UBS Investor Watch

Share it well

Discussing and dividing wealth across generations

Explore the insights

- Please select

- Inheritance planning is top of mind for US investorsInheritance planning is top of mind for US investors

- But many aren’t having the conversations critical to a smooth transferBut many aren’t having the conversations critical to a smooth transfer

- Dividing an inheritance fairly complicates the processDividing an inheritance fairly complicates the process

- Conflicts, lack of communication negatively impact wealth transferConflicts, lack of communication negatively impact wealth transfer

- How to spur action on inheritance planningHow to spur action on inheritance planning

- Spotlight on family dynamicsSpotlight on family dynamics

Get the global perspective

Even though high net worth investors have made strides over the last eight years with estate planning, they worry about the financial and familial discord that can accompany wealth transfer.

Eight in 10 investors say they want the inheritance process to go smoothly. Nearly as many are concerned about minimizing taxes and making sure that beneficiaries use their inheritance wisely. And many want to give while living.

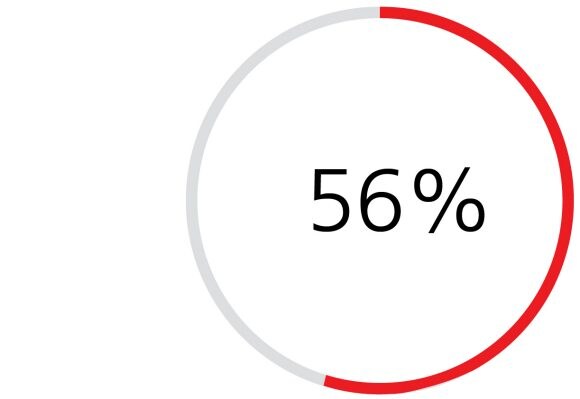

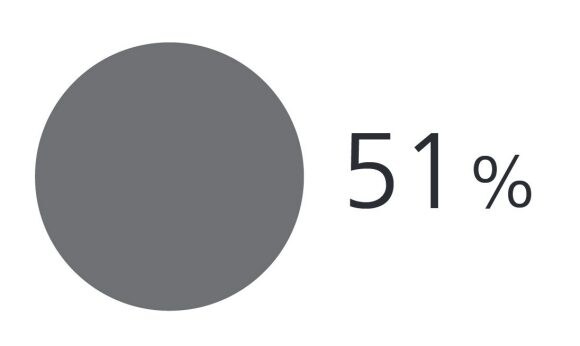

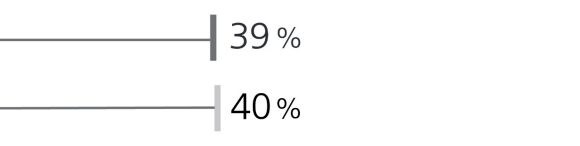

Investors have become more diligent about preparing …

Investors have become more diligent about preparing …

I have a wealth transfer/estate plan

- 0 %

- 0 %

... but they have concerns about transferring wealth

... but they have concerns about transferring wealth

% important

The transfer of assets goes smoothly

The transfer of assets is done in a tax-optimized way

My heirs use their inheritance wisely

More than money

More than money

Beyond transferring assets, investors want to pass on their family’s values. Yet

4 in 10

4 in 10

benefactors said they worry that heirs don’t share their values.

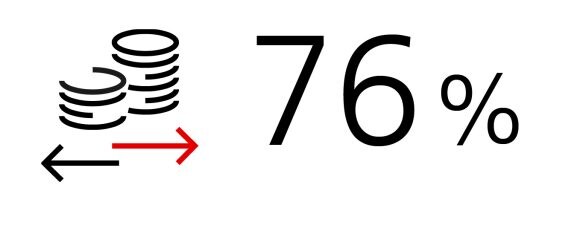

And many don’t want to wait until the end to help heirs

And many don’t want to wait until the end to help heirs

prefer to pass on wealth while still living

prefer to pass on wealth while still living

Investors are reluctant to have “the talk” about inheritance plans. Half of benefactors have not shared how much they’re worth and a third haven’t said how they intend to divide their assets.

Why? Many families simply aren’t comfortable talking openly about finances. Benefactors say that inheritance planning isn’t a pressing issue, and their heirs feel it’s a depressing topic. In addition, parents don’t want heirs to feel entitled, while heirs don’t want to appear greedy.

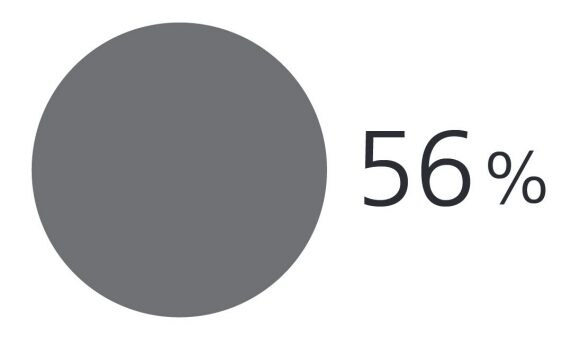

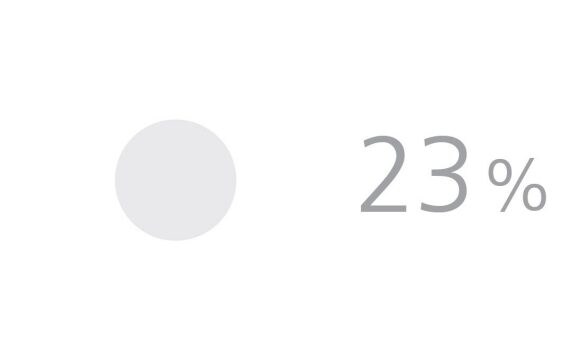

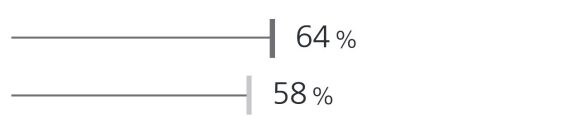

Benefactors are withholding important information …

Benefactors are withholding important information …

My heirs don't know how much I have

I have not shared my most recent will with my heirs

My heirs don't know where all my wealth is (e.g., accounts)

My heirs don't know how my wealth will be divided

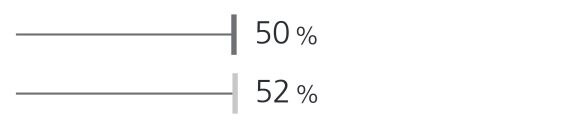

… and families struggle to start the conversation

… and families struggle to start the conversation

“It’s not a pressing issue”

Benefactors

Benefactors

Inheritors

Inheritors

“Don’t want heirs to feel entitled or appear greedy”

“We don’t talk about financial issues in the family”

“It’s a depressing topic for everyone concerned”

“I’m not sure how to bring up this topic”

Many US investors grapple with the notion of fairness. Half, for example, are struggling with how to share their assets in a way they consider fair, particularly if it means dividing assets unequally.

Benefactors who have resolved to favor some heirs over others are clear about why: 70% will give more to heirs with whom they have closer relationships. Others cite heirs’ financial needs and shared values.

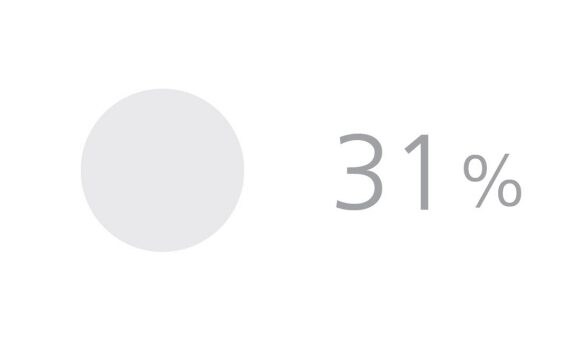

Benefactors find it challenging to divide assets

Benefactors find it challenging to divide assets

49%

Why certain heirs will inherit more

Why certain heirs will inherit more

We have a closer relationship

Greater economic need

Different generations will receive different amounts

I trust them more with money

They live in a way that more closely matches my values

They took more responsibility caring for me

Failure to take the necessary wealth transfer steps can result in financial loss and family discord. Many estates pay excess taxes without protection strategies in place. Others are subject to court decisions and delays when benefactors neglect to draft wills and other documents.

Many heirs have experienced such fallout. One quarter of those we surveyed admit to having conflicts with other heirs. Among heirs who also served as executors, 55% said carrying out their benefactors’ last wishes was difficult.

Failure to take steps had consequences

Failure to take steps had consequences

- 0 %

Heirs who experienced conflicts over the division of assets

- 0 %

Heirs who served as executors said carrying out last wishes was difficult

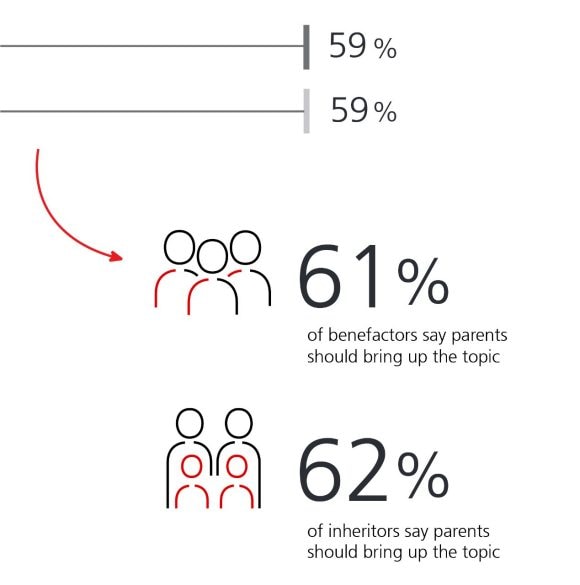

Though obstacles exist, and wealth transfer can be complicated, both benefactors and potential heirs agree on how to break down barriers.

Topping the list is having a written wealth transfer plan. Investors also cite having more open communication and insight into how other families approach estate planning and professional assistance. Both agree that parents should initiate the conversation.

Benefactors and heirs agree on meaningful action …

Benefactors and heirs agree on meaningful action …

Have a formal wealth transfer/estate plan

Have everyone involved in the same room to discuss together

Have more open communication

Learn how other families approach this topic

Have a professional facilitate discussions

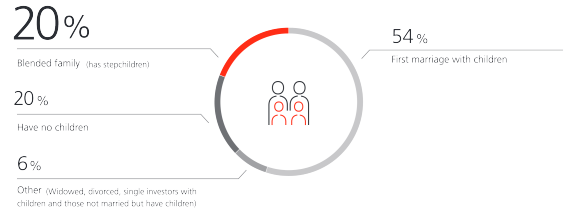

Family dynamics and the type of assets being passed, particularly family businesses, can complicate inheritance plans.

More than half of the families we surveyed are made up of a first marriage with children. But one in five investors are in “blended” families with stepchildren, and just as many investors have no children.

Not all families look alike

Not all families look alike

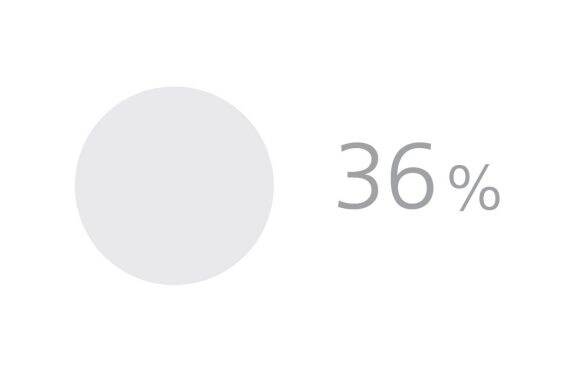

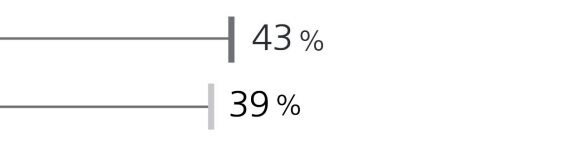

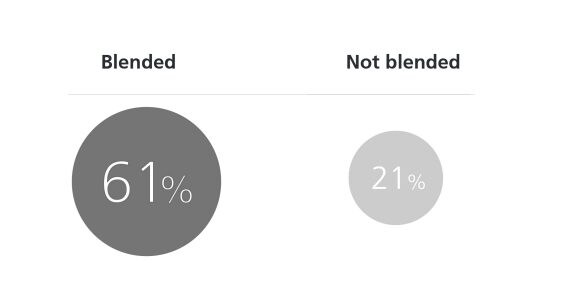

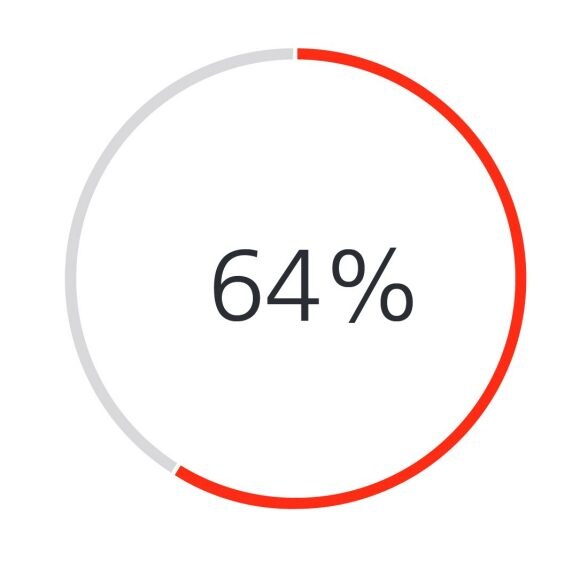

Blended families find dividing assets more difficult …

Blended families find dividing assets more difficult …

% who struggle to divide assets fairly

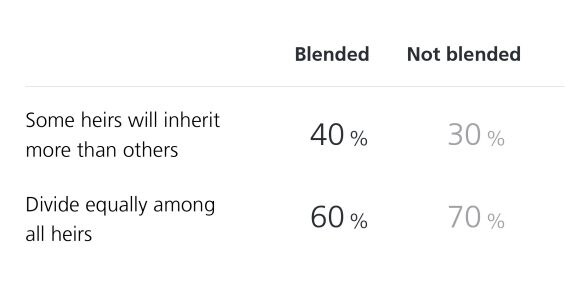

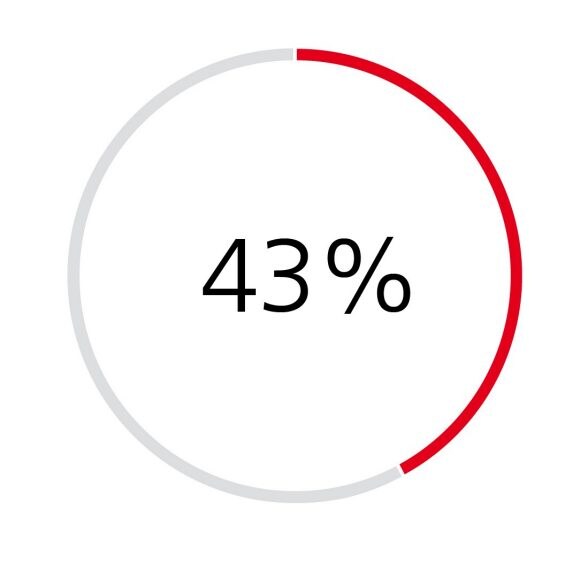

… and are less likely to divide assets equally

… and are less likely to divide assets equally

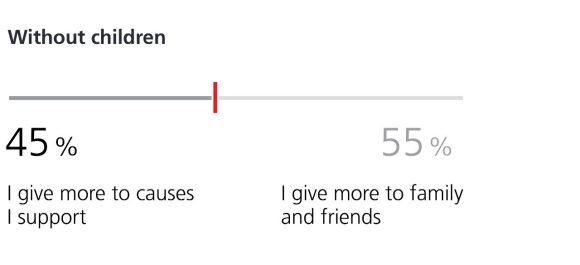

Investors without children give more to charitable causes …

Investors without children give more to charitable causes …

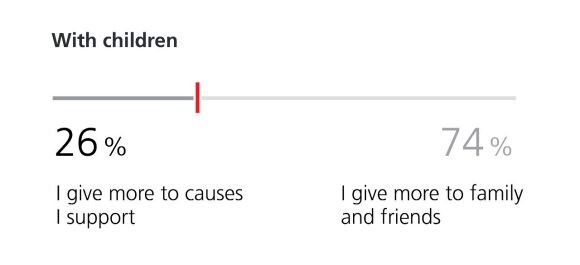

… and are likely to give more to some heirs than others

… and are likely to give more to some heirs than others

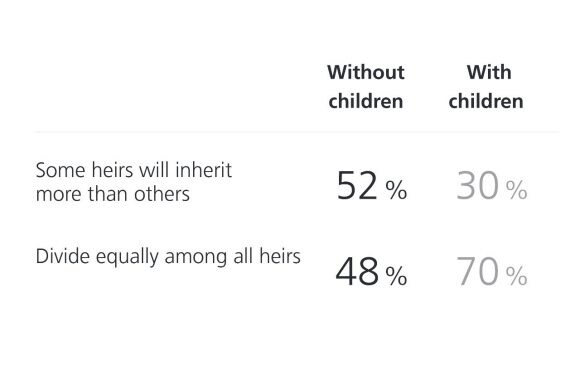

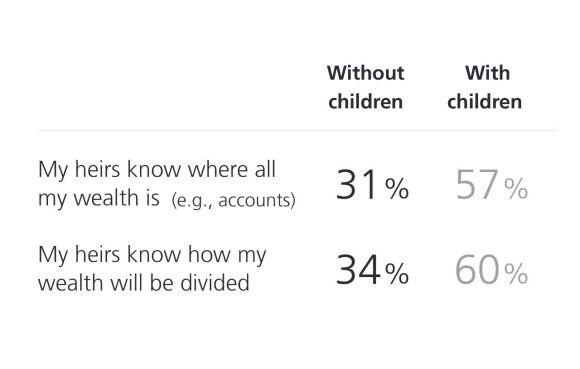

But they also tend to communicate less

But they also tend to communicate less

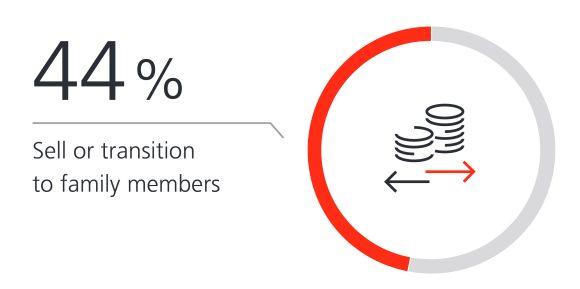

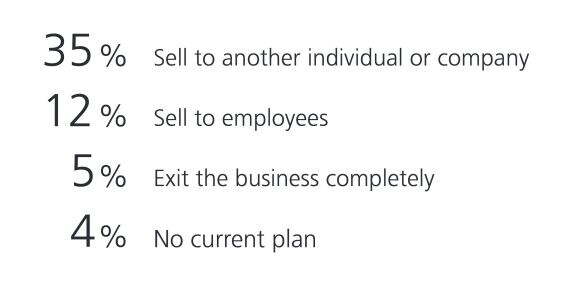

Many business owners plan to pass their business on to family

Many business owners plan to pass their business on to family

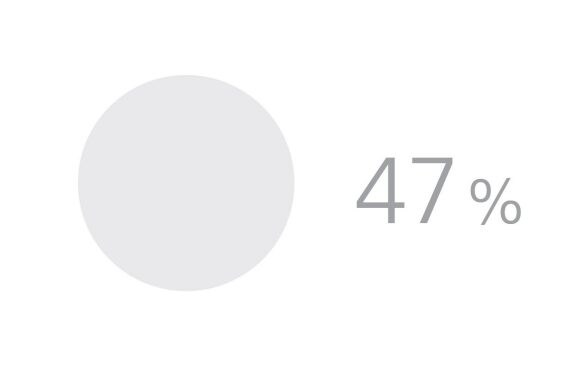

But they aren’t sure how to divide assets …

But they aren’t sure how to divide assets …

Struggle to divide evenly

Struggle to divide evenly

Haven’t set expectations about business transition

Haven’t set expectations about business transition

… or whether heirs want the business

… or whether heirs want the business

What business owners think their heirs want

What heirs actually prefer

About the survey:

About the survey:

For this edition of UBS Investor Watch, we surveyed 2,259 US investors with at least $1 million in investable assets. The research was conducted from April - August 2022.