The world is changing rapidly and so are investors’ priorities.1

Global awareness of sustainability has never been higher. Investors as well as consumers, corporations and policymakers are shifting their focus toward addressing environmental, social and governance (ESG) issues.2

We believe sustainability matters for all investors

At UBS, we believe sustainability is relevant to how you manage your wealth. Sustainable investing can help you advance your financial goals while contributing to sustainability outcomes. We invite you to discover the world of sustainable investing and the possibilities it offers you to pursue what matters most.

Sustainability is central to our purpose, so it’s only natural that we’re putting sustainable investing where it belongs: at the heart of what we do. It is our preferred solution for wealth management clients wishing to invest globally.3

Defining the E, S & G

ESG topics can present new opportunities as well as important considerations for any investment. However, these topics drive the strategy when it comes to sustainable investments.4

Environmental

Includes water and waste management; ways of improving energy efficiency; carbon intensity and climate risk management.

Social

Such as data privacy and security; managing supply chains effectively; diversity and equality; human capital management.

Governance

Such as addressing issues of board diversity and corporate transparency.

Will she always be this happy?

Live a good life on a healthy planet?

Can sustainable investing protect her future?

What is sustainable investing?

What is sustainable investing?

Sustainable investing is not an investment product, or an asset class. It’s an investment philosophy. Sustainable investing offers the potential to create better outcomes—for your portfolio and our future.

Two fundamental approaches2

Two fundamental approaches2

At UBS, we see two main approaches to sustainable investing:*

Sustainability focus-Investing in strategies with a clear sustainability objective

Example: Intentionally investing in companies that manage a range of ESG issues and opportunities better than their competitors

Impact investing-Investing in strategies that seek to generate measurable, verifiable and positive environmental or social outcomes

Example: Investing in companies with the objective to engage in dialogue with management to drive progress on social or environmental outcomes

*Please review Important information about sustainable investments in the disclosures at the end of this document.

Myth vs. reality

Myth vs. reality

Myth

You give up returns with sustainable investments

Myth

You can’t measure the impact of a sustainable investment

Myth

Sustainable investing is only about protecting the environment

Approach sustainable investing your way

Approach sustainable investing your way

Once you determine your approach, there are a few different ways you can incorporate sustainable investing into your portfolio.

Insights

Take a closer look at sustainable investing—and discover the difference it could make for your portfolio—and the world

Take a closer look at sustainable investing—and discover the difference it could make for your portfolio—and the world

Key findings

Key findings

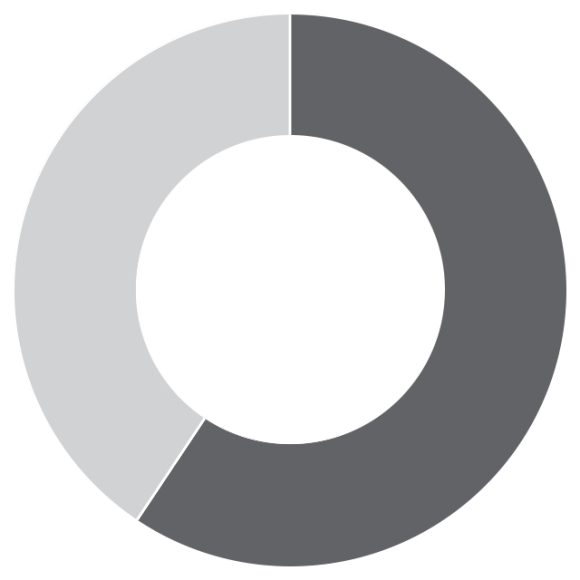

59%

59%

of investors surveyed are more interested in sustainable investing as a result of COVID-19 5

69%

69%

of women surveyed are highly interested in sustainable investing as a result of COVID-19 5

76%

76%

of younger investors surveyed are highly interested in sustainable investing as a result of COVID-19 5

Research

Research