We’re here for you

Arrange an appointment for a nonbinding consultation, or if you have any questions, just give us a call.

![]()

header.search.error

Strategies for early retirement

The key to retiring early without significant shortfalls in your income is detailed planning. Avoid financial insecurity with our tips.

Content:

If you retire before the regular retirement age, you are considered to have retired early. The reasons for retiring early include the wish for more time for family, hobbies or volunteer work. Studies show that many Swiss people would like to retire early. However, there are also involuntary reasons for early retirement.

When you think about your retirement, you are faced with some important decisions. Let’s draw up a plan together based on your personal wishes, so that nothing stands in the way of a relaxed financial future.

Legally, early retirement is possible from the age of 58 with the pension fund. However, you can only start receiving your OASI pension at the earliest at age 63, two years before the reference age. Under OASI 21, women of the transitional generation can start receiving their OASI pension as early as age 62.

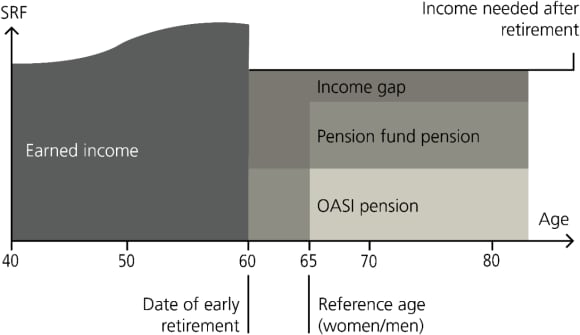

Early retirement has financial consequences. Plan early on to avoid pension shortfalls. For each year that you withdraw early from the OASI, you will lose 6.8% of your pension until the end of your life. Even if you retire early, you will still have to pay OASI contributions. The benefits from pillar 2 are lower because the accumulated capital and interest are reduced. Expect a reduction of 7–8% in pension fund benefits. Your costs may remain high, even if you cut back. You should take this into account when you plan your retirement.

If the benefits from pillars 1 and 2 are not enough to maintain your desired standard of living in retirement, you’ll need to save more. Find out how much today.

Use existing assets to bridge income gaps. If you own land, a house or an apartment, you can sell or rent out this property. An additional mortgage is also possible, but it should be taken out before retirement, as financing conditions may change. A tailored financing concept with up to five pillar 3a solutions can also help.

Flexible and tax-privileged pension plans in pillars 2 and 3 can help you reduce your income losses.

There are two options in pillar 2:

You can make additional contributions to your pension fund to increase your future benefits. Many funds allow this until shortly before retirement. The pension fund statement provides information about the amount of possible contributions. Additional contributions can be deducted from taxable income but should be spread over several years. No capital withdrawals are allowed in the following three years after a buy-in.

Some pension funds offer bridging pensions, which are financed from your capital or additional contributions. This solution is interesting if your employer participates.

Pillar 3a can close income gaps in the event of early retirement. An early withdrawal is possible up to five years before the regular retirement age. From this point on, only withdrawal due to age is permitted, and a partial withdrawal is no longer possible. With two or more 3a accounts, you can stagger the withdrawals thereby flexibly reducing your financial gaps and saving on taxes. Calculate your tax burden with the pillar 3a tax calculator.

Using a concrete example of a single man with a net salary of CHF 90,000, we can see what early retirement at the age of 64 would cost him. Our rough calculation takes into account the lower OASI contributions and income taxes due to retiring early. As a result of the one-year earlier withdrawal, the OASI and pension fund benefits are reduced. In summary, the result is:

Loss up to regular retirement age:

Lifetime loss from 65 years of age (total):

The losses from early retirement can be significant. The specific impact early retirement will have depends on the individual case. You can ask the OASI and the pension fund about what you can expect.

Here are some tips for the calculation:

If early retirement is not possible as the financial losses would be too big, an alternative is available: partial retirement or working fewer hours without accessing your pension fund benefits.

Early retirement is often driven by the desire to find ways and means to achieve new life goals. This is understandable, but these goals must also be affordable. Early retirement often leads to an income shortfall.

You should therefore clarify your exact plans and financial possibilities early on. With professional support, you can also find new ways and means of ensuring your financial security. Through careful budget planning, you can ensure that your personal retirement journey begins happily.

Arrange an appointment for a nonbinding consultation, or if you have any questions, just give us a call.

Disclaimer