Featured research

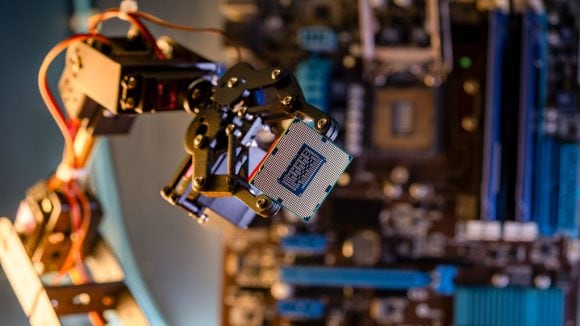

The great broadening in equities

With a global equity rally now taking shape, is your portfolio ready to capture emerging investment opportunities?

See what these insights mean for your own portfolio

Talk to a UBS Financial Advisor

Insights for your entire financial life

Articles and reports delivering financial guidance for life’s most important stages

Timely market commentary

Watch UBS Trending weekdays at 9:30 a.m., ET. for conversations with market experts, analysts and influencers.

UBS podcasts

Stay in the know with our latest analysis on the markets, economy, trends and politics.

Get in touch

Together, we can help you pursue what’s important

Together, we can help you pursue what’s important