Platform of choice. Delivering solutions. Managing risk.

Speak to the QA team about how we can help you.

ESG

Factors

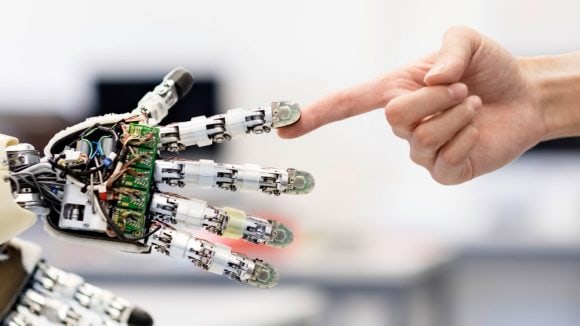

Machine Learning

Macro

Market Structure

Portfolio Construction

Investor Behaviour

Hosted by Paul Winter, Global Head of Quantitative Research