1862

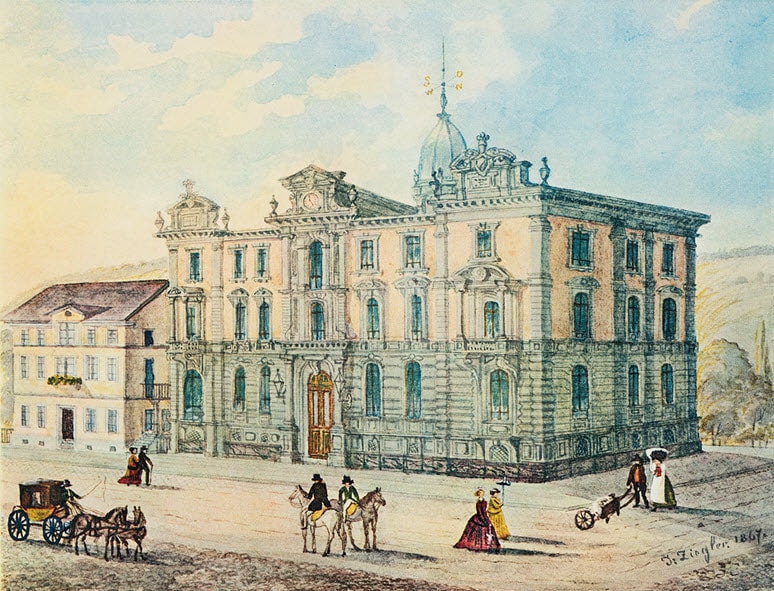

Bank in Winterthur

Bank in Winterthur is the historical starting point of today’s UBS. In 1912, Bank in Winterthur merged with Toggenburger Bank to form Union Bank of Switzerland.

1862

Warehouse

There was a push to transform Winterthur into Switzerland’s leading cargo handling center while Bank in Winterthur was being founded. The bank was therefore tasked with managing a warehouse built by the Winterthur Chamber of Commerce (“Kaufmännische Gesellschaft Winterthur”).

1863

Toggenburger Bank

Toggenburger Bank, founded in Lichtensteig in Eastern Switzerland in 1863, is the second predecessor of Union Bank of Switzerland. It did business as a commercial and currency-issuing bank; it also focused on domestic mortgage and savings business. Toggenburger Bank was one of the few banks authorized to issue banknotes until the Swiss National Bank was founded in 1906.

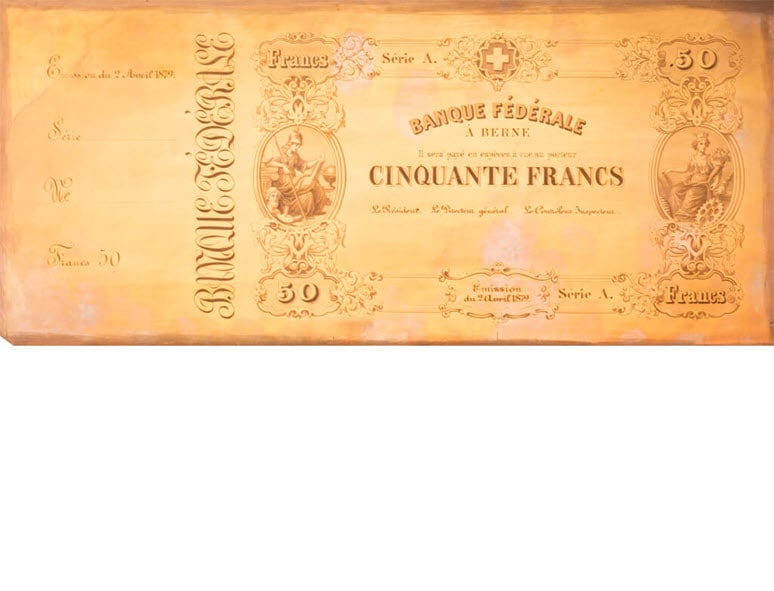

1864

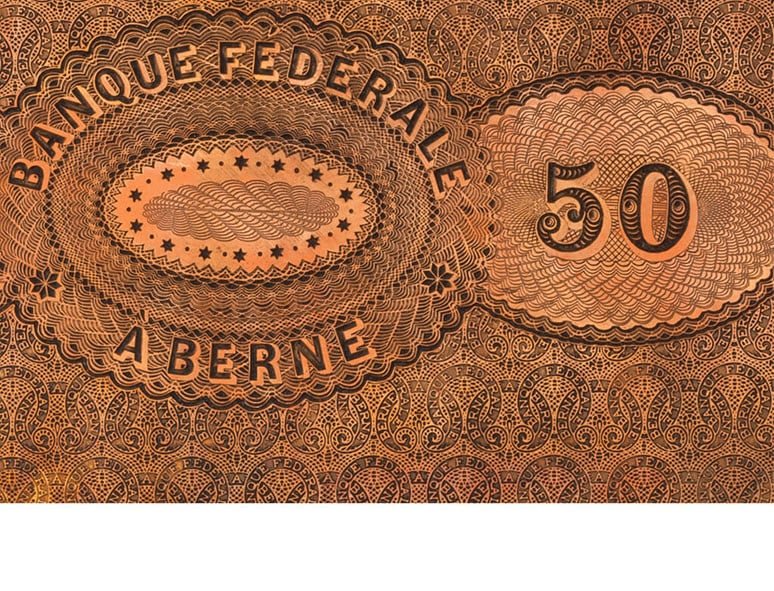

Eidgenössische Bank

Eidgenössische Bank was established in Switzerland’s capital, Berne, in 1864. Between 1864 and 1882, it issued its own banknotes that could be redeemed at branches and partner banks in and outside Switzerland. Eidgenössische Bank was taken over by Union Bank of Switzerland in 1945.

1872

Basler Bankverein

The merger of Basler Bankverein with Zürcher Bankverein in 1896 and then with Basler Depositen-Bank one year later created Swiss Bank Corporation (SBC) in 1897. SBC and Union Bank of Switzerland merged to form UBS in 1998.

1880

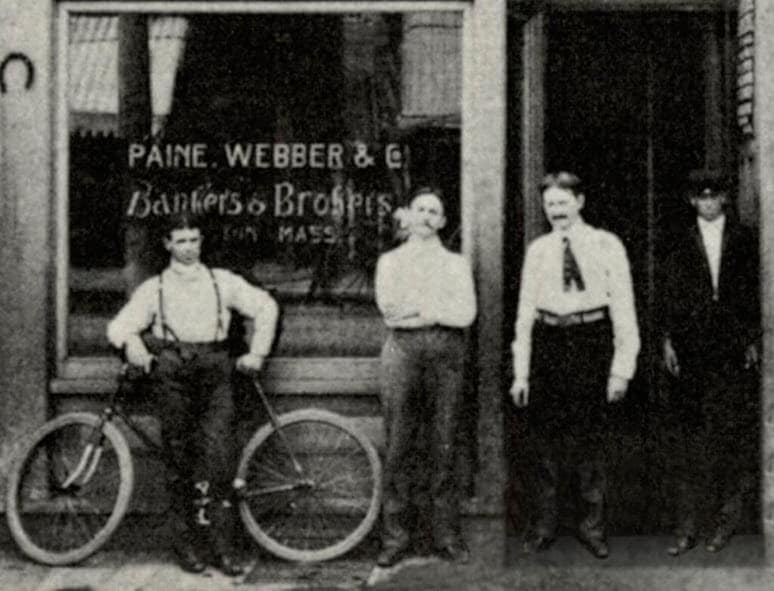

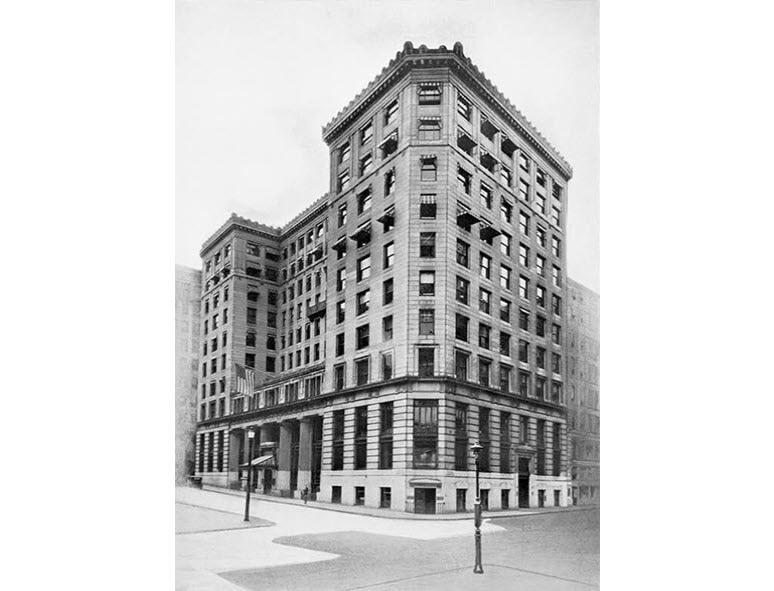

Paine Webber

Paine & Webber was founded by William A. Paine and Wallace G. Webber in Boston, USA, in 1880. A partnership was formed with Charles H. Paine in 1881 and renamed Paine, Webber & Co. Paine Webber, as the company was called after 1984. At the time, that it was acquired by UBS (in 2000), it had grown to become the fourth largest US private bank with over 8,500 client advisors and a network of 385 locations.

1896

Banca Svizzera Americana

Banca Svizzera Americana was founded in 1896 with its headquarters in Locarno and satellite offices in Lugano and San Francisco. Banca Svizzera Americana merged with Union Bank of Switzerland in 1920, allowing the latter to gain a foothold in Italian-speaking Switzerland.

1898

Branch of Swiss Bank Corporation in London

Swiss Bank Corporation opened its first branch in London under the name Swiss Bankverein in 1898. This was the first branch of a Swiss bank in London, then the center of world trade and finance. During World War I, the bank had to deny several newspaper rumors that it was under German control. This was one of the reasons why the London branch changed its name from Swiss Bankverein to Swiss Bank Corporation (SBC) in 1917.

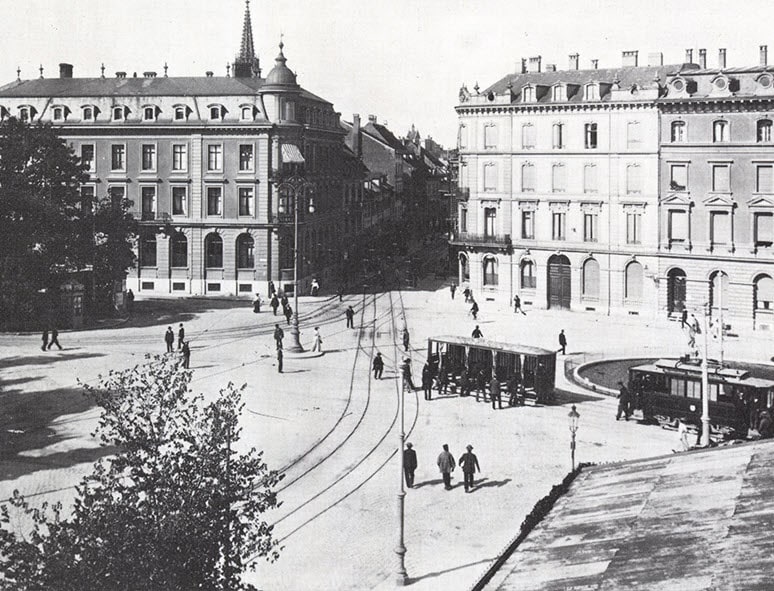

1899

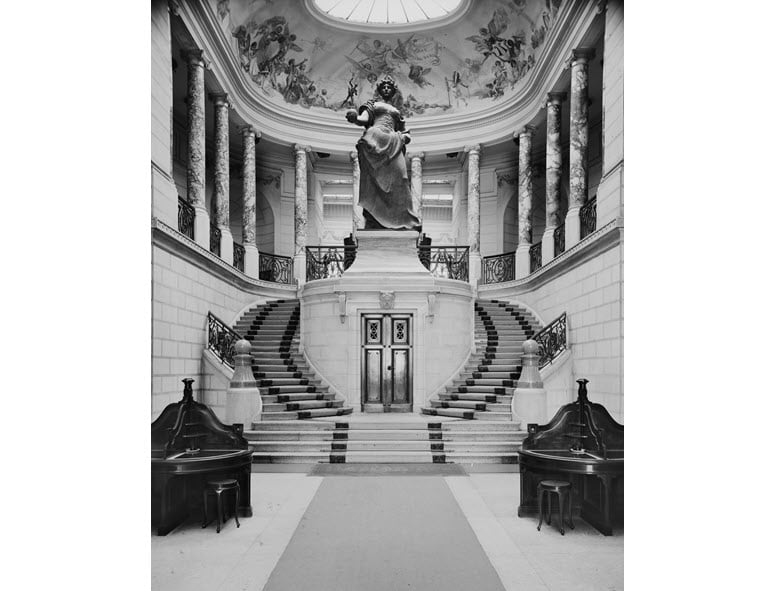

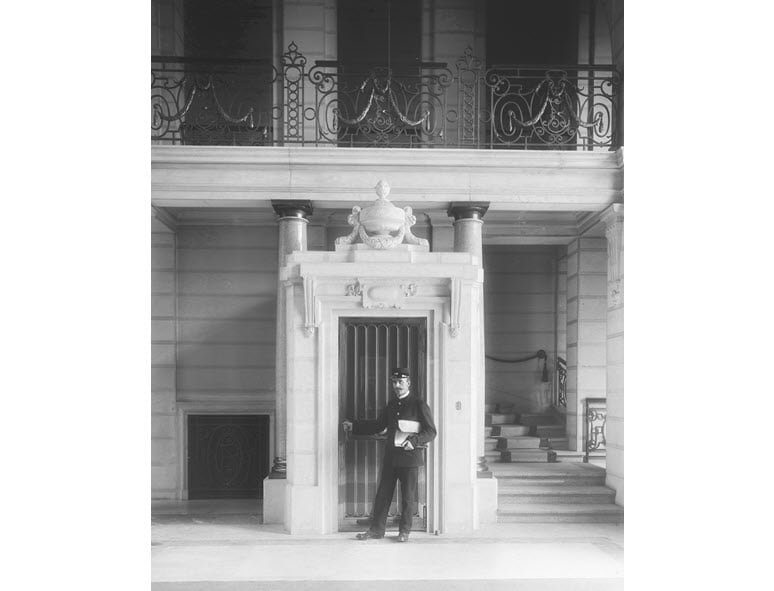

Swiss Bank Corporation moves to Paradeplatz

In the same year that Basler Bankverein merged with Zürcher Bankverein (1886), the bank obtained land at Paradeplatz in Zurich, located directly opposite the headquarters of its competitor, Schweizerische Kreditanstalt (predecessor to today's Credit Suisse). After two years of construction using plans by architect Charles Mewès, the bank, by then called “Swiss Bank Corporation” (SBC), moved into the building in 1899. The monumental building lasted 57 years and was replaced in 1956 by a larger complex between Talstrasse, Talacker and Bärengasse.

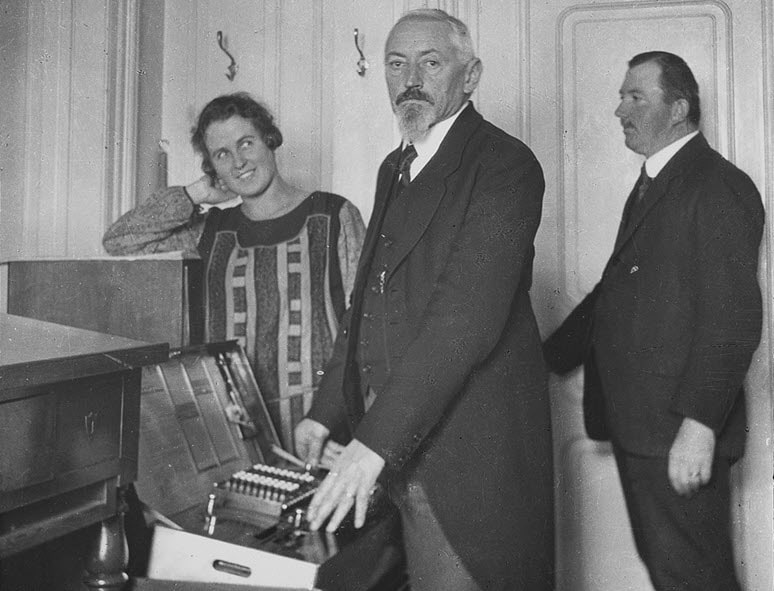

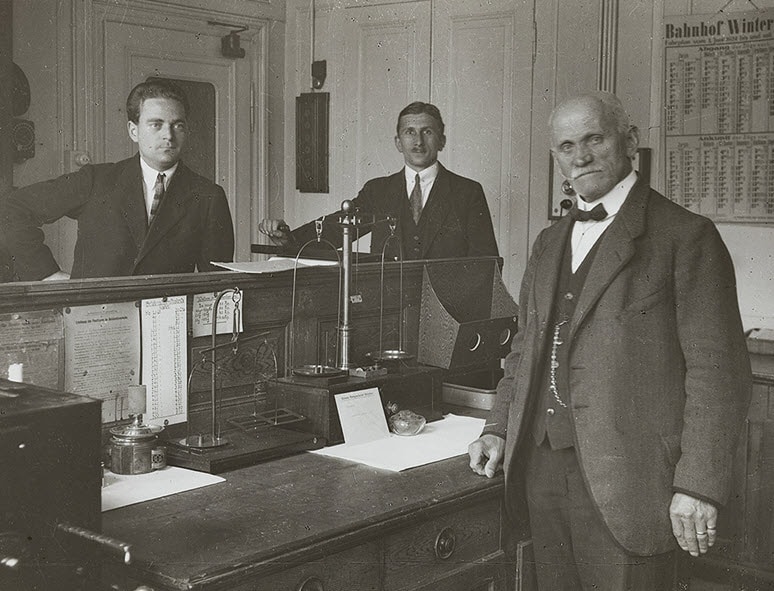

1900

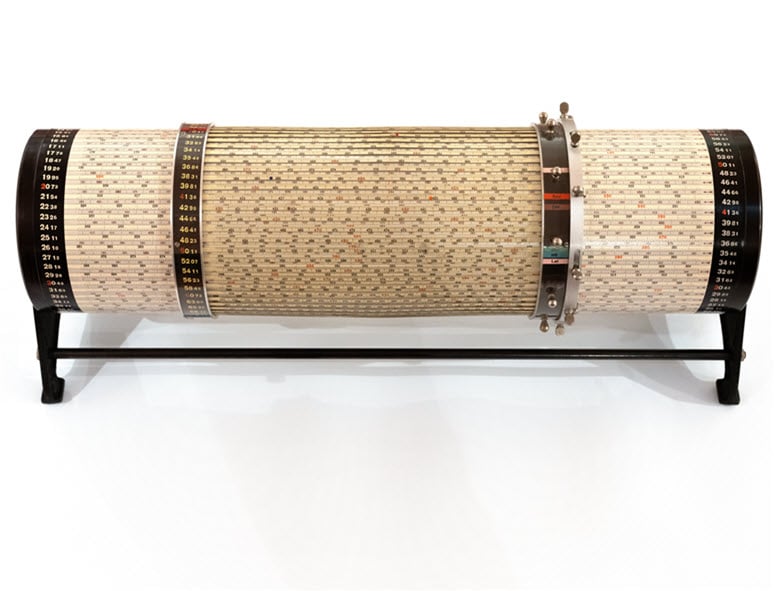

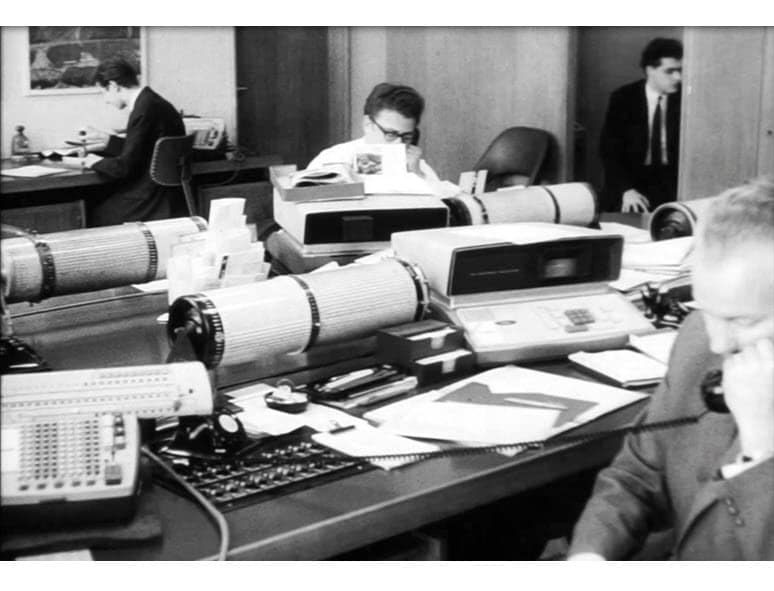

The Calculation Cylinder - a new mathematical instrument

At the turn of the century, an analog calculating device became the most widely used mathematical instrument in banking, the stock exchange and insurance: the calculation cylinder. It simplified various financial mathematical tasks and accelerated work processes in currency conversion, interest calculations, statistics, and even wages. Logarithmic calculation cylinders were also used at the SBV and SBG. Particularly popular were the calculation cylinders of local firms National and Loga-Calculator. The innovation of this instrument lay in the fact that the logarithmic slide rules were arranged on a cylinder, making the scale length of the rods shorter. The cylinders were more compact, equally accurate, and easier to use than slide rules. For simpler calculations, accountants still liked to use the slide rule.