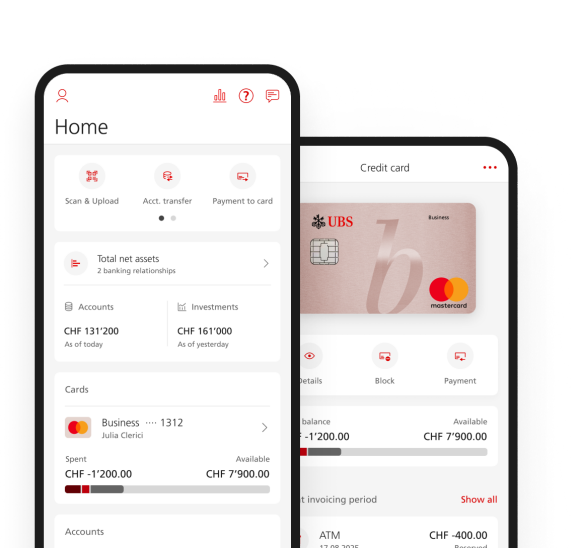

The most important features at a glance

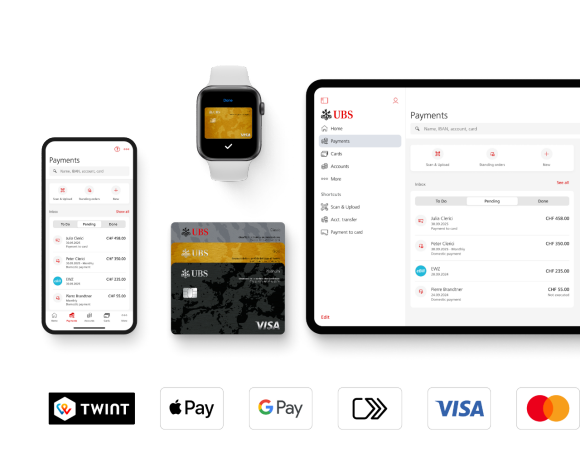

Just pay. Anytime. Anywhere.

Just pay. Anytime. Anywhere.

Pay without a card, without extra steps – directly with your smartphone. UBS TWINT, Apple Pay, Google Pay and Samsung Pay: for security and convenience in every situation.

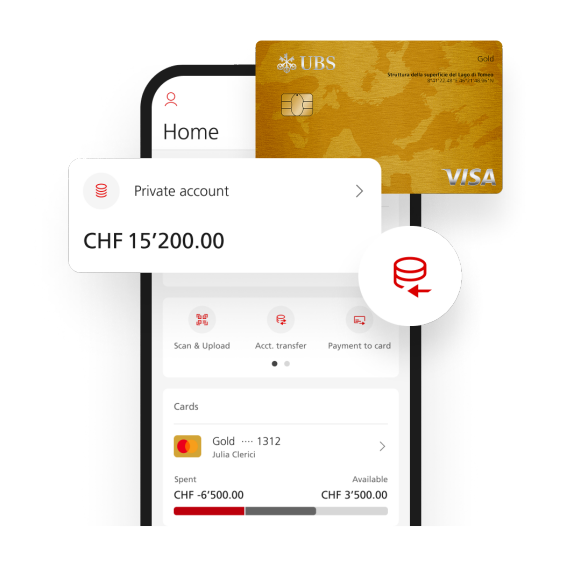

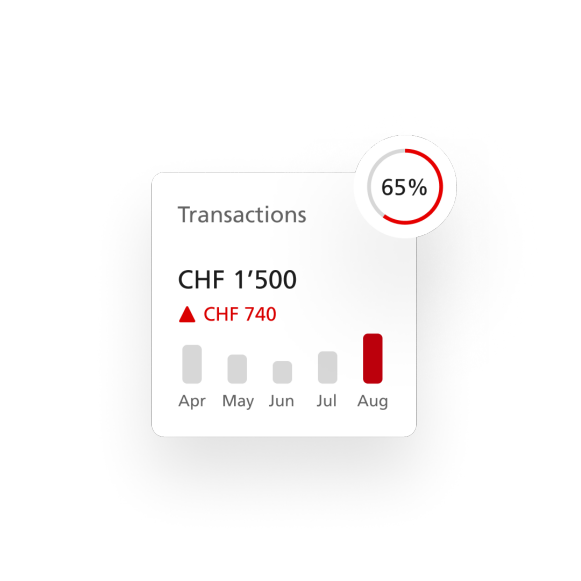

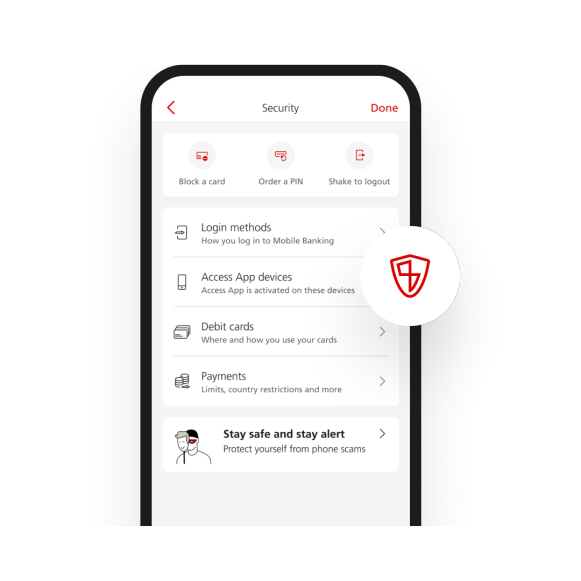

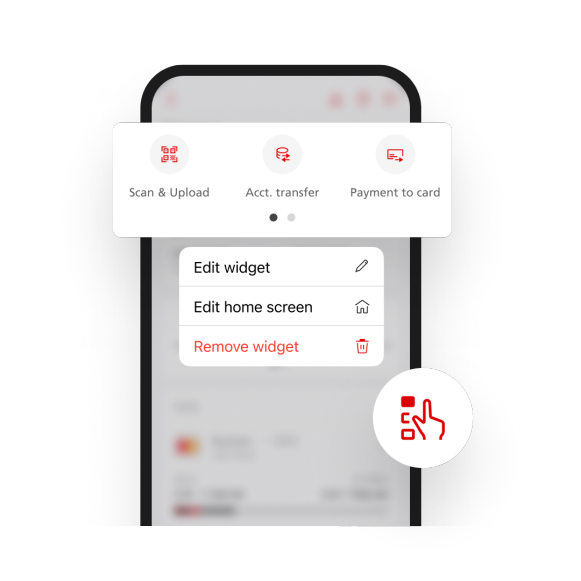

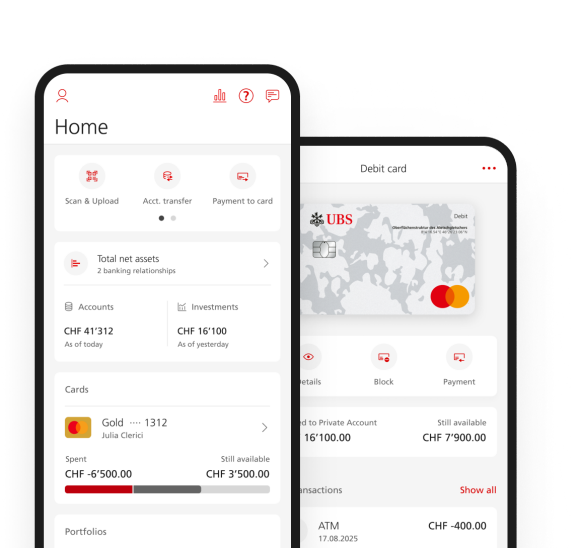

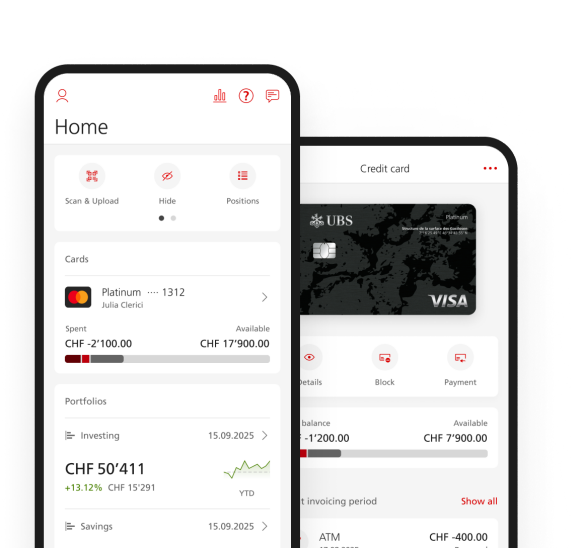

Banking made simple

We’re here for you.

We’re here for you.

Do you have a question about the Mobile Banking App? Here you can quickly find answers to the most common questions.