also exposes the family office to risk that can come from a lack of accountability and poor decision-making. These stages represent the most vulnerable points in a family office’s lifecycle.

Developed: This stage marks a turning point. Here, families begin to formalize governance frameworks—creating family charters, establishing advisory boards, or introducing independent professionals who complement family decision-makers. The purpose of governance at this level is to bring clarity and balance: defining roles and responsibilities, as well as aligning operational strategy with family values.

Reporting also improves, supported by more professionalized systems, including external software and outsourced providers that enable consolidated and reliable reports. As a result, performance oversight and transparency become increasingly consistent and embedded in day-to-day management.

Professionalized: This stage represents a significant leap forward. Governance becomes structured and deliberate, guided by formal policies and informed by independent expertise. Investment governance becomes central, with investment committees (ICs) and family councils established to ensure disciplined oversight, each with defined mandates, scopes and accountability mechanisms. Decision-making processes become documented, with risk management, audit trails and performance evaluation embedded into daily operations.

Most importantly, governance at this stage shifts from being reactive to proactive. Reporting reaches a standard comparable to early-stage financial institutions, providing consistency and accuracy. The family office is anticipating challenges, fostering accountability and integrating best practices from the corporate world while remaining true to family culture.

Mature: At this stage, governance transcends administration and becomes an instrument of stewardship. Only very few family offices reach this level of sophistication. At this stage, the family office often operates as a professional institution, with the family’s involvement limited to strategic oversight. Reporting mirrors that of large financial institutions, marked by institutional-grade systems and full transparency. Independent boards and committees ensure that decisions are objective, forward-looking and aligned with multi-generational goals.

By following this journey, families can build governance systems that evolve with them. As governance strengthens, it enables better risk management processes and performance optimization, laying the foundation for long-term sustainability.

Building the right structures

Effective governance requires careful design. We believe that the following tools and structures form the backbone of a strong governance framework:

As governance strengthens, it enables better risk management processes and performance optimization, laying the foundation for long-term sustainability.

The human dimension of governance

Indeed, a strong governance framework provides consistency, transparency and accountability, but we would like to emphasize that its success ultimately depends on the people who uphold it. Policies and structures alone cannot ensure effective governance; it is the collective capability, mindset and integrity of those involved that bring governance to life. Even the most sophisticated systems will fail without the right people.

More importantly, family offices are, by nature, deeply personal organizations. In the KPMG Agreus Global Family Office Compensation Benchmark Report 2025, we found that 77% of family office employees report to at least one family member, and within that, 33% report to multiple family members. Furthermore, the Benchmark Report revealed that 63% of family offices surveyed employ at least one family member, yet 80% lack a formal employment policy for family involvement. This highlights a critical gap: without clear policies and professional boundaries, personal relationships can complicate objectivity and accountability.

When close personal relationships intertwine with significant wealth and responsibilities, hiring and retaining the right people becomes essential. Recruiting for a family office is nuanced due to the softer aspects, such as cultural fit, which is the alignment with the family’s mission and ethos. These aspects matter as much as the credentials of the candidates. A successful family office needs professionals who not only possess technical and financial expertise, but also understand the intricacies of family values, confidentiality and long-term stewardship. When the right people are in the right roles, and with the right structure in place, communication will flow naturally, decisions will be informed by diverse perspectives and the family office becomes resilient through change.

Building effective governance in family offices is not a one-off exercise; rather, it is an ongoing journey of professionalization, reflection and adaptation. As wealth grows, so too must their governance structures, ensuring that values, strategy and accountability remain aligned across generations. At the same time, families must also remember that human capital is the cornerstone of effective governance; it is the expertise, integrity and cultural alignment of individuals that bring governance to life. With all these in place, families can safeguard wealth and sustain the family legacy for generations to come.

* Global Family Office Compensation Benchmark Report 2025, Agreus and KPMG Private Enterprise.

Paul is the co-founder of Agreus Group, a recruitment and consulting business dedicated to working exclusively with single family offices globally. Based in the UK office, he leverages his extensive experience to provide tailored recruitment and consulting solutions, helping clients achieve long-term success. For more than 15 years, he has helped family offices build effective teams, strengthen governance, sharpen strategy, and optimize operations for lasting success. With a deep understanding of the unique needs of family offices, he has helped clients across the world build and strengthen their teams.

Tayyab is the co-founder of Agreus Group, a recruitment and consulting business dedicated to working exclusively with single family offices globally. For more than 15 years, he has helped build and professionalize family office clients across the world. Tayyab recently moved to the UAE to build out the Agreus presence in the Middle East. He is closely involved with family offices and helps address their pain points in navigating issues such as leadership, governance, culture, hiring, compensation and retention strategies.

Human capital is the cornerstone of effective governance; it is the expertise, integrity and cultural alignment of individuals that bring governance to life.