Helping you create stronger plans. Helping employees secure their future.

Helping you create stronger plans. Helping employees secure their future.

A variety of retirement plan solutions can help meet the evolving needs of plan sponsors and prepare employees for a secure retirement.

We offer fiduciary services to retirement plans that range from consulting services to discretionary and nondiscretionary advisory programs. Depending on your organization’s specific needs, we have a solution for you.

Get in touch

Get in touch

We can help you pursue what matters

How we work with you

Tailored solutions

Tailored solutions

Our Retirement Plan Consulting Services follow a prudent investment decision-making process with UBS acting as an ERISA fiduciary. In addition, we help plan sponsors manage plan complexity in the following areas:

- Fiduciary governance

- Plan health optimization

- Participant retirement readiness

Our Retirement Plan Guided Solutions offer two investment advisory services that help you make key decisions that affect plan participants and reduce your fiduciary burden:

- UBS Retirement Plan Manager—Discretionary investment management with UBS acting as an investment manager under ERISA Section 3(38)

- UBS Retirement Plan Advisor—Nondiscretionary investment advice with UBS acting as a nondiscretionary investment fiduciary under ERISA Section 3(21)

Personalized service

Personalized service

As your dedicated team, we get to know you and your retirement plan needs. On an ongoing basis, we’ll serve as your single point of contact, coordinating the services you need and saving you valuable time.

Plus you have the access to the vast resources of one of the world’s leading wealth managers.

Participant engagement and retirement readiness

Participant engagement and retirement readiness

As a global wealth management firm, we have the resources and experience to help you deliver participant education.

Our clients

Our clients

We work with organizations of all sizes. From start-ups to Fortune 500 companies that include manufacturing, business, healthcare, professional services, and state and local government, plan sponsors throughout the US have chosen UBS.

Our people

Our people

You receive objective advice and specialized services from a highly experienced team. They’re focused on addressing a wide range of needs, from helping you manage plan fiduciary responsibilities to maximizing the benefits of your plan for employees.

Why choose UBS corporate retirement plan services

An established resource with the heritage of a global leader

-

7000 +

retirement plans, from

small businesses to the

Fortune 5001 -

$ 160 + billion

UBS Wealth Management Americas retirement plan assets2

-

30 + years

providing investment advice as a fiduciary

Today’s retirement landscape

How the SECURE 2.0 Act and state requirements could impact your plan and your employees

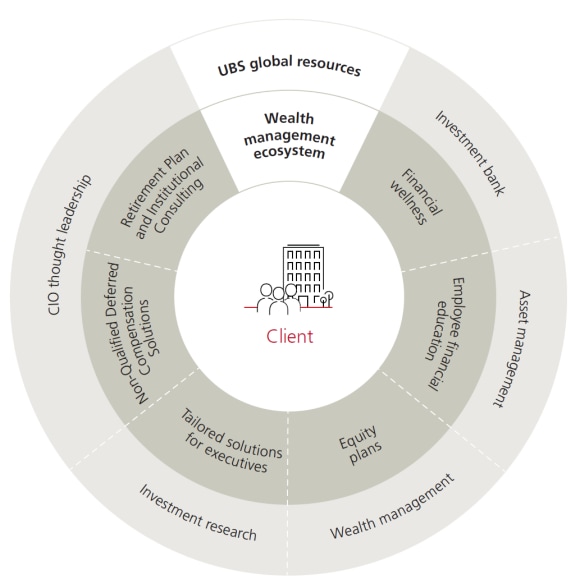

UBS offers an extensive ecosystem of additional solutions

We help address your needs beyond the workplace by coordinating access to UBS’s expertise across the firm, including:

- Wealth management

- Asset management

- Investment banking

- Research

- CIO thought leadership

- Employee financial wellness

- Employee financial education

- Equity plans

- Tailored solutions for executives

- Retirement plan and institutional consulting

Explore more

Insights for you

UBS Workplace Voice

Our publication series keeps you up-to-date on key trends in the workplace. Gain insights into employee and employer attitudes and behaviors about workplace benefits, such as equity awards, financial wellness and retirement.