Win a Galaxus voucher worth CHF 250

Open your UBS key4 banking with accounts and cards now and be in with the chance to win one of five Galaxus vouchers worth CHF 250 each. Participation in the prize draw is automatic – we’ll keep our fingers crossed for you!

The promotion is valid until 8 February 2026.

This information is issued by UBS Switzerland AG and/or its subsidiaries and/or affiliated companies (“UBS”, “we”).

The terms and conditions for the raffle can be found in our legal note for marketing activities, which you can access via the link below. In addition to the conditions mentioned there, the following applies during the promotion period from 15 December 2025 (12:00 midnight CET) to 8 February 2026 (11:59 p.m. CET):

All individuals residing in Switzerland who open a UBS key4 banking account or UBS Me account for the first time during the promotion period are automatically entered into the competition. UBS Switzerland AG (UBS) will give away 5 Galaxus vouchers worth CHF 250 per prize.

The winner will be selected randomly and notified directly at the end of the participation period. Multiple entries are excluded. If it is not possible to contact the winner within a reasonable period of up to two weeks, their claim to the prize will lapse, and UBS may draw a new winner. The prize cannot be exchanged or paid out in cash.

There is no entitlement to issue the prize in another name. Swiss substantive law exclusively applies. Legal recourse is excluded. No correspondence will be entered into regarding the raffle. Any taxes, fees or charges incurred as a result of the prize must be borne by the winner.

Please note that for minors, the legal representative must acknowledge the terms and conditions of participation.

Legal Note

The data transmitted with this form via the internet to UBS is encrypted. However, there is still the possibility that unauthorized third parties may be able to gain access to the data transmitted via this form, especially through malware on a computer. By using this form to transmit confidential data (e.g., an account number) you accept the risk of disclosing the banking relationship and banking client information to third parties, and release UBS from any liability for losses from the use of this form, as permitted by law.

By providing your telephone number and/or e-mail address above you expressly approve UBS contacting you via telephone and/or via unsecured e-mail. By providing your email address, you agree that we send you marketing communication from UBS in regular intervals (such as newsletters). Please note that you can revoke your consent at any time by unsubscribing from UBS e-mails, by contacting your UBS client advisor or by raising a data subject request.

Please be aware that the use of e-mail can involve substantial risks such as lack of confidentiality, potential manipulation of contents or sender’s address, wrong recipient, viruses etc. UBS assumes no responsibility for any loss or damage resulting from the use of e-mails. UBS recommends that you do not send any sensitive information via e-mail, that you do not include details of the previous message in any reply, and that you enter e-mail addresses manually every time you write an e-mail. UBS never requests the disclosure of personal means of access (e.g., username, contract number, passwords, or security codes) via e-mail or telephone. If you receive such a request, it could be a phishing attempt, which you can report via www.ubs.com/phishing.

UBS does not accept any transaction orders for your UBS customer relation submitted via this form, including but not limited to account openings, payment or stock market transaction orders, revocation of orders or authorizations, blocking of credit cards, changes of address. Please contact the appropriate branch or your client advisor for such transactions.

Privacy Disclaimer

We collect and process the information you enter in above fields ("Personal Data") for the purpose of engaging in prospecting and business development and/or protecting and enhancing the UBS brand (the "Purpose"). Your personal data may be passed on to companies of the UBS Group, external service providers of UBS and other third parties in Switzerland and processed by them in order to fulfill the Purpose.

By participating in the raffle, you (in the case of minors, the legal representative) agree that all personal data provided may also be used, in addition to the above-mentioned purpose, for UBS’s own marketing purposes, especially for product advertising and newsletters. Thereby, we may collect details of your interaction with e-mails that we send to you for client relationship management and/or business development purposes (such as whether you open e-mails and what content you are interested in), to evaluate whether and how we may offer products, services and events that may be of interest to you. You can revoke your consent at any time by unsubscribing from UBS e-mails, by contacting your UBS client advisor or by raising a data subject request.

For more information about how we process your data, your rights in respect of your data and the contact details of our Group Data Protection Office please read our Privacy Disclaimer for marketing activities and our Privacy Statement, accessible via links below.

Bank account services – comparison of UBS key4 banking packages

Pure

Everything you need day-to-day

CHF 0 / month

Accounts and cards

Personal and savings account

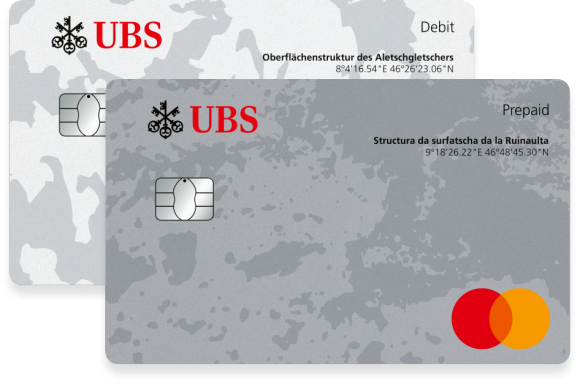

Prepaid card and debit card

Benefits of the prepaid card

Top up your card and always keep track of your expenses.

Pro

More benefits day-to-day and when traveling

CHF 14 / month

6 months free of charge

Accounts and cards

Personal and savings account

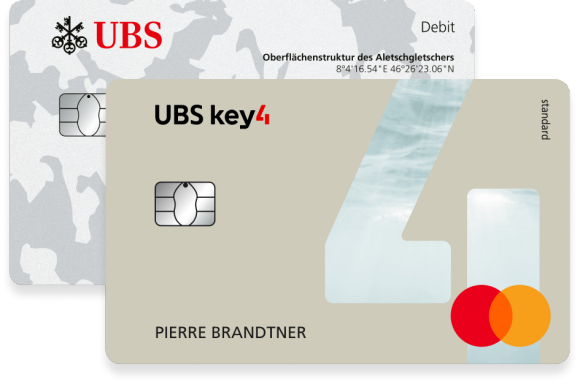

Standard credit card and debit card

Benefits of the standard credit card

Spending limit of up to CHF 5,000

2 KeyClub points for every CHF 1,000 spent

Attractive Mastercard exchange rate plus 0.5% surcharge

Travel and aviation accident insurance

Prime

Perfect for frequent travelers

CHF 22 / month

6 months free of charge

Accounts and cards

Personal and savings account

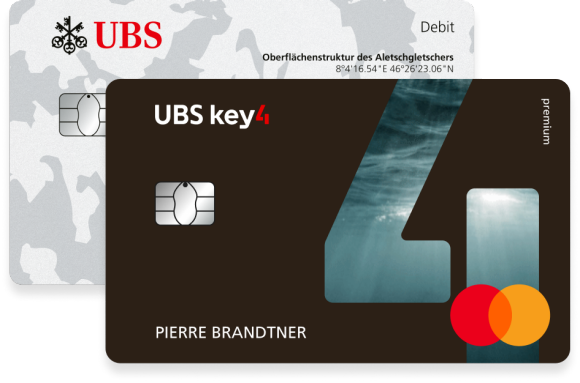

Premium credit card and debit card

Benefits of the premium credit card

Spending limit of up to CHF 10,000

4 KeyClub points for every CHF 1,000 spent

Attractive Mastercard exchange rate plus 0.5% surcharge

Priority pass for access to airport lounges

Travel and aviation accident insurance

Insurance coverage for rental cars

* UBS KeyClub points worth CHF 50. 1 KeyClub point = CHF 1. Redeemable at any time in the KeyClub eStore.

Discover additional benefits

Manage your money anytime and anywhere conveniently in the app.

Pay bills, cover parking fees or share expenses with friends – all instantly via smartphone.

Keep track of your expenses and receive personalized savings tips.

Thousands of clients trust UBS every day and rate our app with 4.7 stars*.

* The rating is an average value determined from the user ratings submitted in the Apple App Store and Google Play Store.

Collect points and save – with UBS KeyClub

With the KeyClub bonus program, you collect points every time you make a payment with your credit card, which you can redeem for products, digital gift cards or event tickets.

- 50 KeyClub points as a welcome gift

- Collect points with every credit card payment

- Redeem points: 1 point = CHF 1 (for example at partners such as Manor, Coop, Migros, Galaxus or Ikea)

- Recommend UBS and get even more points

Frequently asked questions about UBS key4 banking

UBS key4 is UBS’s digital product line. The associated products are integrated into the UBS Mobile Banking App..

The basic digital offer is called UBS key4 banking and includes a personal account, a savings account, a prepaid card or UBS key4 credit card with attractive exchange rates, a debit card, mobile payment solutions (Apple Pay, Google Pay, Samsung Pay and others), UBS TWINT and the UBS KeyClub bonus program. UBS key4 banking is available from CHF 0.

And that’s just the beginning: our digital offering is growing and more products will be available soon. Learn more

Download the app, set it up in minutes – done

Download the app, set it up in minutes – done

- Download the “UBS & UBS key4” app.

- Select “Open account”.

- Confirm your identity by video call or selfie (have your ID or passport on hand).

- Sign the contracts in the app.

- Set up login with the Access App.

- Log in and carry out initial banking transactions.

How we verify your identity

Depending on the type of ID, you can either confirm your identity yourself at any time or have it verified in a video call (Monday – Friday: 8:00 a.m. – 10:00 p.m., Saturday: 9:00 a.m. – 5:00 p.m.).

With biometric passport or biometric ID and a selfie

- Scan your ID document.

- Your personal information will be read automatically.

- Take a selfie and we will match it with your ID document.

With ID or passport via video call

- Start the video call in the app.

- Have your passport or ID* ready.

- We will identify you during the call.

* In addition to a passport or ID, foreign nationals also need a B, C, Ci or L residence permit

- Yes, this is possible around the clock with a biometric passport or biometric ID, since you can identify yourself with a selfie.

- With a non-biometric passport or non-biometric ID, we will be happy to verify your identity at the following times in a video call: Monday – Friday: 8:00 a.m. – 10:00 p.m., Saturday: 9:00 a.m. – 5:00 p.m. Opening hours vary on public holidays..

- Minimum age: 12 years

- Residence in Switzerland

- Passport or identity card* from one of these countries

- For students:

- Valid student ID, or

- Written confirmation of studies or confirmation of enrollment

- For foreign nationals (without a Swiss identity document): (not a Swiss national)

- Residence permit (B, C, Ci or L), or

- Confirmation of registration from the municipality

- Smartphone with camera and iOS, minimum version 13, or Android, minimum version 10

- Smartphone with the usage restrictions as provided by the manufacturer (no rooting or jailbreak, find out more here)

- Stable internet connection

* All identification documents must be final. This means, for example, we do not accept any pending permit applications for foreigners

Yes, you must be a resident of Switzerland and subject to taxation in Switzerland in order to open the account. In certain cases, we require proof of residence.

- Valid passport or valid ID

- One of the following:

- Residence permit (B, C, Ci or L), or

- Confirmation of registration from the municipality

You will receive two physical cards by mail. One is a debit card linked to your personal account. The other is either a prepaid card (if you chose Pure) or a credit card (if you chose Pro or Prime).

A debit card is directly linked to your personal account. This means the account balance changes immediately each time you use the card. More information about the UBS Debit Card

A credit card has a fixed monthly limit and is not linked to your personal account. Instead, all expenses for a billing period are consolidated, and you receive an invoice. More information about UBS Credit Cards

EA prepaid card is not linked to your personal account. You need to add money to your card before you can use it. Other people, such as your parents, can also top up the card. More information about the UBS Prepaid Card

Which offer is right for you depends on your needs.

If you like to travel, frequently spend time abroad, or simply enjoy shopping online – including in online stores outside Switzerland – then the Pro and Prime offers are best for you. With a credit card, you are more financially flexible and also benefit from better exchange rates on payments in foreign currencies.

If you prefer to decide in advance how much money you can spend, Pure is the right offer for you. You add credit to the prepaid card in the app and have the desired amount available for your daily expenses.

If you are still under 18, only the offer with the prepaid card is available to you.

UBS KeyClub is our bonus program where you collect points that you can redeem for products and digital gift cards in the KeyClub eStore (1 point = CHF 1).

Collect KeyClub points every time you pay with your credit card (within UBS key4 banking, young adults between 18 and 26 as well as students up to 30 also collect KeyClub points with the prepaid card).

Partners include Zalando, Manor, Migros, Coop, Ikea, Galaxus and many more. More about KeyClub

If you have set up your login with the Access App and can now log in to UBS Mobile Banking without any problems, everything worked perfectly.

If your identity has been verified but you were not prompted to set up a login, we have sent the contracts to you via email. In this case, please print out the contracts, sign them and return them to us.

If an error message is displayed in the app or your identity could not be verified, the account could not be opened. Please book an appointment via the link.

Opening an account is divided into four steps. During the first two steps, you can pause the process at any time. Simply exit the app, but leave it running in the background. We will store the information you’ve entered for 72 hours. If you return after this time, you will need to restart the opening process.

As soon as you begin the identity verification step, you must stay in the app until you have digitally signed the contracts.

We're here to help

Did you find this page helpful?

Please enable javascript in your browser and retry.

The feedback component cannot be displayed.