Perspectives: Heat pumps, plastic reduction, and decarbonizing steel

Sustainable investing

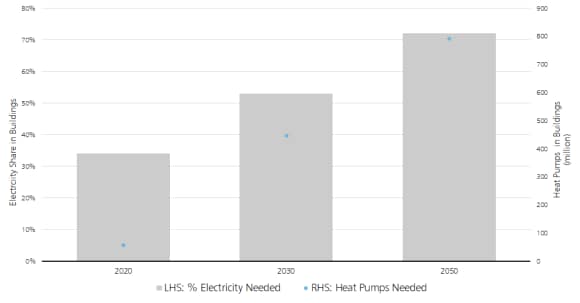

- Almost half of global energy demand stems from heating and cooling, and switching to a heat pump could result in savings and lower emissions for a majority of households.

- The UN intergovernmental meeting on plastic reduction concluded in Canada with a focus on plastic recycling and circularity, instead of production limits. We see opportunities in line with our “Circular economy” and “Blue economy” Long Term Investment themes (LTIs).

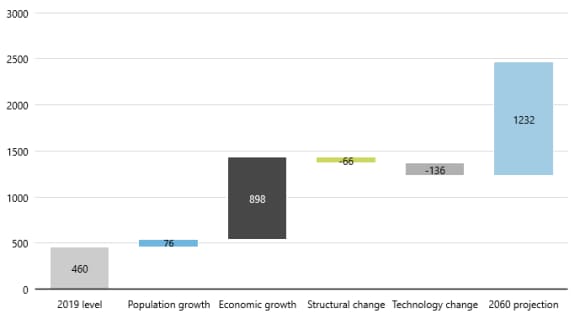

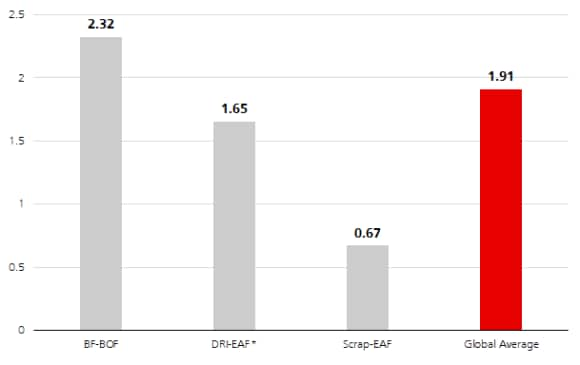

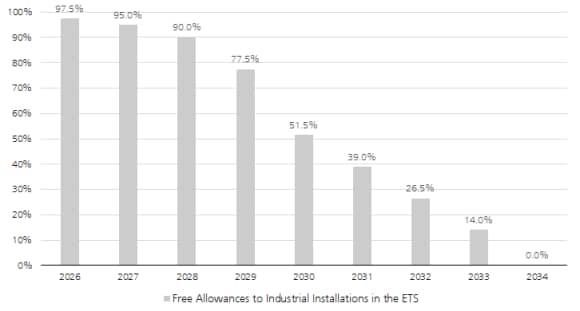

- Steel is responsible for 8% of global emissions, and is a hard-to-abate sector in that it is structurally challenging to decarbonize. We explain why, and look at differences between regions.

Perspective

Recommended reading

Recommended reading