CIO House View

Global asset class preferences

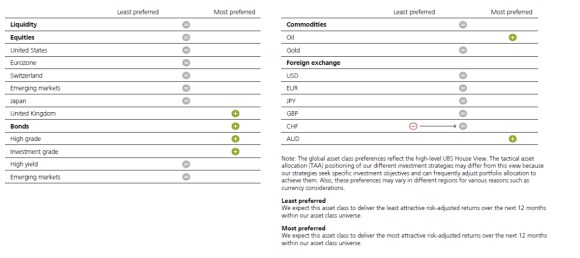

Global asset class preferences

As at March 2024

Asset Class Outlook

Asset Class Outlook

- In our global strategy, we keep our preference for bonds over equities.

- Within equities, we retain our preference for quality. Our most preferred region is emerging markets (EM).

- Within bonds, we prefer high grade and investment grade over high yield and emerging market credit.

- Within commodities, we hold a preference for oil.

- Within foreign exchange, we have the CHF as least preferred and the AUD as most preferred. We stay neutral on the remaining major currencies.

Key scenarios - June 2024

|

| Upside: Goldilocks | Upside: Goldilocks | Base case: Soft landing | Base case: Soft landing | Downside: Hard landing | Downside: Hard landing | Things to watch | Things to watch |

|---|---|---|---|---|---|---|---|---|---|

| Probability | Upside: Goldilocks | 20% | Base case: Soft landing | 60% | Downside: Hard landing | 20% | Things to watch |

|

| Market path | Upside: Goldilocks | Bonds slightly up, equities up | Base case: Soft landing | Bonds up, equities slightly up | Downside: Hard landing | Bonds up, equities sharply down | Things to watch |

|

| Economic growth | Upside: Goldilocks | The US continues to grow above the trend rate of about 2% as labor markets, household balance sheets, and corporate earnings prove resilient. China opts for large-scale fiscal stimulus. European growth improves. | Base case: Soft landing | The US economy slows to roughly trend growth over the next 12 months. Other Western economies continue to decelerate | Downside: Hard landing | Falls sharply on a global scale toward mid-2024 owing to the delayed impact of monetary tightening. Sticky US inflation pushes bond yields higher in the near term, but yields later move sharply lower as the economy enters recession. China continues to decelerate amid underwhelming fiscal support. | Things to watch | US, China: PMI data |

| Inflation | Upside: Goldilocks | Reaches central bank targets earlier than expected. | Base case: Soft landing | Continues to slow in the US and in Europe, normalizing by 2H24. | Downside: Hard landing | Falls quickly as demand for goods and services collapses. | Things to watch | Global: Oil price |

| Central banks | Upside: Goldilocks | Cut policy rates more than current market expectations. The Fed cuts at least 100bps. | Base case: Soft landing | Start cutting policy rates by mid-2024 as inflation normalizes. The Fed cuts rates by 75bps. | Downside: Hard landing | Cut interest rates after seeing evidence of a deep recession. The Fed cuts rates down to 1-1.25%. | Things to watch | Global: Oil price |

| Financial conditions | Upside: Goldilocks | Ease as a better growth-inflation mix is priced in. | Base case: Soft landing | Ease gradually amid building expectations of upcoming monetary easing. | Downside: Hard landing | Tighten dramatically, causing stress in the financial system and increasing the risk of systemic events. | Things to watch | Global financial conditions |

| Geopoltics | Upside: Goldilocks | The Middle East crisis de-escalates. The war in Ukraine also de-escalates, e.g., via a ceasefire agreement. Progress is made in bilateral relations between the US and China. | Base case: Soft landing | The Middle East crisis results in a contained regional confrontation. The war in Ukraine drags on as ceasefire negotiations remain elusive. The US-China strategic rivalry continues. | Downside: Hard landing | The Israel-Hamas war turns into a regional conflict with potential for greater disruption to oil supply. The war in Ukraine escalates, and US-China tensions intensify. | Things to watch | Middle East crisis and oil supply |

Asset class targets - December 2024

Key targets for December 2024 | Key targets for December 2024 | spot* | spot* | Upside | Upside | Base case | Base case | Downside | Downside |

|---|---|---|---|---|---|---|---|---|---|

Key targets for December 2024 | MSCI AC World | spot* | 940 | Upside | 995 (+6%) | Base case | 940 (+0%) | Downside | 700 (–26%) |

Key targets for December 2024 | S&P 500 | spot* | 5,225 | Upside | 5,500 (+5%) | Base case | 5,200 (-0%) | Downside | 3,700 (–29%) |

Key targets for December 2024 | EuroStoxx 50 | spot* | 5,000 | Upside | 5,400 (+8%) | Base case | 4,900 (-2%) | Downside | 3,800 (–24%) |

Key targets for December 2024 | SMI | spot* | 11,619 | Upside | 12,300 (+6%) | Base case | 11,640 (+0%) | Downside | 9,800 (–16%) |

Key targets for December 2024 | MSCI EM | spot* | 1,032 | Upside | 1,200 (+16%) | Base case | 1,100 (+7%) | Downside | 820 (–21%) |

Key targets for December 2024 | Fed funds rate (upper bound, %) | spot* | 5.5 | Upside | 4 | Base case | 4.75 | Downside | 1.25 |

Key targets for December 2024 | US 10-year Treasury yield (%) | spot* | 4.27 | Upside | 4 | Base case | 3.5 | Downside | 2.5 |

Key targets for December 2024 | US high yield spread** | spot* | 314bps | Upside | 300bps | Base case | 400bps | Downside | 800bps |

Key targets for December 2024 | Euro high yield spread** | spot* | 339bps | Upside | 325bps | Base case | 400bps | Downside | 800bps |

Key targets for December 2024 | US IG spread** | spot* | 81bps | Upside | 70bps | Base case | 100bps | Downside | 200bps |

Key targets for December 2024 | Euro IG spread** | spot* | 114bps | Upside | 100bps | Base case | 140bps | Downside | 200bps |

Key targets for December 2024 | EURUSD | spot* | 1.09 | Upside | 1.15 (+5%) | Base case | 1.12 (+3%) | Downside | 1.03 (–6%) |

Key targets for December 2024 | Commodities (CMCI Composite) | spot* | 1,812 | Upside | 2,000 (+10%) | Base case | 1,860 (+3%) | Downside | 1,470 (–19%) |

Key targets for December 2024 | Gold*** | spot* | USD 2,161/oz | Upside | USD 2,000/oz (–7%) | Base case | USD 2,250/oz (+4%) | Downside | USD 2,500/oz (+16%) |

UBS House View Monthly

UBS House View Monthly

Investing in Asia Pacific monthly guide

Investing in Asia Pacific monthly guide

UBS House View Year Ahead

UBS House View Year Ahead

Strategic Asset Allocations (SAAs)

Strategic Asset Allocations (SAAs)

UBS CIO Strategic Asset Allocations are an essential part of our disciplined style of managing and growing our clients' wealth. The CIO SAAs ensure that our clients remain on course to their financial goals and steer clear of common investment dangers by investing in a well-diversified manner.

USD

USD Sustainable Investing (Balanced)

USD Asia Focus

Disclaimers

Disclaimers

Past performance is no indication of future performance. *since inception