How to manage risk in a bear market

Bear market guidebook: What are the characteristics of a bear market, how can you protect yourself, and what should you do now?

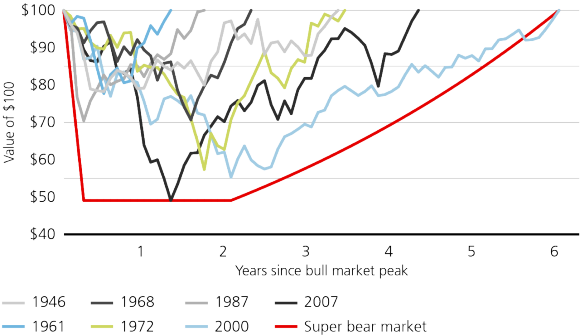

When it comes to understanding market risks and their impact on investment success, there is an elephant in the room—or rather, a bear. A “bear market” occurs when there is a greater-than-20% peak-to-trough drop in the S&P 500. Although the 20% threshold is arbitrary, crossing this level has historically been an important dividing line between painful-but-short-lived corrections—where recovery time is measured in months—and the years-long recovery period for bear markets.

Although they are a natural part of the investing experience, there’s a certain taboo about discussing bear markets and recessions, as if acknowledging them increases the likelihood of experiencing one. Our research suggests that this taboo is counterproductive. In studying bear markets closely, you will learn that they aren’t as dangerous as they seem.

It’s important to note that there is no panacea for bear markets. Almost all investors will experience at least a handful of bear markets—both in their working years and during retirement—and they will be painful. But there’s a difference between pain and damage, and our research tells us that bear market protection doesn’t have to be expensive—especially if investors are proactive.

As we’ll show below, bear markets needn’t be a threat to financial success. In fact, for the well prepared, they can be an opportunity to improve long-term returns. After reviewing this research, you can work with your financial advisor to make sure you’re prepared. It’s never too early—and rarely too late—to plan.

What is a bear market?

A period in which US stocks fall by more than 20% from a peak. But most bear market damage occurs while markets struggle to recover from this drop.

Start a conversation

Start a conversation

Reach out to learn more about the Bear market guidebook and how we can help you prepare.

Although bear markets are painful, it usually only takes a few years for the stock market—and even less time for balanced, diversified portfolios—to fully recoup bear market losses. Even in a worst-case “super bear market,” market losses are temporary for investors who are able to stay the course.

The main risk that investors face during a bear market is panic, but even the most patient investors can be forced to sell at bear market prices if they are living off of their portfolios. When an investor sells part of their invested portfolio during a market drawdown, they not only lock in otherwise-temporary losses—they also prevent their assets from fully participating in the market recovery and future gains. For unprepared investors, an ill-timed bear market can force them to catastrophically deplete investment portfolios. This dynamic is a particularly potent danger for retirees without a well-funded Liquidity strategy—cash and short-term bonds to maintain their lifestyle.

Our “Bear market calculator” helps you to estimate the cost of selling during a bear market—what we call “bear market damage”—by running your portfolio and your plan through a super bear market. While we don’t expect the current bear market to be anything like this worst-case scenario, the exercise provides useful perspective about the difference between pain (temporary “paper” losses) and damage (locking in losses and forgoing gains). The calculator works in three stages:

Bear market calculator

An illustrative portfolio stress test for market downturn preparedness

Enter your portfolio’s value.

We will assume the bull market peaks this month, beginning the bear market decline.

What is your stock/bond allocation?

Pick the mix closest to your risk level.

How might your portfolio look under the worst historical circumstances?

Without adding to or taking from your portfolio, the value at the trough would be . Your portfolio would fully recover to its value in .

Do you plan to save or spend during the bear market?

Between and , will you make deposits into or take withdrawals from your portfolio?

I'll make depositsI'll take withdrawals

I'll do nothing

How much per month?

Estimate the average monthly amount in this timeframe.

How might your deposits change your portfolio under the worst historical circumstances?

Your portfolio’s trough value would increase to , more than the if you weren’t adding to your portfolio. In , you would have , more than the without deposits. of this is due to your deposits; the remaining is from growth of your deposits during the bear market recovery.

Contact your advisor today

Congratulations, it appears that you are already protecting your spending needs from volatility and even adding to your portfolio at discounted bear market prices. For more ways to take advantage of market drawdowns, and to make sure you’re on track to meet your long-term goals, discuss the Liquidity. Longevity. Legacy. (3L) framework with your advisor today.

Start a conversationThe value of investments may fall as well as rise and you may not get back the amount originally invested.

Timeframes may vary. Strategies are subject to individual client goals, objectives and suitability. This approach is not a promise or guarantee that wealth, or any financial results, can or will be achieved.

How might your withdrawals change your portfolio under the worst historical circumstances?

Your portfolio’s trough value would decrease to , lower than the if you didn’t withdraw from the portfolio. In , you would have , which is less than the recovery value without withdrawals. of this is due to your withdrawals throughout the bear market; the remaining represents what we call “bear market damage”.

How can you avoid this?

Using our Liquidity. Longevity. Legacy. (3L) framework, you can build out a Liquidity strategy that allows you to fund your spending needs without locking in otherwise-temporary losses. Let’s take a look at what would happen to your portfolio using a fully funded Liquidity strategy.

Timeframes may vary. Strategies are subject to individual client goals, objectives and suitability. This approach is not a promise or guarantee that wealth, or any financial results, can or will be achieved.

How would leaving your portfolio alone affect it under the worst historical circumstances?

Your portfolio’s trough value would remain at . When the market fully recovers in , your portfolio would also fully recover to . Bear markets are painful, but when you don’t spend out of your portfolio during one, you don’t lock in any otherwise-temporary losses. As a result, you don’t incur any bear market damage.

Contact your advisor today

Congratulations, it appears that you are already protecting your spending needs from volatility. If you would like to find ways to take advantage of market drawdowns, or if you would like to make sure you’re on track to meet your long-term goals, discuss the Liquidity. Longevity. Legacy. (3L) framework with your advisor today.

Start a conversationThe value of investments may fall as well as rise and you may not get back the amount originally invested.

Timeframes may vary. Strategies are subject to individual client goals, objectives and suitability. This approach is not a promise or guarantee that wealth, or any financial results, can or will be achieved.

How would protecting your spending needs change your portfolio under the worst historical circumstances?

Your portfolio’s trough value would increase to , higher than the without using the 3L framework. In , you would have , which is more than the without using the 3L framework. By building a Liquidity strategy ahead of time, you would be able to fund your of withdrawals while incurring bear market damage of versus without using the 3L framework.

Contact your advisor today

To learn more about how the 3L framework can help you maintain your lifestyle during periods of volatility while also remaining keenly focused on growing wealth for your long-term objectives, discuss this—and other ways to prepare your portfolio for bear markets—with your advisor today.

Start a conversationThe value of investments may fall as well as rise and you may not get back the amount originally invested.

Timeframes may vary. Strategies are subject to individual client goals, objectives and suitability. This approach is not a promise or guarantee that wealth, or any financial results, can or will be achieved.

We define a bear market as an episode where US large-cap stocks fall by at least 20% from peak to trough. Rather than focus only on the peak-to-trough drop time period—what we call the “drawdown” period—we also include the time that it takes for stocks to register another all-time high—what we call the “recovery” period.

The 20% threshold may seem arbitrary, but it is useful because it filters out a large number of painful-but-short-lived drawdowns for that asset class. For drops greater than 10%, but less than 20%, we generally call them “bull market corrections.” For less-than-10% drops, there are no agreed-upon definitions. Sell-offs of this magnitude are fairly common, and short-lived, and usually earn names like “dip,” “sell-off,” “reversal,” “pullback,” or “slide.”

It’s also important to note that, generally speaking, risk and return parameters are not relevant if we apply them directly to other asset classes or portfolios. After all, a “big” percentage change for one asset class may be a relatively minor move for another asset class or investment strategy. So while we use US large-cap stocks as the basis for defining bear markets, this is only for clarity, not because we’re suggesting that investors should measure their performance against an all-equity benchmark like the S&P 500.

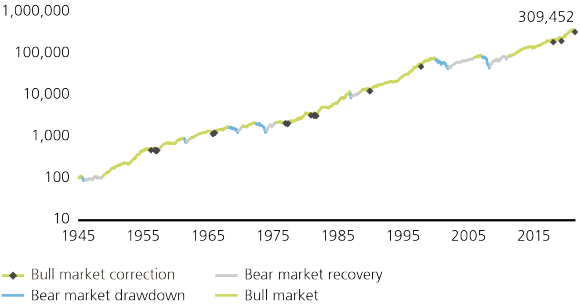

With this definition in mind, let’s look at historical returns to evaluate what market cycles look like using our framework.

Bear markets are rare, and over relatively quickly

Growth of USD 100 invested in US large-cap stocks in 1945, categorized by market environment using monthly total returns

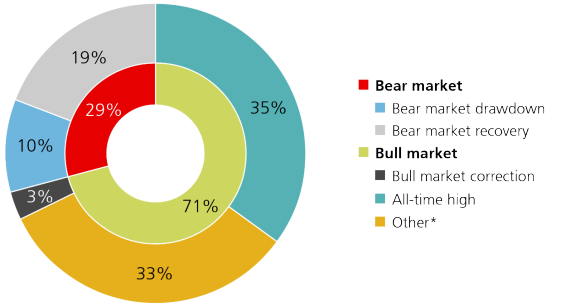

Stocks have spent about two-thirds of the time at, or within 10% of, an all-time high

Time spent by market environment, US large-cap stocks, monthly returns since 1945

Rather than thinking of markets as a “cycle” or a “clock,” this data helps us to see that markets are more like a runaway train when viewed over the long term. As investors, our job is to try to keep up with the train, which rarely stops and never truly goes backwards. This context is important as we ask ourselves how much long-term growth we’re willing to forfeit in order to improve our comfort level during the painful-but-rare “pauses.”

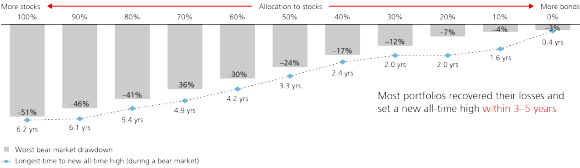

Adding bonds significantly reduces bear market risk, in both pain and duration

Post-WWII bear market performance, based on allocation to US large-cap stocks (the remainder is invested in intermediate US government bonds), in %

Unfortunately, history tells us that the quest for “the perfect hedge” may be a wild goose chase. No matter how well intended or designed, the strategies that provide the most potent protection against equity downside risk also tend to be the most costly in terms of sacrificing long-term growth potential.

That’s particularly true if the goal is to hedge against all downside movements, instead of only against the long and deep sell-offs that characterize bear markets. That’s because—in order to make sure that there is a high negative correlation during all downside episodes—a strategy must risk also having a high negative correlation when markets go higher. In a world where stocks usually go higher, strategies that seek to go “short” or directly hedge equities seem doomed to fail. This cost is especially high for strategies that employ leverage to “make the most” of their short windows of opportunity.

As a result of these challenges, we don’t usually recommend direct hedges as a part of our strategic or tactical asset allocation. As we will note below, it’s important to prioritize cost-effective protection before moving on to less-reliable or costlier hedging strategies.

Here are some “damage mitigation” strategies, in declining order of efficiency:

1. Think structurally

Make sure that your portfolio is taking the right amount of risk to meet your short- and long-term objectives.

2. Plan strategically

The most direct way to manage equity risk is to trim some stocks from the portfolio in favor of a higher allocation to core bonds.

3. Consider hedges

There are many strategies that could mitigate the portfolio’s downside exposure if used to replace a part of the equity allocation.

4. Manage liabilities prudently

If used carefully, borrowing strategies can be highly beneficial to improving bear market returns.

There are a handful of tactics that investors can employ during a bear market.

Read the full report

Read the full report

For a deeper read, download the full whitepaper, “Bear market guidebook: How to manage risk and harness opportunity in a market downturn.”