In conversation

History lessons

The role of innovation in shaping wealth creation in the US

![]()

header.search.error

In conversation

The role of innovation in shaping wealth creation in the US

Our new In conversation series features John Mathews and Ulrike Hoffmann-Burchardi, who explore the role of innovation and technology investments historically and today—and why innovation is a key lens for identifying drivers of wealth creation.

Ulrike is responsible for bringing together market and investment insights to create financial impact for UBS clients across the Americas. She also serves as Global Head of Equities.

Highlights include:

John: Most people don't know, Ulrike, that you're a bit of a historian. Our country's coming up on its 250th anniversary, and maybe you could talk about some of the lessons we’ve learned and the innovations we’ve made over the last 250 years as we think about the future.

Ulrike: What's so fascinating is that you can learn so much from history. At the peak of the railroad mania in 1871, we invested nearly 6% of US GDP into railroad CAPEX. There is some anxiety that right now we have around 1 to 1.5% in AI CAPEX. But when we look back at history, that is not unprecedented.

Also, if you think about the stock market back in the 1900s, at the peak, about two-thirds of companies in the indices were railroad stocks. We have some concerns about concentration in the US. But when there's truly transformational innovation, I think it's insightful to look back at history and see just how much concentration we’ve seen in historical periods.

John: That’s a great point. So how do you see innovation and technology influencing the next decade? Everyone's talking about AI. Everyone's talking about technology. How do you see it?

Ulrike: Again, we think the transformational lens is a very important one, and it's one that shapes our equity views. If we go back to history, I think four data points are interesting.

So it's clear that these transformational innovations have had a big impact and wealth creation in the equity market. And therefore we think it's the lens that we need to incorporate in our offerings going forward.hsd

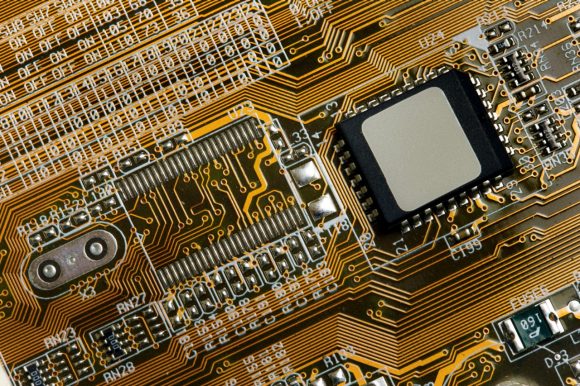

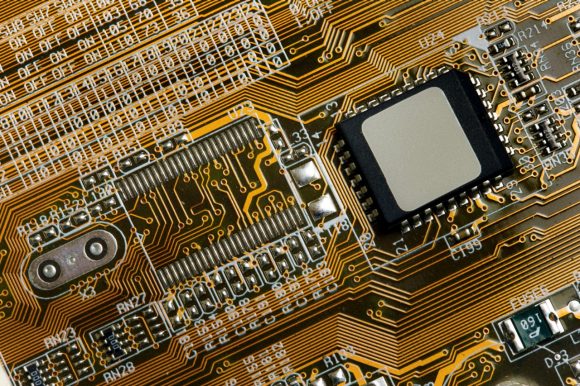

Three important transformational innovations that we think are going to shape the next decade are artificial intelligence, not surprisingly; electrification—this is a broader trend, not just AI data centers; and then lastly, longevity.

And we not only write about those and recommend stocks that are in the vortex of these big innovations, we also have created global teams that follow these opportunities for us and put together a portfolio of stocks that embrace these opportunities that we think are going to be poised for future growth.

So for us, innovation is one key lens that shapes our views on the equity market.

John: There's so much talk about technology, especially AI. The longevity conversation, I think, has gotten a little lost in the shuttle. So, tell us a little bit about how you see that aspect playing out.

Ulrike: For us, all our three transformation opportunities are predicated on a view about the future. Investing is about envisaging the future, predicting what's to come. And one prediction that we have is that by 2030 in the US, we'll have more 65-year-olds and older compared to 18-year-olds and younger.

And the first investing opportunity for us is in companies that are causal to creating this longevity, which [are] pharma and medtech. We actually think this is a really interesting time to invest in healthcare for a number of reasons.

For instance, we see that some of the policy headwinds that have been with us about pricing and tariffs seem to now at least be answered by the deal that Pfizer and the US government put together. We also think that the big de-stocking that happened over Covid is finally coming to an end.

And all these transformations are connected, of course. AI will have a key role to play in healthcare as well. We think this is almost a free call option when you invest in healthcare, because the costs of bringing a drug to market have risen so immensely over the last ten years. And AI can bring down costs in all layers of the value chain, from discovery to clinical trials to go to market. So we are excited to invest in longevity at this juncture.

John: I spend a lot of time with clients, and healthcare is always a topic on their minds—healthcare, living healthy longer—this whole concept of longevity. So I'm not surprised to hear this. You and I have talked a lot about the great wealth transfer, where $70 trillion will change hands to the next generation or two over the next 25 years. The baby boomer generation is aging, which creates a lot of opportunity in this longevity space.

Let's double click on AI. When it comes to AI and technology, many of our investors are asking, “Am I too late? Are valuations too high now? Should I wait for a pullback?” What is your longer-term view on where we are in the investment cycle of AI?

Ulrike: Yes, maybe we just step back and try to articulate the overall investing thesis. We think that AI is the most profound innovation in human history. And we think it's one of the largest investing opportunities. And the reason is that the technology is self-learning for the first time in human history. These current models are training the next generation of models, and the pace of innovation is therefore so much more rapid.

Having said this, we are now over three years in, with ChatGPT and its launch in November of 2021. Now the narrative will shift from this first phase, where it was all about the promise of AI, what it could do to ROI, to this next phase where it's going to be about the proof: who can actually deliver on that promise? I think that's a very exciting opportunity.

We think that as part of a portfolio, AI always needs to be dynamically managed, because the opportunity set shifts. Initially it was all about the enabling layer and the portfolio was very focused on the chip companies, the hyperscalers. But we think that over time, it's going to broaden out, and we have already positioned in a way that's a little bit more diversified.

Our whitepaper that we published with the launch of these portfolios talks about how ultimately the value will be created in the application layer. I think that is the journey that we are on and in particular this new year, I think we'll hear a lot more about the use of AI, both from the consumer but also from the enterprise, and to see how we can actually monetize the promise of this new technology.

John: Right. What about data centers? You talked about electrification earlier, which encompasses many things. But we hear so much talk about massive CAPEX investment in data centers and the power required for that. How is the team thinking about that in the context of the AI revolution?

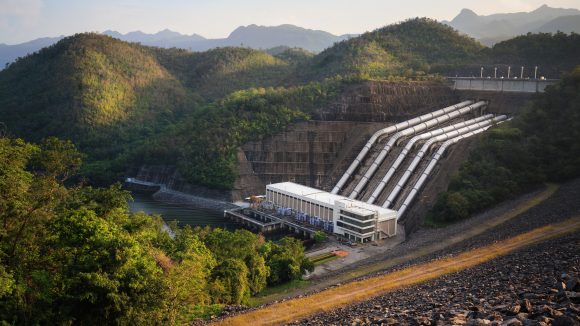

Ulrike: First of all, we think that electrification is a trend in and by itself—a very strong structural trend. We need to electrify our economy, transportation, housing, industry more broadly. So independent of AI data centers, that is a very large opportunity for us. In our estimates, AI data centers add about 8% of incremental electricity demand by 2030. It’s not that much, but because it's incremental demand, it now pushes the envelope somewhat. And we see that power increasingly is becoming a bottleneck. We have increasing demand for electricity, but the supply side is not only limited, it's actually also decreasing because our grid is so outdated. We actually estimate that we lose about 5% of electricity every year to outages and malfunctions.

Again, this is an opportunity because supply and demand are not matched, and we think a lot more infrastructure needs to be built there.

John: Well, I’ve never thought of it that way—we need the infrastructure to run these massive data centers, and also need to upgrade our outdated systems anyway.

We happen to work for the largest global wealth manager in the world. Talk about your experience having that global perspective, and maybe also talk about how this AI revolution looks elsewhere in the world.

Ulrike: I can speak personally that a team that is in all regions of the world and can comment on what's happening on AI, what's happening on electrification, on the pharma side, etc. is a huge asset for the quality of our research. There's so many ways that we can leverage the deep research expertise in different regions to improve the quality of our insights.

It's interesting to have different perspectives about how different regions approach these huge opportunities. You have the US which is a leader in especially closed source AI, large language models that are not opening up their recipe on how they are actually doing the work. And this is opposed to China, which now has become a leader in open source AI, efficient and very cost-effective AI, where the recipe is shared more broadly. And then Europe, of course—we have yet to see how they're going to play in this global ecosystem.

John: If we look back at 2025, we saw market rotation happen throughout the year. How would you advise family office investment professionals to think about global diversification?

Ulrike: Diversification is of course key. You want to align with alpha opportunities at the same time. I would say for us when it comes to the longer-term investment thesis, we think a diversified exposure is important. You don't just want to bet only on AI, because every other part of the economy will also profit from AI, whether it's the healthcare sector, industrials, utilities and so forth.

And that also means geographical diversification. A lot of the opportunities in industrials and utilities lie outside the US. Broad regional diversification is something that we always recommend.

John: Yes, I think it's really important for people running family offices to not lose sight of global diversification.

Any final thoughts, Ulrike, that you would like to share today?

Ulrike: What I would say, going back to the original question about history, is that every cycle changes its costume, but not the script. Thinking again about what we can learn from history, there are certainly many CAPEX cycles that have shown us that at some point, they’re periods of investments. We always have to look at any innovation or any opportunity and ask, “What is the revenue opportunity and what is ultimately the spend?” That’s an equation that we have to keep watching for all of these opportunities to see when it's time to maybe adjust the portfolios.

John: It’s been great to have you with us today.

Ulrike: Thank you for the opportunity.

John currently serves as the Head of Private Wealth Management for Global Wealth Management US. John sets the strategic direction for UBS Private Wealth Management and helps UBS Private Wealth Advisors deliver comprehensive capabilities and solutions to clients. He built and collaborates with dedicated knowledge centers at UBS, including Advanced Planning, Family Advisory & Philanthropy Services, Family Office Solutions, Global Families & Institutional Wealth Americas, and the OneBank Coverage team. John plays an instrumental role in coordinating the firm’s capabilities, which includes the integration of global solutions from UBS’s Investment Bank as well as our Asset Management Division. In addition, John is also a member of the Global Wealth Management US Management Forum. John earned a B.A. in political science from the University of Florida, where he continues to be an active alumnus.

Ulrike is Chief Investment Officer for the Americas and Head of Global Equities at UBS Global Wealth Management. She serves on the Global Investment Committee, which defines the UBS House View, guiding USD 5.5 trillion in assets. Prior to joining UBS, Ulrike was a Partner and Senior Portfolio Manager at Tudor Investment Corporation. Ulrike has been recognized for multiple consecutive years as one of Barron’s “100 Most Influential Women in US Finance.” She received the 2023 Women’s Investment Leadership Award from the Managed Futures Association (MFA).* She serves on the board of 100 Women in Finance and on the board of NYC FIRST, a global youth-serving robotics community advocating for STEM education in grades K–12. Ulrike is a Fellow of the 2021 class of the Finance Leaders Fellowship and a member of the Aspen Global Leadership Network. She holds a Ph.D. in Finance from the London School of Economics and Political Science, and a Master's degree in Finance from the University of St. Gallen in Switzerland.

John Mathews

Head

Private Wealth Management Americas

UBS Global Wealth Management

Ulrike Hoffmann-Burchardi

Chief Investment Officer Americas

UBS Global Wealth Management