How to allocate private equity in a multi-asset class portfolio

Discover how investors can benefit from an allocation to private equity.

At a glance

At a glance

In this report, we explore how investors can include private equity in a multi-asset class portfolio. While the proportion of private equity in a portfolio very much depends on an investor's unique preferences, our findings suggest that up to 20% of an equity allocation is appropriate.

Investors tend to include private equity in their portfolios to harvest liquidity premiums and enhance returns. This allocation also provides access to sectors and companies that are underrepresented in public markets. But while illiquid asset classes have the potential for high alpha generation, they also reduce investors' flexibility. This makes it harder to react to unforeseen changes in personal circumstances or market opportunities. As a result, investors should have a long investment horizon.

They may also still want to keep some of their wealth in liquid assets, even though they offer a lower expected return. In our view, the portion of a portfolio that should be allocated to illiquid assets depends very much on personal preferences and constraints, such as the need for flexibility, the anticipated time horizon, and short- and medium-term cash flow needs relative to overall wealth. However, a proportion of up to 20% of the equity allocation should typically enable most investors to profit from higher expected returns without compromising flexibility too much.

Why private equity?

Why private equity?

The role of private equity investments in investors’ portfolios has evolved over the past decade. Although the asset class was largely regarded as a niche allocation a few years ago, investors are increasingly looking at it as a way to enhance returns and access a unique opportunity set not available through listed markets.

These singular features have become more relevant today. Return expectations for almost all asset classes, and for bonds in particular, have fallen in recent years, as reflected in our lower capital market assumptions today versus a few years ago. As a result, constructing portfolios with satisfying returns has become a challenge for most asset allocators, especially for those with long-term liabilities (e.g., pension funds).

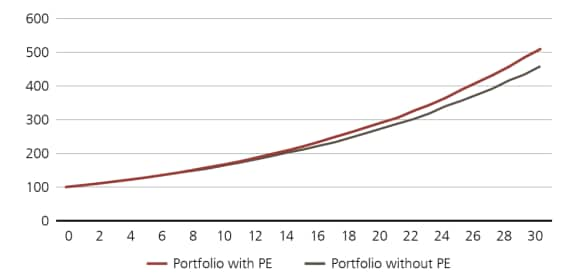

One way to address this issue is to consider allocating to private equity investments. Historically these have outperformed public listed equity investments. Going forward, we expect portfolios that include private equity to provide a higher return than traditional portfolios (Fig. 1).

Incorporating illiquidity in investor portfolios

Given the challenges associated with the asset class, allocating to private equity—and illiquid assets more generally—requires careful planning. To identify the appropriate allocation, investors first need to assess their willingness to invest for the long term, their tolerance for illiquidity, and their capacity to fund current and future expenses without touching their private equity allocation. By addressing these questions, investors can be better prepared to incorporate illiquid investments into their portfolios. In particular, investors should consider:

Figure 1

Expected wealth development of a USD Balanced Portfolio with PE and without PE over 30 years

Expected wealth development of a USD Balanced Portfolio with PE and without PE over 30 years

Cumulative wealth growth over 30 years

Investor takeaways

Investor takeaways

- Portfolios can benefit from an illiquidity premium and the potential of harvesting manager alpha. This approach is compelling to investors who have a long time horizon and who can forgo some of the flexibility provided by liquid investments.

- Private equity investments provide exposure to sectors and companies underrepresented in public equity markets and thus increase the diversification of an overall portfolio.

- We think that the proportion that can be allocated to private equity depends very much on personal preferences and constraints, such as the need for flexibility, the investment time horizon, and the short to medium-term cash flow needs relative to overall wealth. Investors must be sure they can finance potential capital calls and that they will not need to access the money invested in illiquid private markets, even if personal circumstance change or financial markets suffer a downturn.

- For most investors, an allocation of up to 20% of the equity allocation should enable them to profit from the asset class’s higher expected returns without compromising on flexibility too much.

Recommended reading

Recommended reading