Supreme Court rules IEEPA tariffs illegal

Supreme Court rules IEEPA tariffs illegal

On 20 February 2026, the Supreme Court of the United States (SCOTUS) ruled in a 6-3 decision that the Trump administration’s tariffs levied under the International Emergency Economic Powers Act (IEEPA) are illegal, upholding multiple lower court rulings during 2025. Justice Roberts delivered the majority opinion, with Justices Kavanaugh, Alito, and Thomas in dissent. The decision expressed a reluctance to read extraordinary delegations of Congressional authority into ambiguous statutory text, consistent with recent rulings upholding the major questions doctrine (a principle holding that on issues of vast economic and political significance, federal agencies must possess clear, explicit authorization from Congress to act).

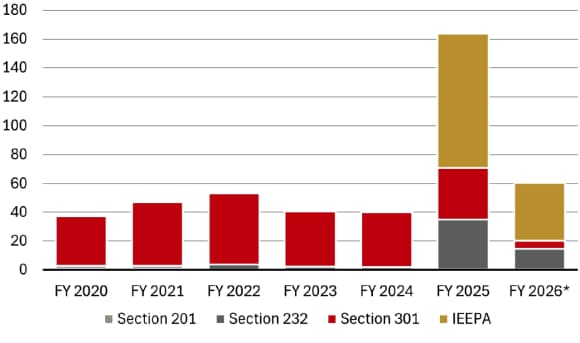

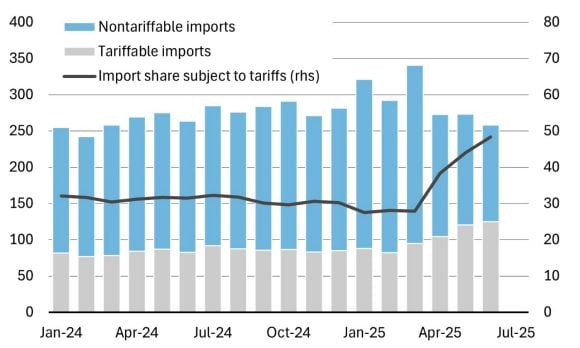

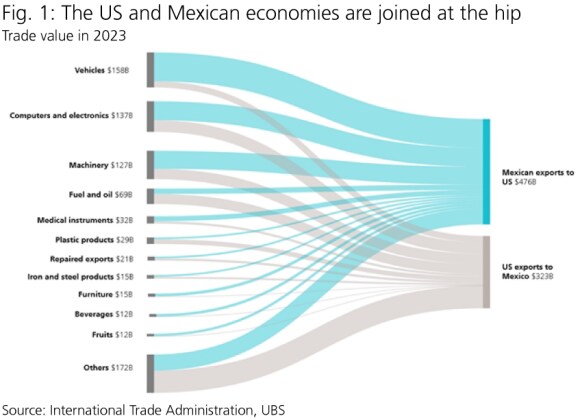

The ruling halts the collection of two-thirds of the administration’s tariff revenue. Since the IEEPA tariffs were first applied against Mexico, Canada, and China related to fentanyl and immigration in March 2025 and then expanded to include a wide range of other tariffs, US Customs and Border Protection (CBP) has levied USD 133.5 billion in customs duties through mid-December under the IEEPA trade remedy (see Fig. 1). Extending the CBP data, Penn-Wharton Budget Model economists estimated the IEEPA tariffs collected so far have since risen to USD 175 billion.

IEEPA generated the bulk of the US tariff revenue

CIO Alert | Markets fall amid Greenland tensions

CIO Alert | Markets fall amid Greenland tensions

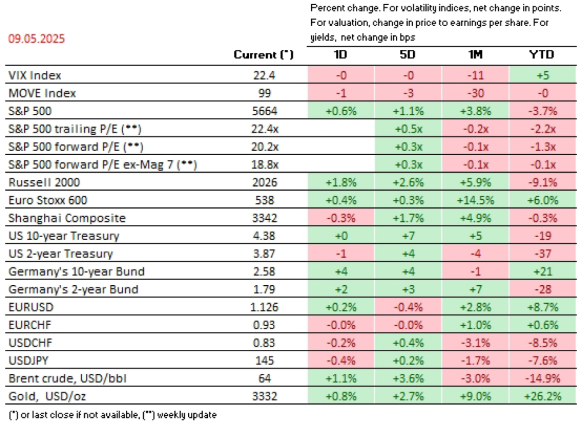

Equities and bonds across the world fell on Tuesday, prompted by an escalation in geopolitical tensions over Greenland and concerns over Japanese fiscal policy.

Over the weekend US President Donald Trump threatened to impose escalating tariffs on eight European countries until the US is allowed to buy Greenland. The EU is reported to be considering retaliatory measures, potentially including tariffs and/or restricting access to the EU single market for US companies. Ahead of a speech in Davos on Wednesday, Trump said on social media that there was “no going back” on his goal to control Greenland.

Fears of prolonged uncertainty and the prospect of a resumption of a US/EU trade war weighed on equities. The US S&P 500 closed 2.1% lower and Europe’s Stoxx600 closed 0.7% lower. Of course, it is important to put this in the context of around 15% and 19% rallies in the S&P 500 and Stoxx600 over the past year.

Notably, the US dollar also fell sharply, with the DXY dollar index depreciating 0.8%, in contrast to its historical tendency to appreciate during times of heightened volatility. Investors turned to other perceived “safe havens,” with gold rallying by 3.7% to reach a fresh record high, and the Swiss franc appreciating by 0.9% against the US dollar.

Meanwhile, in Japan, Prime Minister Sanae Takaichi formally dissolved the lower house of the National Diet on Monday for a snap election scheduled for 8 February. During a press conference, she pledged to cut the consumption tax on food, strengthen national security, and increase investment in various sectors.

Japanese government bonds (JGBs) fell on the news, amid fiscal concerns, with yields on 10-year bonds rising a further 8bps to 2.35%, up from a recent low of 2.08% on 8 January. This contributed to negative sentiment toward government bonds around the world as investors worried about the potential for repatriation flows as Japanese yields become more attractive to domestic investors. Yields on 10-year US Treasuries increased by 7bps to 4.29%, up from a low last week of 4.14%.

What do we expect from here?

The impact of geopolitical events on financial markets, including the US strike against Iranian nuclear facilities and the arrest of Venezuela’s president Maduro, has tended to be smaller when the resolution is quick and conclusive.

We are therefore monitoring for the risk of a prolonged standoff or a retaliatory tariff escalation between the US and Greenland/Denmark/the EU, with both sides exerting economic and political pressure on one another, which would in our view have the most damaging effect on risk assets—in particular in Europe.

A more benign potential resolution would be for the Trump administration to establish free military and resource access, but without acquiring Greenland. Experience from last year shows that the Trump administration is prepared to negotiate and dial back tariffs from initially imposed levels.

Though we are mindful of the potential for further short-term volatility, our base case is that tensions over Greenland are not a reason to change our overall positive view toward risk assets. This geopolitical uncertainty supports broadening out equity exposure across regions, sectors, and structural themes. Next month’s Supreme Court judgment on the use of IEEPA tariffs, were it to deem them unlawful, could also hamper President Trump’s ability to impose fresh tariffs.

Meanwhile, the recent sell-off in longer-term government bonds in Japan and the US demonstrates the kind of pressures that can arise when fiscal policy is questioned. But if long-term bond yields continue to rise, we would expect a combination of adjustments to bond issuance and potential central bank intervention to keep yields contained. After initial volatility, this would be a positive for the bond market but could lead to higher volatility in currencies. Our June forecasts for 10-year yields in the US and Japan, of 3.75% and 2.00%, respectively, are below current levels.

How do we invest?

Add to equities. We continue to believe a positive global growth outlook provides a favorable backdrop for stocks in 2026. Real GDP growth is one of the most important macro drivers for equity markets and the four largest economies in the world are all in fiscal expansion mode. Solid economic growth in turn should bode well for corporate profits. We expect S&P 500 earnings per share to increase by 12% this year, compared to our 2025 estimate of 11%, and profit growth is also gathering pace elsewhere in the world.

Although a US/EU trade war poses risk, the increased need for European nations to boost defense spending. A stronger focus on sourcing military equipment from within the region should support European defense stocks.

Seek diversified income. We continue to believe quality bonds—specifically high-grade government and investment grade corporate bonds—have an important role as a source of yield and diversification in 2026. We expect medium-duration quality bonds (four to seven years) to deliver mid-single-digit returns from a mix of yield and capital appreciation as the Fed cuts rates. We believe volatility in yields on the back of current fiscal and geopolitical concerns represents an opportunity for under-allocated investors to add exposure.

Favor commodities. Gold is continuing to prove an effective hedge against rising geopolitical tensions. We prefer gold to other precious metals for this purpose, as its price is less affected by industrial demand cycles and it is benefitting from persistent demand from central banks for reserve diversification. More generally, we believe commodities are set to play a more prominent role in portfolios in 2026, with returns across industrial and precious metals driven by supply-demand imbalances, structural demand, geopolitical risks, and fears about monetary debasement.

Hedge market risks. On top of maintaining a diversified portfolio and exposure to gold investors can also consider substituting direct equity exposure for capital preservation strategies. These strategies can often limit downside risk while allowing some participation in upside. While returns may be capped in strong markets, such strategies reduce drawdowns and support long-term wealth preservation. Replacing some direct equity positions with these strategies can make portfolios more resilient to volatility and shocks. As well as looking for direct hedges, diversifying with alternatives can provide a source of less correlated returns, which is particularly useful when stocks and bonds are moving in tandem.

DoJ investigation adds uncertainty to Fed leadership transition

DoJ investigation adds uncertainty to Fed leadership transition

This weekend, the Federal Reserve announced that the Department of Justice (DoJ) has launched a criminal investigation into Chair Powell’s June 2025 testimony to Congress on the Fed’s building renovations. Chair Powell responded with a statement indicating his view that the grand jury subpoena was about pressuring the Fed’s ability to set monetary policy “based on evidence and economic conditions” and the influence of political pressure. The news extends an active period of executive actions and other announcements intended to reduce borrowing costs. Last week, President Trump ordered the government-sponsored entities, Fannie Mae and Freddie Mac, to purchase USD 200bn of mortgage-backed securities and then separately proposed a one-year cap on credit card interest rates.

The immediate consequence of the DoJ investigation announcement is additional uncertainty over the timeline of potential changes in Fed leadership, and specifically the next Fed Chair. President Trump was expected to announce his nominee sometime over the next two weeks, and while he still may, the following dates and institutional considerations could influence the timing of the announcement and the process for a new Chair being in place. These institutional factors also suggest that any changes to the Fed’s policy-making framework are likely to be gradual.

Supreme Court oral arguments and decision: On 21 January, the Supreme Court hears arguments around Governor Lisa Cook’s criminal investigation and her potential removal from the Board of Governors. If the Supreme Court rules in favor of the White House, the hurdle for current and future governors to be removed could be fairly low, which could then influence how long other board members serve.

Senate confirmations of senior Fed officials: The Senate plays a key role in personnel outcomes by confirming the nominations of future governors and the next Fed chair. Senator Thom Tillis (R-NC) has said he would oppose the confirmation of any nominees until the DoJ investigation is resolved. This could slow the confirmation of the next Fed chair. Additionally, Governor Miran’s term expires at the end of January, and he can stay on until a successor is confirmed.

Announcements by Fed board members about their tenure: Jerome Powell’s term as the chair ends in May; however, his term as a board member expires in 2028. He has not announced his intention to step down and create another vacancy on the seven-member board. Two members were appointed during the Biden administration, and announcements about their future plans will be closely monitored.

The market reaction to news of the investigation has been relatively muted. After initially declining at the open, the S&P 500 rallied back to positive territory by midday. The 10-year Treasury yield has similarly retraced most of its initial rise and remains within the 4.0-4.2% range, which has held in recent months. Gold has experienced the largest move, up 2.2%. The market-implied probability of a Fed rate cut in March has fallen further to about 25% from 30% on Friday, while the likelihood of a cut by June is down to 95% from 100%. The market is still pricing two full cuts by December 2026.

The market reaction is consistent with our view that the DoJ investigation does not materially alter the likely path for Fed rate cuts in 2026. We believe additional evidence of labor market weakness will result in an additional rate cut in 1Q. Beyond that, subsequent rate cuts are more likely to depend on how growth and inflation evolve over the duration of the year than on who’s the next Fed chair. Market pricing already reflects the assumption that the two current front-runners to be the next Fed chair would shift policy in a dovish direction.

Trump announces one-year 10% cap on credit card interest rates

Trump announces one-year 10% cap on credit card interest rates

After the close on Friday, President Trump posted on social media that later this month he will call for a one-year cap on credit card interest rates at 10%. No additional details have been provided beyond the social media post, though bank and credit card stocks are likely to react negatively Monday. We would view sharp pullbacks in the larger issuers as potential opportunities for several reasons:

- The administration’s ability to implement such a cap is highly questionable;

- Even if enacted, the cap would likely be temporary, and

- The financial impact on the largest card issuers appears manageable.

Additional factors also lead us to believe that steep declines in bank and credit card stocks is unwarranted.

Rate caps are tough to implement

It’s unclear what authority the administration has to enact a cap on credit card interest rates. While this administration has at times pursued policies through executive orders and emergency declarations, it’s notable that the President’s social media post stated he will be “calling for” the rate cap, as opposed to implementing. This may suggest the administration is considering alternative avenues. We note that any executive order or unilateral policy change will likely face immediate legal challenges. Additionally, if such a rate cap is possible, why not impose a similar limit on mortgages?

Alternatively, the President could encourage other departments or agencies to pursue the changes. For example, while the CFPB did successfully implement a cap on credit card late fees during the Biden administration, the Dodd-Frank Act bars the CFPB from placing limits on extensions of credit unless explicitly authorized by law.

In Congress, legislation to cap credit card interest rates was introduced in both chambers last year. However, neither the House nor Senate versions gained traction, making passage of such a law highly unlikely.

Beyond the mechanics of implementation, if a cap were imposed, card issuers and lenders would likely prioritize protecting margins over volumes. This would result in tighter lending standards and fewer loans, which could hurt consumer spending and GDP growth—a key priority for the administration in an election year. Additionally, the Bank Policy Institute suggests that the most affected consumers would be those who regularly borrow by rolling over credit card balances month-to-month, as well as those consumers with weaker credit histories who rely on credit cards for backup liquidity. Therefore, a credit card interest rate cap is not an unequivocal win for all consumers.

Potential impacts look manageable for the stocks

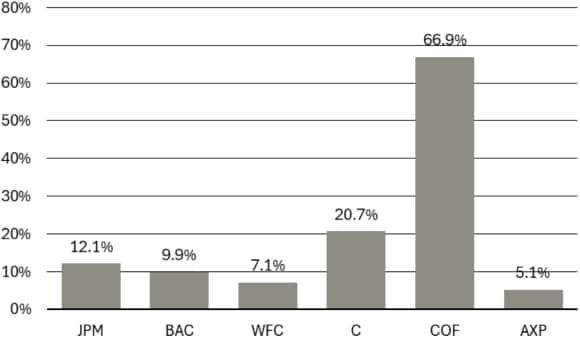

While the outlook for implementation remains highly uncertain, bank and card issuers are likely to react negatively on Monday. Below, we assess the financial exposure of several major US credit card issuers by illustrating the domestic credit card net interest income as a percentage of total revenue for each company. The actual values could vary owing to differences in commercial and international card exposures, which are not always disclosed, but we believe the below estimates are broadly representative.

Estimated domestic consumer credit card net interest income

While the materiality of exposure varies and could influence reactions, we highlight several key points that we believe significantly limit the overall financial impact. First, President Trump’s social media post indicated the proposed cap will last only one year. This would substantially limit its financial impact, as issuers would likely revert to normal practices after a year. Second, if implemented, the cap would likely apply only to new loans, not existing ones, further reducing its impact. Lastly, issuers could at least partially offset any lost net interest income. When the CFPB imposed a cap on credit card late fees in 2024 (which, ironically, was eliminated by the Trump administration last year), the most affected issuers implemented mitigating factors, not only by raising interest rates, but also by adding new fees to make up for the lost late fees. If an interest rate cap were implemented, issuers would likely impose or increase annual fees, statement fees, late fees, etc. Even if the issuers were to appease the President by voluntarily reducing certain rates, we would expect minimal impact to overall profitability given this same dynamic.

As a result of these key factors, we see the financial implications of the proposed one-year interest rate cap as very manageable for the largest issuers. Nevertheless, regardless of whether any cap is ultimately imposed or not, we acknowledge that banks attracting the administration’s ire is a negative development and could diminish the strength and momentum of the recent deregulatory tailwinds. Additionally, in the unlikely scenarios where entire loan books are subject to the cap, or if legislation gains traction in Congress, our outlook would turn more cautious.

We believe a dip could present a compelling opportunity

Bank and credit card issuers are likely to decline on the news. However, we would view sharp pullbacks in the largest issuers as potential opportunities because implementation remains highly uncertain, any impact is likely temporary, and larger card issuers can at least partially offset the lost net interest income.

We also note that bank earnings season kicks off this week, with JPMorgan reporting on Tuesday, followed by Bank of America, Wells Fargo, and Citi on Wednesday. We expect the proposed interest rate cap to be a key topic on earnings calls and believe management commentary could be supportive if messaging is compelling. We also expect 4Q financial results and 2026 outlooks to be mostly positive for the broader group.

Potential policy pivot

Potential policy pivot

As the saying goes, elections have consequences. Most investors were already anticipating how the US midterm elections could influence policy decisions over the next year. The results of gubernatorial and New York City mayoral elections on 4 November pulled forward those consequences. It wasn’t the best night for President Trump and Republicans, as voters reminded them that high inflation and poor affordability are losing issues for incumbent politicians. Other developments have also weighed on Trump’s standing, with his net approval measured by Real Clear Politics falling from about -6% in late October to -12% now. The question is whether these shifting political winds will lead to a pivot in the Trump 2.0 economic agenda, and what that could mean for the investment outlook if it does.

As a start, it’s worth asking if the overarching economic ideology of Trump 2.0 will shift. Back in January this ideological choice could be simplified to MAGA versus DOGE. This choice characterized MAGA as a populist "America First" approach and rejection of globalism, aiming to help people who haven’t benefited from the economic prosperity of the past 25 years. In contrast, DOGE’s aim was to reduce government spending and shrink the deficit, favoring the private sector to create prosperity. A further simplification is to say that MAGA benefits labor and DOGE favors capital, and the more DOGE that Trump 2.0 economic policies are, the more constructive the investment outlook.

Nearly 12 months later, neither ideology is an accurate distillation of Trump 2.0 policies, which have been a heterodox mix that deviates notably from conventional supply-side economics. Tariffs have been a tax increase disrupting global supply chains, while stricter immigration has also been a drag on labor supply. The One Big Beautiful Bill Act (OBBBA) is more conventional supply-side policy, with tax cuts designed to incentivize investment. Based on this policy mix, neither capital nor labor should be the clear beneficiary. But the election results and Trump’s falling approval ratings suggest that the general public definitely doesn’t think the policies are labor-friendly, which sets the stage for a potential policy pivot.

Whether that occurs also depends on what economic outcome Trump wants to achieve. Prior to 4 November, I suggested in "The two most important numbers in economics" that higher nominal GDP growth was a desired outcome. That’s easier to achieve if you begin with the assumption of a low neutral fed funds rate, which can justify more aggressive Fed rate cuts. The implication is that the Trump administration would favor policies that result in the economy running hot going into the midterms.

The election results and the spotlight on affordability and inflation may be changing this preference. It’s difficult to achieve lower inflation, lower energy prices, and lower long-end rates while also pushing for stronger growth, and the former might be more important than the latter for electoral success. There are already policy tweaks at the margin. Eliminating tariffs of certain food imports is one example. Another is Trump floating the idea of extending the ACA enhanced premium tax credits to avoid significant cost increases starting 1 January.

The most relevant potential pivot pertains to Fed policy. Trump has repeatedly said rates are too high, and it’s long been expected that his nominee to be the next Fed chair would share that view. Reports that Kevin Hassett is the likely choice lend credence to that view, reinforced by his comments last weekend that inflation has fallen to 2.5% and grocery inflation is closer to 1.5%. That could be a preview of the case he’d make as chair for multiple rate cuts. While that should be good for growth (and asset prices), the risk is that inflation remains stuck near 3% and the yield curve bear steepens as investors price in a larger inflation premium in long-end rates. Such an outcome—elevated inflation and rates—may more than offset the political benefit of stronger growth.

Could that result in a Fed that’s less dovish than it otherwise would have been prior to 4 November, and thus suggestive of a Trump 2.0 policy pivot? That’s impossible to ever really know, but an indirect indication is whether Hassett makes the case for a 2.5% neutral fed funds rate. Stephen Miron, whom Trump appointed to the FOMC in September, has argued that the neutral rate is back to this level after rising to 3% (or higher) the past couple of years. His case hinges on a positive labor supply shock lifting the neutral rate, and the steep decline in net immigration in 2025 and likely beyond lowering potential growth and thus the neutral rate. Hassett making the same argument would suggest that the desire for lower rate remains undaunted. But if he demurs somewhat, it could reflect inflation and affordability concerns resulting in a more conventionally dovish approach to rate cuts.

The bottom line: All these considerations and the evidence so far suggest that a Trump 2.0 economic policy pivot will occur at the margins, but the bias will still favor nominal growth-enhancing policies, although with more consideration of the inflation consequences. This partially reflects the likely desired outcome, and the simple fact that there are more policy levers to pull in the near term that could boost growth than can reduce inflation. That suggests that the predominant macro regime in 2026 is likely to be reflation, but the political appeal of disinflationary growth policies makes a Goldilocks outcome incrementally more probable. Either outcome is good for risk assets, but especially equities and, along with them, concern about bubbles.

Supreme Court decides fate of IEEPA tariffs

Supreme Court decides fate of IEEPA tariffs

- The Supreme Court holds oral arguments on 5 November in the case against the administration’s use of the International Emergency Economic Powers Act to levy tariffs. The court will likely issue its ruling later this year, potentially early next year.

- The US government could be forced to refund USD

- 130- 140 billion of tariff revenue (0.5% of 2024 US GDP), which would provide a modest windfall to US importers that paid the tariff but would modestly worsen the US fiscal outlook (7.9% of 2025 US federal budget deficit).

- We expect the administration to partially rebuild the tariff wall with other trade remedies (e.g., Sections 201, 232, 301) that are less flexible and more limited in scope. This process may take several quarters to unfold.

- Except for China and its rare earth leverage, we assume goods trade surplus countries won’t retaliate against new tariffs to avoid potential escalation and deeper economic damage.

- Rebuilding the tariff wall with more targeted levies on specific products and countries will likely spark episodes of heightened volatility in certain regional markets and sectors, but this is likely to prove short-lived if countries don’t retaliate.

- We think a lower US effective tariff rate and no retaliation could prove supportive for stocks by improving consumer spending power. By limiting inflation, it also allows room for more Fed funds rate cuts. The yield curve could modestly steepen as investors price a slightly worse US budget deficit outlook.

US-China tariffs: De-escalation post Xi-Trump meeting

US-China tariffs: De-escalation post Xi-Trump meeting

The much-anticipated Xi-Trump meeting concluded today with constructive tones and outcomes. Notably, President Xi emphasized dialogue, cooperation, and long-term stability as the foundation for US-China relations, calling for mutual understanding and expanded collaboration. His remarks also appeared intended to reassure US concerns about the implications of China’s growth for the US economy.

Based on Trump’s speech on Air Force One and China’s Ministry of Commerce statements, key outcomes from the latest talks include:

- Tariff cut: US lowers fentanyl-linked tariffs to 10% and extends the reciprocal tariff truce by one year, reducing the effective rate to 30%from 40%.

- Soybean: China resumes US soybean purchases immediately.

- Rare earths: China suspends new export controls for one year, improving US access.

- Tech restrictions: US pauses “>50% affiliate entity list rules” for one year.

- Shipment fees: US suspends probe and special port fees on China’s ships for one year.

- Future visits: Trump to visit China next April; Xi may visit the US afterward.

While no final agreement was reached on TikTok, Russian oil, and Blackwell chips, the overall tone of the meeting was constructive, with both sides emphasizing consensus on resolving major trade issues. Both leaders have also agreed to continue collaboration in varied fields and further negotiations, aiming to resolve major trade issues and maintain a constructive relationship.

Overall, the Xi-Trump meeting has eased immediate trade tensions and set a positive tone for further negotiations. The tariff de-escalation is in line with our base case that the tariff landing zone should be 30-40%. The details and implementation of the agreements approved by the two Presidents would be important to watch.

Monitoring the economy amid a shutdown

Monitoring the economy amid a shutdown

Private data releases help sketch the economic picture

In our 25 September report previewing a US government shutdown, we provided a select list of October's economic data releases that would not be published in the event Congress was unable to pass a continuing resolution. Now that the data releases from the Bureau of Labor Statistics, the Census Bureau and the Bureau of Economic Analysis have been paused throughout the shutdown, we highlight the private sector and Federal Reserve economic data releases that will continue to be published to provide a timely gauge of economic conditions (see Fig. 1).

Selected monthly private economic releases

Data Category | Data Category | Indicator | Indicator | Source | Source |

|---|---|---|---|---|---|

Data Category | Consumer | Indicator | Consumer Confidence Consumer Sentiment | Source | Conference Board Univ. of Michigan |

Data Category | Housing | Indicator | Existing Home Sales (SAAR) | Source | National Assoc. of Realtors S&P CoreLogic Case-Shiller |

Data Category | Inflation | Indicator | ISM Manufacturing Prices ISM Non-Manufacturing Prices | Source | ISM ISM |

Data Category | Employment | Indicator | ADP Employment Change Job Cut Announcements | Source | Automatic Data Processing Challenger, Gray & Christmas |

Data Category | Manufacturing | Indicator | ISM Mfg. Purchasing Manager Index Industrial Production | Source | ISM Federal Reserve |

Investors view Fed on autopilot this month, not flying blind

Despite having less visibility on the economy during the shutdown, we expect the Fed to cut the policy rate twice in the fourth quarter, each time by 25 bps—once at the end of October and again in mid-December. The market-implied probability that the Fed cuts rates by 25 basis points in late October stands at 100%, with still sizable odds of an additional cut at its meeting in mid-December.

As we wrote in our last report, the economic impact from US government shutdowns is usually modest—even those that stretch for several weeks. The shutdown in 2018-19 was a partial shutdown but also the longest at 34 days. It resulted in an estimated reduction in 2019 GDP of just 0.02%, according to the Congressional Budget Office. The current episode may prove somewhat more disruptive than in 2018-19 because this represents the first full shutdown since 2013 (a full shutdown occurs when Congress hasn't passed any of the 12 annual appropriations bills.) CBO estimates that the furloughs could affect as many as 750,000 employees out of the just over 2 million people who work at the agencies subject to discretionary spending approvals. UBS estimates the number at closer to 550,000. Still, the two estimates represent between 0.3-0.5% of the US labor force. In addition, the Office of Management and Budget is preparing plans to fire government employees, and the administration has placed various spending programs under review during the shutdown, which could amplify the downside effects. Ultimately, these moves raise uncertainty: The number of employees who would be affected is not yet known, and, as with the DOGE firings and spending cuts earlier in the year, these moves would likely be subject to litigation.

A potential endgame

The economic effect of the shutdown also hinges on its duration, but it's impossible to know how long the stalemate in Congress will last. At issue is the expiry at the end of 2025 of enhanced Affordable Care Act subsidies, which Democrats are seeking to extend in any continuing resolution. Historically, extended government shutdowns yield little for the party forcing the shutdown. In the failed Tuesday vote to pass a continuing resolution, three Democrats voted in favor of keeping the government open, while one Republican voted against. This yielded a 55-45 outcome, five votes shy of the necessary 60 vote threshold to move the legislation forward. If Senate Majority Leader Thune is able to pick up at least five more Democratic votes, most likely either Senate moderates or those representing purple districts, the shutdown will end.

US government shutdown on the horizon

US government shutdown on the horizon

A looming US government shutdown

A US government shutdown next week appears highly likely, in our view. Congress has not approved any of the 12 fiscal 2026 annual appropriations bills and is unlikely to pass a short-term funding package (known as a continuing resolution) before the fiscal year ends on 30 September. Continuing resolutions have been used more frequently to fund the government when legislators are unable to pass appropriations bills and agree on the budget. In the current highly charged political climate and with narrow majorities in both chambers, lawmakers appear unwilling to make the concessions needed to fund the government. Barring a last-minute, bipartisan effort to end the stalemate, a shutdown of the government would begin on 1 October. This seems unlikely with Congress out of session for the remainder of this week; the Senate returns to DC on 29 September and the House is scheduled to return on 6 October.

The practical effects of a shutdown

At risk in a shutdown are the discretionary spending categories (e.g., education, transportation, defense) that are subject to annual appropriations, or roughly 25% of federal spending. Not all workers and agencies would be affected. If the 2023 shutdown contingency plans are used as a guide for this year, roughly a third of federal workers would be furloughed. Of those who would continue to work, about half would receive full pay, while the other half would work without pay. Employees would receive their pay when the shutdown ends and the funding gap is closed, mostly likely when the two sides are able to agree to some form of a continuing resolution. Meanwhile, essential services (those that are viewed as protecting life and property) would continue. Mandatory spending (outlays not affected by annual appropriations such as Social Security, Medicare, Medicaid, income security programs and retirement benefits) would also proceed without interruption. Interest on the debt will continue to be paid, as would Treasury auctions.

Economic data from the Bureau of Labor Statistics (monthly inflation and employment reports, as well as weekly jobless claims), Bureau of Economic Analysis (GDP, personal income and spending), and the Census Bureau (retail sales, housing starts) would be suspended during the shutdown (see Fig. 1). Federal Reserve and private sector economic data would continue to be published during a shutdown, but the lack of data during the shutdown would constrain monetary policymakers from seeing the evolution of the economy ahead of the FOMC’s 28-29 October meeting at a time when the impact of tariffs could begin to come into focus.

Selected government data releases during Oct 2025

Date | Date | Economic release | Economic release | Period | Period |

|---|---|---|---|---|---|

Date | 2 Oct | Economic release | Initial Jobless Claims | Period | 27 Sep |

Date | 2 Oct | Economic release | Factory Orders | Period | Aug |

Date | 2 Oct | Economic release | Durable Good Orders | Period | Aug F |

Date | 3 Oct | Economic release | Employment Situation | Period | Sep |

Date | 7 Oct | Economic release | International Trade in Goods and Services | Period | Aug |

Date | 9 Oct | Economic release | Initial Jobless Claims | Period | 4 Oct |

Date | 15 Oct | Economic release | Consumer Price Index | Period | Sep |

Date | 16 Oct | Economic release | Retail Sales | Period | Sep |

Date | 16 Oct | Economic release | Producer Price Index | Period | Sep |

Date | 16 Oct | Economic release | Initial Jobless Claims | Period | 11 Oct |

Date | 17 Oct | Economic release | Housing Starts | Period | Sep |

Date | 23 Oct | Economic release | Initial Jobless Claims | Period | 18 Oct |

Date | 24 Oct | Economic release | New Home Sales | Period | Sep |

Date | 27 Oct | Economic release | Durable Goods Orders | Period | Sep P |

Date | 29 Oct | Economic release | Advance Goods Trade Balance | Period | Sep |

Date | 30 Oct | Economic release | Gross Domestic Product | Period | 3Q A |

Date | 30 Oct | Economic release | Initial Jobless Claims | Period | 25 Oct |

Date | 31 Oct | Economic release | Employment Cost Index | Period | 3Q |

Activity delayed, not derailed

US government shutdown risk flares up more often lately, most recently six months ago when funding decisions were pushed to the brink but ultimately resolved at the last minute with a continuing resolution. Despite the frequent flare-ups, it’s been nearly seven years since the last government shutdown in late 2018 and early 2019 during President Trump’s first term, which partially closed the government for 35 days. Despite being the longest government shutdown on record, a Congressional Budget Office study concluded that the economic impact was minimal; the authors estimate that the economy lost only 0.02% of projected GDP in 2019 directly related to the shutdown. Delayed paychecks initially slowed economic activity during the shutdown, but the disbursement of back wages when the government reopened spurred above-trend growth in subsequent quarters.

The financial market impact

There have been many US government shutdowns over the years but few that lasted longer than a week. By definition, anything shorter than a week would have a negligible impact on the economy and therefore little impact on financial markets. We constructed three time series to measure the degree of volatility associated with shutdowns for the S&P 500 and the 10-year Treasury note yield in instances when the shutdown was longer than a few days. The table shows the percentage change of the S&P 500 and the 10-year Treasury yield leading up to the final date of budgetary authority and through the date that funding was restored. We focused on the weeks leading up to the shutdown because we believe media coverage over the possibility of a shutdown tends to influence investor behavior. Of those that have lasted longer than a week, we have seen mixed financial market results both heading into, and during, the shutdown (see Fig. 2).

Financial market moves ahead of and during past extended government shutdowns

Start Date of Budget Impasse | Start Date of Budget Impasse | Date of Funding Restoration | Date of Funding Restoration | Duration of Budgetary Statement (Number of Calendar Days) | Duration of Budgetary Statement (Number of Calendar Days) | Percent Change from 1 Week Prior To The Final Date of Budgetary Authority | Percent Change from 1 Week Prior To The Final Date of Budgetary Authority | Percent Change from 2 Weeks Prior To The Final Date of Budgetary Authority | Percent Change from 2 Weeks Prior To The Final Date of Budgetary Authority | Percent Change from 1 Week Prior To 1 Day Prior To Resolution | Percent Change from 1 Week Prior To 1 Day Prior To Resolution |

|---|---|---|---|---|---|---|---|---|---|---|---|

S&P 500 Index |

|

|

|

| |||||||

Start Date of Budget Impasse | 12/16/1995 | Date of Funding Restoration | 1/6/1996 | Duration of Budgetary Statement (Number of Calendar Days) | 21 | Percent Change from 1 Week Prior To The Final Date of Budgetary Authority | -0.2% | Percent Change from 2 Weeks Prior To The Final Date of Budgetary Authority | 1.5% | Percent Change from 1 Week Prior To 1 Day Prior To Resolution | -0.1% |

Start Date of Budget Impasse | 10/1/2013 | Date of Funding Restoration | 10/17/2013 | Duration of Budgetary Statement (Number of Calendar Days) | 16 | Percent Change from 1 Week Prior To The Final Date of Budgetary Authority | -1.2% | Percent Change from 2 Weeks Prior To The Final Date of Budgetary Authority | -0.9% | Percent Change from 1 Week Prior To 1 Day Prior To Resolution | 1.2% |

Start Date of Budget Impasse | 12/22/2018 | Date of Funding Restoration | 1/25/2019 | Duration of Budgetary Statement (Number of Calendar Days) | 34 | Percent Change from 1 Week Prior To The Final Date of Budgetary Authority | -7.1% | Percent Change from 2 Weeks Prior To The Final Date of Budgetary Authority | -8.2% | Percent Change from 1 Week Prior To 1 Day Prior To Resolution | 1.6% |

Start Date of Budget Impasse |

| Date of Funding Restoration |

| Duration of Budgetary Statement (Number of Calendar Days) |

| Percent Change from 1 Week Prior To The Final Date of Budgetary Authority |

| Percent Change from 2 Weeks Prior To The Final Date of Budgetary Authority |

| Percent Change from 1 Week Prior To 1 Day Prior To Resolution |

|

10-Year Treasury Note Yield |

|

|

|

| |||||||

Start Date of Budget Impasse | 12/16/1995 | Date of Funding Restoration | 1/6/1996 | Duration of Budgetary Statement (Number of Calendar Days) | 21 | Percent Change from 1 Week Prior To The Final Date of Budgetary Authority | 1% | Percent Change from 2 Weeks Prior To The Final Date of Budgetary Authority | 1% | Percent Change from 1 Week Prior To 1 Day Prior To Resolution | -1% |

Start Date of Budget Impasse | 10/1/2013 | Date of Funding Restoration | 10/17/2013 | Duration of Budgetary Statement (Number of Calendar Days) | 16 | Percent Change from 1 Week Prior To The Final Date of Budgetary Authority | -3% | Percent Change from 2 Weeks Prior To The Final Date of Budgetary Authority | -9% | Percent Change from 1 Week Prior To 1 Day Prior To Resolution | -4% |

Start Date of Budget Impasse | 12/22/2018 | Date of Funding Restoration | 1/25/2019 | Duration of Budgetary Statement (Number of Calendar Days) | 34 | Percent Change from 1 Week Prior To The Final Date of Budgetary Authority | -3% | Percent Change from 2 Weeks Prior To The Final Date of Budgetary Authority | -9% | Percent Change from 1 Week Prior To 1 Day Prior To Resolution | -5% |

The more significant adverse stock market reaction heading into the 2018 shutdown is notable, but it should be viewed in the context of investor worries over the imposition of import tariffs throughout 2018 and concerns over the impact of progressively tighter monetary policy. While it is possible that the equity market reaction to the 2018 shutdown could be repeated, we would note that the initial downtrend in December 2018 was temporary. By the time the stalemate was resolved in late January, the S&P 500 index had rebounded.

Banking on regulatory reform

Banking on regulatory reform

- The substantial financial regulatory reform agenda under the current US administration is well underway, with a potential acceleration over the next six to 12 months.

- While bank capital reform will likely reduce capital requirements holistically, the revised standards will remain much stricter than pre-GFC levels and be more stringent than those in many other countries. We view these changes as a normalization of policy rather than a reversal.

- Revised capital requirements and easing of other regulatory rules provides greater clarity and flexibility for bank management teams. This should result in more productive redeployment and significant increases in balance sheet capacity.

- We see positive implications for both equity and fixed income investors as reforms normalize, driven by improved earnings power, resilient credit profiles, and favorable supply and demand dynamics for Agency MBS and bank corporate bonds as well as preferreds.

IEEPA tariffs ruled unlawful on appeal

IEEPA tariffs ruled unlawful on appeal

Case likely to head to Supreme Court

On Friday, 29 August, the US Court of Appeals for the Federal Circuit issued a 7-4 ruling that upheld the lower Court of International Trade’s (CIT) May ruling that the US administration’s tariffs introduced under the International Emergency Economic Powers Act (IEEPA) are unlawful. The IEEPA tariffs subject to this ruling form the bulk of the administration’s tariff wall and include:

- the overarching 10% baseline tariff,

- the fentanyl and border security tariffs against Canada, Mexico, and China,

- the agreed-upon tariff rates with the UK, the EU, Japan, Vietnam, and others,

- the higher reciprocal tariffs levied on countries that run large bilateral goods trade surpluses with the US and were so far unable to reach a trade deal,

- the 40% additional tariffs on Brazil for its trial of the former president, and

- the 25% additional tariffs on India for purchases of Russian oil.

The appeals court allowed the IEEPA tariffs to remain in effect until 14 October to give the administration time to appeal the decision to the Supreme Court. The Supreme Court is highly likely to accept the case, but the timing of its decision is uncertain.

Rebates applied specifically or broadly?

The appellate (appeals) judges told the CIT to reconsider its decision to block tariffs across the entire US. The judges suggested that, instead, the court might limit its ruling to just the parties directly involved in the lawsuit. This advice comes after a Supreme Court ruling earlier this year in a case about birthright citizenship, which made it harder for federal judges to issue nationwide injunctions. Despite this, some lower courts have continued to block policies nationwide in similar cases.

In the case of tariffs imposed by the government under the IEEPA, the appeals court pointed to the “major questions doctrine”—a legal principle that says if the government wants to make big policy changes with major economic or political impact, it needs permission from Congress. The Supreme Court previously used this doctrine to limit the Biden administration’s actions on student loan forgiveness and climate change.

If the Supreme Court decides that the IEEPA tariffs are a matter of national importance and that the administration overstepped its legal authority, the impact would go beyond just the companies who sued. It could mean that all the tariffs collected under the IEEPA would have to be refunded by Customs and Border Protection, possibly with interest. This could cost the government hundreds of billions of dollars—money that was helping to reduce the federal deficit.

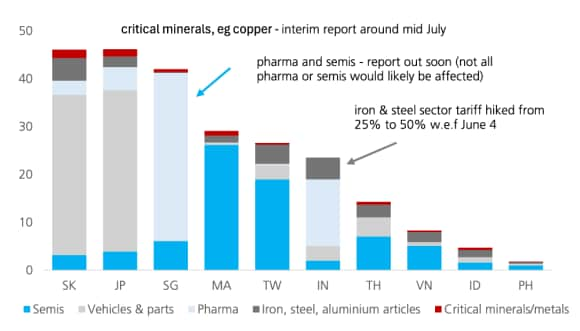

Options to rebuild the tariff wall

Sectoral tariffs under Section 232 of the Trade Expansion Act of 1962 on aluminum, steel, copper, cars, and car parts are unaffected by the appeals court ruling. The administration has already introduced and even concluded a wide range of additional Section 232 investigations to determine whether imports of certain products cause harm to US national security interests. In the event the Supreme Court upholds lower court rulings that the IEEPA tariffs are deemed unlawful, the administration could reconstruct some of its tariff wall with Section 232 tariffs on a wide range of products including pharmaceuticals, semiconductors, aircraft, lumber, and more. For the baseline tariffs, the administration can employ Section 122 of the Trade Act of 1974 to impose tariffs to address persistent balance-of-payment surpluses, but only up to 15% and for only 150 days without an act of Congress to extend them. Any longer-term tariff on countries running trade surpluses would have to come under Section 301, as was the case with China in 2018 and 2019, but only after the Commerce Department completes its investigation.

US government shutdown risk increased

Overshadowed on a busy news day, the Office of Management and Budget directed “pocket rescissions” on Friday valued at nearly USD 5 billion of spending cuts, primarily on foreign aid. The move circumvents Congress, which is afforded the power of the purse, and directs that congressionally authorized payments not be made. Senators from both sides of the aisle condemned the move for sidestepping Congress, which was out of session for its summer recess. This worsens an already rancorous climate in Congress, which needs bipartisan support (60 votes in the Senate) to achieve the passage of all 12 appropriations bills before 30 September or a continuing resolution that would keep the government open but would extend the Biden budget baseline for the length of the continuing resolution. Odds of a government shutdown have increased as a result of this action.

Investment implications

Both events are likely to have limited directional impact on financial markets in the near term but could stoke volatility as market participants attempt to determine the net effect. We won’t know the outcome for the IEEPA tariffs until the Supreme Court issues its ruling. The timing of this decision is uncertain but likely before 1Q26. If it declares the IEEPA tariffs unlawful, the return of collected duties to importers would help their earnings. However, there are numerous risks: a slightly worse fiscal position for the federal government; the actual headline risk for countries and sectors as the administration rebuilds its tariff wall; the fracturing of deals that involved investment pledges, improved market access, and purchase commitments; and the potential for retaliation given the administration’s more limited tariff authority.

No tariff inflation? Not so fast

No tariff inflation? Not so fast

At a glance

- We expect the US effective tariff rate, now at over 18%, to settle near 15% by mid-2026, which corresponds to a 30-40% tariff range for China and 10-15% for other countries.

- The jump in tariffs and the corresponding fall in the value of the US dollar have yet to show up in a meaningful way in official inflation measures. The pass-through takes time, but the evidence that companies will pass this on to consumers is starting to accumulate.

- Although the effects of these tariffs have been slow to evolve, we estimate that tariffs will ultimately reduce GDP growth by around 1pp. Similarly, we expect the CPI to end around 1pp higher than it would be without the tariffs.

The US effective tariff rate has risen to more than 18%, according to researchers at The Budget Lab at Yale University, yet the jump in tariffs has yet to show up in a meaningful way in official inflation measures. The pass-through takes time, but the evidence that companies will pass this on to consumers is starting to accumulate.

I’m only just now beginning to see prices of imports begin to rise. Woodworking is one of my hobbies, and imported power tools are now more expensive. Festool, which I consider to be the Mercedes-Benz of power tools for its German engineering and design, announced that it would assess an “import fee” on 1 August. A look at an orbital sander on Festool's website, for example, suggests its price rose by 6% in early August. Why 6%? It’s possible this is the price increase that Festool needed to charge its customers to maintain its margins now that European manufactured products face a 15% tariff. If one assumes that shipping, warehousing, retailing, and other costs add 50-60% to the price of an imported power tool, then a 6% price increase would theoretically cover the cost of the tariff and protect margins.

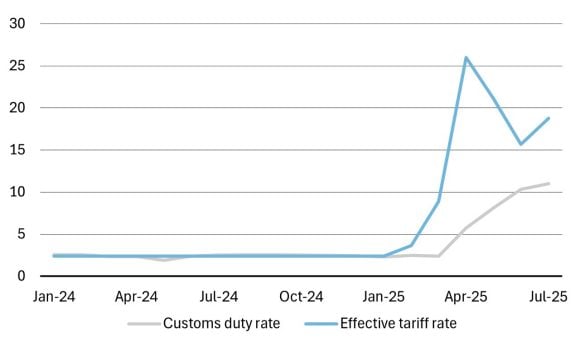

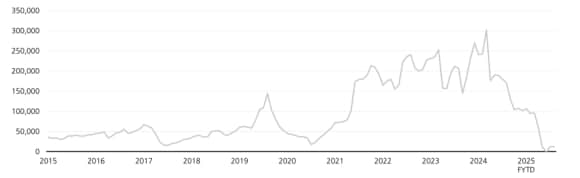

And so it begins. The long-dreaded goods inflation pressure is finally arriving at US shores and in stores. After several months wondering what the tariff rate will be, companies are passing it on to consumers. US International Trade Commission data show that customs duties collected at the border have been steadily rising since the start of the year as an increasing number of imported goods are now subject to tariffs (see Fig. 1). The higher tariff rates are also pushing the collected duty rate higher (see Fig. 2).

Fig. 1: More imported goods subject to tariffs

Fig. 2: Posted tariff rates start lifting the duties collected

But yes, this process takes time. Low-frequency purchases and premium products, like power tools, feed into CPI more slowly than high-frequency purchases, like bananas and coffee. Some imports were front-loaded to avoid tariffs. Fig. 1 offers evidence of an import spike in March 2025 when companies stocked inventories and consumers shopped ahead of the tariffs. And tariffs take a while to hit because shipping takes time. Goods shipped to the US after the administration imposed tariffs could take weeks or even months to reach store shelves.

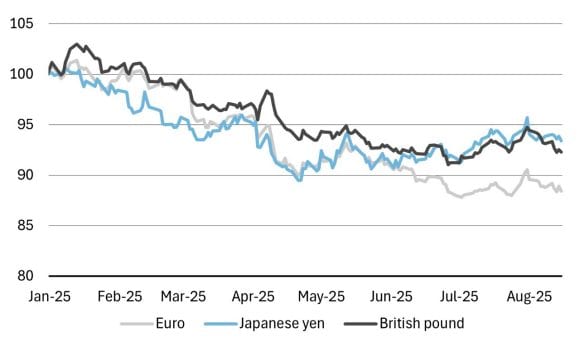

In addition to the effect of tariffs, exporters to the US also face a sharply weaker US dollar since the start of the year. Rather than appreciate in the face of higher tariffs as many anticipated, the US dollar has weakened 11% versus the euro, 6% versus the Japanese yen, and 7% versus the British pound (see Fig. 3).

Fig. 3: Weaker US dollar versus major trading partners

Some exporters routinely hedge their US dollar exposure, cushioning them from the impact of dollar depreciation, but such hedges would typically be in place for a year at most, so eventually their margins will take a hit unless they raise the prices in dollars that they charge importers. In turn, this would make it even more difficult for importers to absorb the tariffs they are paying. The theory espoused by Treasury Secretary Bessent and others in the administration, stating that consumers would not ultimately bear the cost of the tariffs, is implausible, in our view, unless the dollar strengthens.

As we wrote in our Global Risk Radar report from 8 August, we expect the US effective tariff rate to settle near 15% by mid-2026, which corresponds to a 30-40% tariff range for China and 10-15% for other countries. Although the effects of these tariffs have been slow to evolve, we estimate that tariffs will ultimately reduce GDP growth by around 1pp. Similarly, we expect the CPI to end around 1pp higher than it would be without the tariffs.

War in Ukraine – Alaska summit doesn’t result in immediate progress toward a ceasefire

War in Ukraine – Alaska summit doesn’t result in immediate progress toward a ceasefire

- The meeting between US President Trump and Russian President Putin did not result in immediate progress toward a ceasefire in Ukraine. Follow-up meetings are being discussed, but it remains to be seen whether a framework for negotiations will emerge in the coming days. Trump highlighted that it was up to Zelenskiy to agree to a deal now.

- With the respective positions of Russia and Ukraine remaining far apart, no decisive developments on the battlefield, and continued support for Ukraine, we expect the war to continue into next year. Diplomatic efforts will likely continue, but we think any negotiation process will likely be drawn out given the lack of trust and distance between desired outcomes.

- Markets will likely turn their focus again toward the health of the global economy in light of raised US tariffs and the outlook for global interest rates. We recommend staying invested in well-diversified portfolios, including alternatives, to account for geopolitical and macroeconomic risks. We favor high grade credit and allocations to transformational innovation in the equities space.

US tariffs: Implications for the Swiss economy

US tariffs: Implications for the Swiss economy

- Swiss GDP growth significantly slowed in 2Q25 as US tariffs hit Swiss exports.

- Our GDP forecast for Switzerland assumes 15%US tariffs on Swiss goods (excluding gold and pharmaceuticals). If tariffs remain at 39%, we believe Swiss GDP growth could be reduced by up to 0.4 percentage points.

- While up to 0.4% of employment may be at risk if tariffs remain at 39%, the short-time work scheme should help cushion the impact on the labor market and limit the increase in unemployment, in our view.

Tariffs gradually feeding into inflation

Tariffs gradually feeding into inflation

Released today, the CPI for July rose 0.2% m/m, while core CPI, which excludes food and energy, increased 0.3%. The data was broadly in line with consensus expectations, and equity markets moved higher after the release.

Looking at details of the report, falling energy prices (-1.1% m/m) helped to curtail the headline CPI, while airfares (+4%) and medical services (+0.8%) pushed the CPI higher. Core goods prices were up a relatively modest 0.2%m/m.

As shown in the chart, it appears that the downward trend in core inflation has been broken as tariffs start to feed through into retail prices. In July, the effective tariff rate, based on customs duties actually collected, was around 9%. However, after the additional tariffs implemented last week, the statutory rates are around 18%, so the impact on importers' costs should rise further from here. We expect inflation to continue on a gradual upward trend as businesses pass along their higher costs, but slowing shelter inflation and push-back from increasingly stretched consumers should help offset some of the tariff impact. We expect core inflation to be around 3.5% at the end of the year, only modestly higher than the 3.1% reading in July.

Despite the prospect of inflation moving further above the Fed's 2% target, we expect it to resume interest rate cuts at the next FOMC meeting on 16-17 September. Our base case calls for 25-basis-point cuts at each meeting through January for a total of 100 bps, which would bring policy to roughly a neutral setting.

Core inflation starting to rise as tariffs feed through

Data integrity called into question

Data integrity called into question

Following a weaker-than-expected jobs report last Friday, President Trump fired Bureau of Labor Statistics (BLS) Commissioner Erika McEntarfer. This highly unusual move has raised questions over the future integrity of BLS data and government statistics in general.

In our view, just as replacing Fed Chair Powell would not lead to an immediate change in Fed policy, replacing the head of the BLS will not suddenly lead to higher payroll numbers. With or without McEntarfer, we expect the BLS to make substantial downgrades to some of the historic payroll data when the annual benchmark revisions are announced on 9 September. Government statistics involve well established procedures, and we believe the agencies that produce them have a strong culture that would push back against any attempt to manipulate the data.

Nonetheless, we cannot rule out the possibility that future data will be free from political influence. We already have an example of political influence in government data from the first Trump administration, namely the 2020 census. Among other things, the census determines the distribution of seats in the House of Representatives, which has obvious political ramifications. Just this morning, President Trump came out with a social media post saying that he wants undocumented immigrants to be excluded from the census for the first time.

From the beginning of his term, the president has shown a strong preference to work with those who share in his line of thinking. Theoretically, if given enough time, it might be possible to change personnel and procedures in a way that could produce more favorable economic data. Near the top of the list of things that would cause us concern are the CPI data, which are also produced by the BLS. The CPI feeds into Social Security cost of living adjustments, changes to tax bracket income thresholds, payments on TIPS bonds, and a host of other areas with real-world consequences. Even the perception that the data is being altered for political reasons could be problematic.

What Trump’s latest tariff threats mean

What Trump’s latest tariff threats mean

Thought of the day

US President Donald Trump stepped up his tariff threats yet again on Wednesday, doubling the tariff on Indian goods to 50% and targeting a 100% tariff on semiconductor imports. While he said the semis levies would not apply to businesses that had made investments or a commitment to build and invest in the US, no further details about the plan were provided.

The move came as the refreshed “reciprocal” tariffs on a wide range of trading partners came into effect after midnight today. Earlier this week, he said tariffs on semis and pharmaceuticals would be announced imminently, and that imported drugs could ultimately face a tariff rate of 250%.

The market reaction so far has been relatively muted. S&P 500 and Nasdaq futures are both 0.5% higher on Thursday before the US market open, extending the advance on Wednesday that pushed up the benchmark index by 0.7% and the tech-heavy Nasdaq by 1.2%.

Pending final details, we have said the sector impact of semis and pharma tariffs appears manageable at this stage. Here we offer several perspectives for investors to consider as they navigate fresh trade headlines in the coming days and weeks.

Tariff threats remain a pressure tactic rather than a sign of permanent escalation. Trump has demonstrated his escalate-to-de-escalate approach in negotiations, and we believe he has employed a similar strategy with the latest threats. The additional 25% tariff on India is set to take effect in 21 days, providing a window for further talks, with the next round of US-India negotiations scheduled for 25 August. We also think the Trump administration may be using the pharma tariff as leverage in its efforts to gain industry concessions on Most Favored Nation drug pricing. Additionally, the carveouts in these tariffs are not a coincidence—IT services in India (which has the largest revenue exposure to the US) are unscathed, generic drugs are exempt, and companies with commitments to investing in the US will not be charged with duties on semis. This shows that the Trump administration is aware of the potential economic impact of very aggressive tariffs.

Tariffs are increasingly used to address issues other than trade imbalances, with geopolitical tensions coming into play. The Trump administration cited India’s ongoing purchase of Russian energy as the reason for the additional 25% duties, warning that China could also face new tariffs if it continues buying Russian oil as the White House steps up pressure on Moscow to end the war in Ukraine. Such penalties followed the politically motivated 50% tariff on Brazil as the US runs a trade surplus with the South American country. Geopolitical developments are fluid, and whether any truce could be agreed remains to be seen, but Trump’s use of tariffs highlights the intersection of trade and geopolitical risks.

Fundamentals will remain the underlying driving force of markets. With markets becoming less sensitive to trade headlines, investors are taking more cues from economic data. While the impact of Trump’s tariffs has yet to be fully felt, recent data show that US companies are still increasing profits, consumer spending is holding up, and an imminent recession appears unlikely. With the Federal Reserve on track to resume easing in the coming months, fundamentals look set to keep markets supported.

So, our base case remains that the US effective tariff rate will settle at around 15%—enough to weigh on growth and lift inflation, but not enough to derail the US economy or the equity rally. We expect near-term volatility to continue, but think investors should stick to their longer-term financial plan. In addition, to ensure portfolio diversification across asset classes, investors can consider capital preservation strategies for more defensive stock positioning, or prepare to buy the dips to build long-term exposure.

Caught our attention

Swiss executive branch meets on US tariffs. Switzerland's executive body, the Swiss Federal Council, will convene an extraordinary meeting to discuss how to address the 39% tariffs that have come into effect on the nation's exports to the US. This follows the return of President Karin Keller-Sutter and Business Minister Guy Parmelin from Washington on Wednesday without an agreement to head off the levies, which are the highest in the developed world. The tariff, which is more than double the 15% negotiated by the European Union, threatens to place Switzerland at a competitive disadvantage in the US market. The Swiss economy could also be impacted if President Trump follows through on his pledge to impose additional tariffs on imports of all foreign pharmaceuticals coming into the US, since this accounts for the bulk of Switzerland's exports to the US. Despite the news, the Swiss benchmark stock index, the SMI, is trading 0.5% higher at the time of writing.

Our view: While pharmaceuticals, which represent 60% of Swiss exports, remain exempt for now, the proposed 39% tariff threatens key sectors such as watches, machinery, and precision instruments. Although Switzerland has been working to address US concerns, the situation remains fluid, and prolonged disruptions could put Swiss companies at a significant competitive disadvantage. Our base case remains that Switzerland and the US will reach a tariff deal similar to the EU-US agreement, reducing levies to 15%. However, the outcome of the US's Section 232 tariff investigations and Trump’s efforts to lower pharmaceutical prices will be critical for foreign trade. We recommend investors focus on quality, high-dividend stocks, structured strategies, and phasing into balanced portfolios as ways to navigate and take advantage of trade-induced volatility.

India: Oil and tariff conundrum

India: Oil and tariff conundrum

India has returned to the spotlight following a series of recent US tariff announcements, putting US-India trade relations under renewed scrutiny. Last week, US President Donald Trump imposed a 25% tariff on Indian exports after both sides failed to reach a trade deal by the 1 August deadline. On Wednesday, the US administration announced an additional 25% penalty on Indian exports, citing India’s ongoing purchase and “reselling” of Russian energy and military equipment, thus raising the total US tariff rate on Indian exports to the US to 50%.

These developments mark a notable shift from earlier this year, when India appeared well-positioned to benefit from closer US ties, given its growing role as an Asian counterweight to China. The escalation in trade tensions has also raised concerns about India’s vulnerability to global factors and its status as a key beneficiary of multinational companies’ “China+1” strategy.”

Oil remains India's Achilles' heel

Oil has long been viewed as India’s Achilles’ heel, given that it imports 88% of its total oil consumption to fuel the engines of growth for its 1.5 billion people economy. More recently, the share of Russian oil in its imports has risen from just 2% prior to 2022 to about 36% today. While lower oil prices in recent months have been a tailwind for India, any renewed spike would present a headwind for GDP growth and the current account. The latest US tariffs not only target Indian exports to the US but also specifically penalize India’s continued purchase of Russian energy, highlighting the intersection of trade and geopolitical risks.

Maintain Attractive view on Indian equities

Tariff uncertainty could certainly dampen the foreign investors' sentiment as they adopt a wait-and-see approach. However, we do not believe these developments are material enough to change our Attractive view on Indian equities. Our constructive stance is supported by several structural and cyclical factors:

First, we see the latest US tariff threats as a pressure tactic rather than a sign of permanent escalation. The new tariffs are set to take effect in 21 days, providing a window for further talks, with the next round of US-India negotiations scheduled for 25 August. While we do not expect India to budge on protecting its agriculture sector, it has scope for concessions to balance bilateral trade and address US concerns around its reliance on Russia. If India commits to increasing purchases of US energy and defense equipment, we believe this could help facilitate a deal. As a result, we think the current elevated US tariffs are unlikely to be permanent.

Second, India’s goods export exposure to the US remains modest, accounting for only 2.2% of India’s GDP. Even if higher tariffs persist and goods exports to the US drop by 50%, the direct impact would be modest for an economy growing around 6.5% y/y. From an equity perspective, the Indian market’s high share of domestically-generated revenues makes it one of the most insulated equity markets in Asia. Less than 8% of index listed companies' revenues (MSCI India) are from the US, primarily from the service-oriented IT sector which remains unscathed. Still, these developments have introduced some short-term volatility into Indian equities; MSCI India is down 1.9% over the past 10 days, reflecting these realities.

Finally, the key driver for the Indian equity market remains its strong earnings growth story, especially as the earnings downgrade cycle is nearing a bottom, setting the stage for a recovery in line with improving economic growth. Private consumption and government spending continue to support the economy and should drive earnings growth of 11.6% in FY26 and 14.1% in FY27. The upcoming 8th Pay Commission could provide an additional boost to consumption. Importantly, the Indian equity market is increasingly driven by robust domestic flows, underpinned by high household savings and a strong retail investment culture. This shift has also made the market less dependent on foreign flows and more resilient to global volatility.

Therefore, we maintain our "Attractive" view on Indian equities and believe any dips would offer an opportunity to increase exposure.

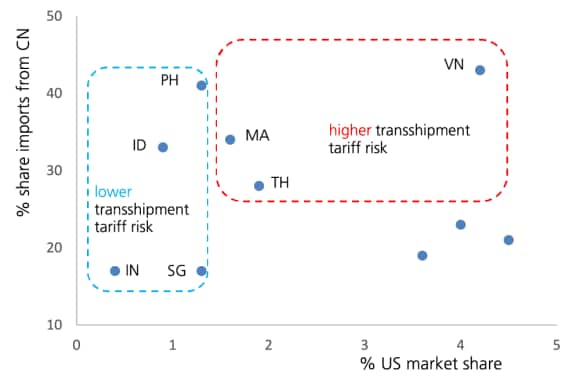

Limited exposure to US market

Currency markets: Tariff uncertainty is here to stay

Currency markets: Tariff uncertainty is here to stay

- The USD has recently gained ground against both G10 and EM currencies, amid better-than-expected US macro data—at least on the surface.

- We remain concerned about slower US growth in 2H, potential Fed rate cuts, persistent twin deficits, and the politicization of Fed policy. Hence, we reiterate our guidance of further USD weakness.

- EUR, NOK, and AUD remain our top picks in G10. In EM, we continue to favor elevated carry in currencies like the MXN, as US tariff risks peak and volatility remains subdued.

US tariffs on Swiss exports: No immediate pressure for SNB rate cuts

US tariffs on Swiss exports: No immediate pressure for SNB rate cuts

- The SNB is expected to keep its policy rate at 0%, intervening in foreign exchange markets only if temporary appreciation pressures on the franc emerge.

- The economic impact of the tariffs should be limited, as key sectors like pharmaceuticals and gold are exempt and our base case assumes lower final tariffs; even if tariffs remain high, we believe a negative policy rate would mainly affect the exchange rate and offer little broader support.

- About 60% of Swiss exports to the US—up to 10%of total exports—are affected by tariffs, not enough to justify aggressive monetary easing, especially given ongoing USD weakness.

The recent announcement of a 39% US tariff on Swiss exports to the United States, effective 7 August 2025, could weigh on Switzerland’s growth and inflation outlook if not swiftly reversed. Intuitively, this weaker outlook should put downward pressure on the Swiss franc. However, the franc’s perception as a safe haven and ongoing global uncertainty have limited its depreciation since the announcement.

At this stage, we are not revising our forecast for the Swiss National Bank (SNB) policy rate. We continue to expect the SNB to keep its policy rate at 0% over our forecast horizon, with only occasional interventions in the foreign exchange market if temporary appreciation pressures on the Swiss franc arise.

Our forecast is based on several factors:

- Tariff impact likely to be limited: Our base case assumes the final tariffs will be lower than currently announced, reducing their negative impact on Swiss growth and inflation. Even if tariffs remain high, the main risk is a temporary dip in growth—potentially two quarters of negative GDP growth, or a technical recession—but not a broader economic downturn, in our view.

- Limited effectiveness of rate cuts: The SNB has little room to offset tariff effects through monetary policy. A rate cut would push the policy rate into negative territory, but negative rates mainly influence the exchange rate. Past experience shows that while negative rates can ease appreciation pressure, they do not generally lead to sustained franc depreciation.

- US dollar dynamics: Since the tariffs target Swiss exports to the US, the USDCHF exchange rate is key. Our purchasing power parity model suggests the USD is not undervalued against the franc, and the dollar is already on a depreciation path due to loose US fiscal policy, expected Fed rate cuts, and global investor diversification out of the USD. The SNB has limited ability to counteract these broader trends.

- Tariff scope is partial: Pharmaceutical and gold exports appear exempt from the new tariffs. Conservative estimates (based on US data for 2024) suggest around 60% of Swiss exports to the US will be affected by the 39% tariff, representing up to 10% of total Swiss exports. Therefore, introducing a negative policy rate to offset tariffs on only a portion of exports would be disproportionate, in our view.

Looking ahead, there is a risk that sector-specific tariffs could be extended, particularly to pharmaceuticals, which would further increase downside risks to Swiss growth. Any inflation impact would likely emerge in 2026 if Swiss unemployment rises, potentially slowing down private consumption and wage growth. However, a negative policy rate would likely do little to support economic growth beyond its effect on the exchange rate.

The euro remains weak against the franc according to our purchasing power parity model, but as long as appreciation pressures are contained, we believe that there is no compelling case for the SNB to introduce a negative policy rate at this stage. That said, a move into negative territory remains a risk scenario if global economic growth slows more than anticipated and triggers more extensive monetary easing in the US and Eurozone, increasing appreciation pressure on the franc.

No deal, but trade talks likely to continue

No deal, but trade talks likely to continue

- Switzerland was unable to reach a trade agreement with the US. It now faces tariffs of 39%starting 7 August.

- Our base case remains that Switzerland and the US will reach a tariff deal similar to the agreement between the EU and the US with 15% tariffs. Given Switzerland’s exposure to pharmaceutical exports, the outcome of "Section 232" tariff investigations and Donald Trump's efforts to lower the prices of pharmaceutical products play an equally important role for foreign trade.

- In our base case, we expect weak growth but no recession for the Swiss economy in the coming quarters. Meanwhile, the SNB is likely to keep its policy rate at 0%.

Switzerland was unable to reach a trade agreement with the US before the deadline on 1 August, President of the Swiss Confederation Karin Keller-Sutter announced via social media. On Thursday evening, the US government published a new list of tariff rates that will apply from 7 August. Tariffs on US imports from Switzerland will be raised to 39%. The proposed tariff rate on “Liberation Day” in April was 31%, and 10% during the subsequent “reciprocal” tariff pause.

The lack of result from negotiations comes as a surprise. There were several indications over recent weeks that Switzerland and the US were closing in on a deal. According to press reports, the Swiss and US delegations already agreed a memorandum of understanding several weeks ago. However, President Keller-Sutter also mentioned that the high US trade deficit with Switzerland (in goods) stood in the way of a final agreement.

The pattern of previous negotiations in US trade disputes suggests that the failure does not mean a breakdown in talks, but rather marks the start of another round of discussions. However, the pressure on Switzerland has increased. In our base case, we still expect the US and Switzerland to ultimately reach a trade deal. We believe it is likely to be similar to the US-EU agreement: a tariff rate of 15% on US imports from Switzerland and a commitment for Swiss companies to make significant investments in the US.

Such an agreement would significantly reduce the tariff burden for companies compared to the currently announced 39% and reduce uncertainty. However, a tariff rate of 15 %still represents a significant increase in levies compared to before "Liberation Day." To make matters worse for Swiss exporters, the US dollar has depreciated significantly against the Swiss franc since the beginning of the year.

A key issue for Switzerland is the levies on its pharmaceutical products. These account for around 60%of Swiss goods exports to the US. A spokesperson for the Swiss Federal Department of Economic Affairs said Swiss authorities understand that the tariffs will not apply to the pharmaceuticals sector, as reported by Reuters. However, two other factors are important with respect to pharmaceutical exports: industry-level tariffs, which are based on the outcome of Section 232 investigations, and President Trump's efforts to lower the prices of pharmaceutical products. While the issue of US pharma imports makes the situation for Switzerland more complicated, it may also create some leeway for a deal.

The US is an important trading partner for Switzerland and accounted for around 19% of all Swiss goods exports in 2024. A trade agreement comparable to that with the EU would significantly impact Swiss exports to the US, but would be manageable, in our view.

If Swiss exports to the US are to be subject to import tariffs of almost 40% for a prolonged period, the economic damage would be much greater. This is especially true because Swiss exporters would also face a competitive disadvantage compared to EU exporters.

Global economic development is crucial

Nonetheless, over 80% of total Swiss exports do not go to the US. For this reason, it is important to consider how US trade policy affects the global and especially the European economy.

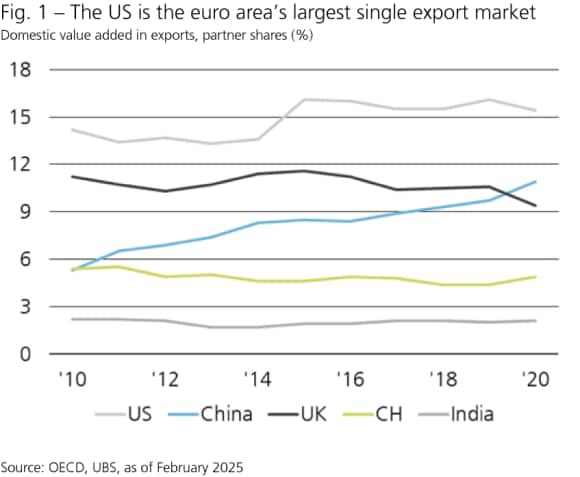

The US currently levies 15% on EU exports. This burdens export-oriented sectors in the Eurozone, but the large German fiscal package should help to cushion some of the negative impact in the medium term. We expect Eurozone growth of 0.7% over 2025, but there is a risk of a more pronounced economic slowdown.

In a scenario with weak but not negative growth in the Eurozone, we expect the Swiss economy to expand by around 1% this year and the next. Foreign trade is likely to weigh on growth, but the economy will continue to be supported by domestic demand. Given the possibility of a stronger slowdown in the Eurozone and higher-than-expected US tariffs, there is also a risk for Switzerland that growth will be weaker than previously forecast.

If Switzerland fails to reach a trade agreement with the US similar to the one with the EU, the downside risks are significantly greater.

SNB likely to keep policy rate at 0%

The Swiss National Bank (SNB) is likely to keep its policy rate at 0% over the next 12 months, in our view. Growth in the second half of the year will probably be weak, but should a tariff deal be reached, the outlook remains resilient enough not to warrant a negative policy rate. With a stable SNB policy rate, a sideways trend in long-term interest rates is also likely. However, negative interest rates cannot be ruled out, especially if Switzerland fails to secure a trade deal with the US.