Showing resilience

Despite a sharp drop in confidence now, investors remain positive for the future

Q1 2020

Q1 2020

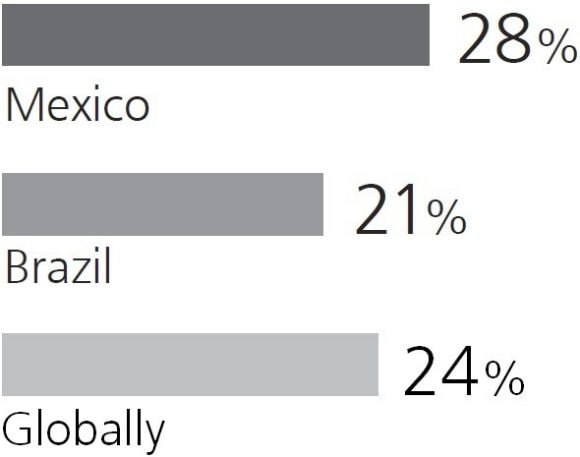

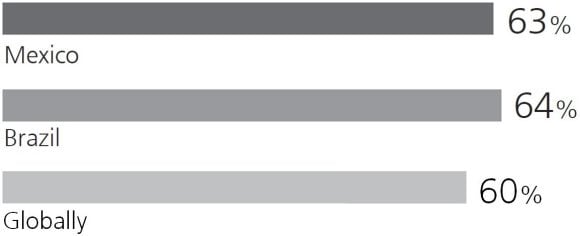

Optimism is down, but long-term outlook remains strong

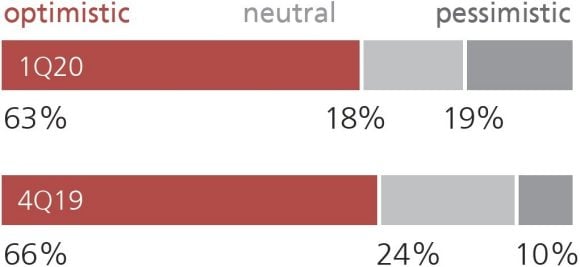

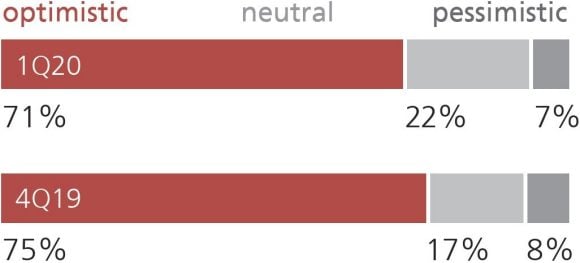

Global economy

Short-term (next 12 months)

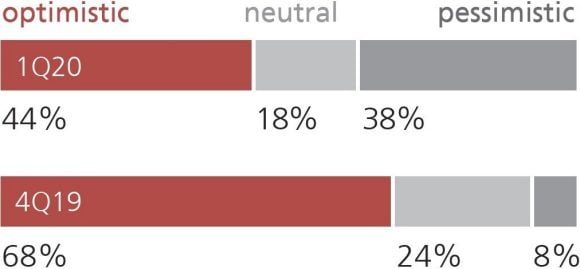

Mexican investors

Brazillian investors

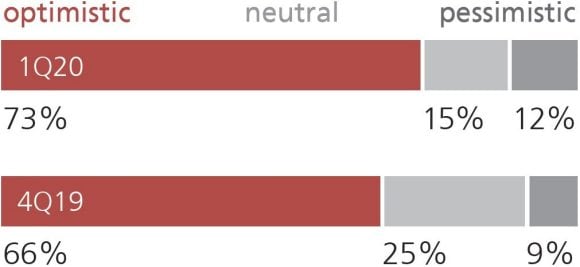

Global economy

Long-term (next 10 years)

Mexican investors

Brazillian investors

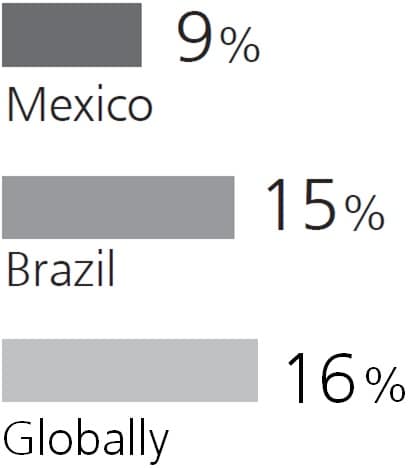

Recession concerns on the rise

Investors see opportunities ahead but risk missing out

“It’s a good time to buy stocks.”

“I’ll wait until stocks drop more.” (another 5% to 20%)

“Not now, it’s a bear market.”

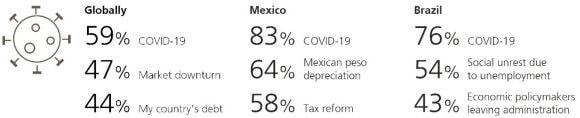

COVID-19 becomes investors’ top concern

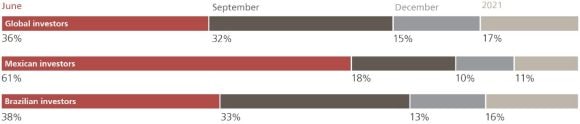

Mixed views on when worst of COVID-19 will be over

Let's make sure your future is looking up. Talk to your UBS Financial Advisor.

About the survey

UBS surveyed 2,928 investors and 1,180 business owners with at least $1M in investable assets (for investors) or at least $1M in annual revenue and at least one employee other than themselves (for business owners), from April 1 – 20, 2020. The global sample was split across 14 markets: Argentina, Brazil, China, France, Germany, Hong Kong, Italy, Japan, Mexico, Singapore, Switzerland, the UAE, the UK and the US. For the 4Q19 results, UBS surveyed 4,838 investors and business owners with at least $1M in investable assets (for investors) or at least $250k in annual revenue and at least one employee other than themselves (for business owners), from December 19, 2019 – January 12, 2020. The global sample was split across the same 14 markets, plus: Indonesia, Malaysia, Philippines, Taiwan and Thailand. For the 3Q19 results, UBS surveyed 4,626 investors and business owners with at least $1M in investable assets (for investors) or at least $250k in annual revenue and at least one employee other than themselves (for business owners), from September 19 – October 13, 2019. The global sample was split across the same 14 markets, except France, plus: Indonesia, Malaysia, Philippines, Taiwan and Thailand.