Create the life you want

Anything is possible when you manage your money the right way. At UBS Wealth Management, our mission is simple: to guide you towards a brighter future for your investments, your business, and eventually your family.

Best Private Bank in Asia Pacific

We won nine awards as part of the region’s highly coveted Asian Private Banker (APB) Awards for Distinction 2023. These wins range across our diverse spectrum of capabilities and underscores our dedication to delivering unique opportunities, services and value to our clients.

Introducing Circle One by UBS

Introducing Circle One by UBS

A digital global ecosystem connecting you to experts, thought leaders and actionable ideas

Invest for good

Invest for good

Invest for returns and drive change through sustainable investing

Women's wealth

Women's wealth

A new approach to financial planning

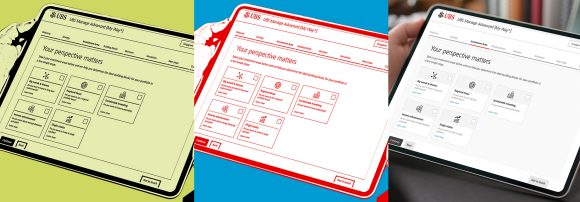

UBS My Way*

UBS My Way*

Manage your wealth according to your individual needs.

Our services for Private Clients

Our services for Private Clients

Grow your wealth, the way you like it

Share your goals with us

Share your goals with us

Come and see us so we can start working to get you closer to your personal financial goals.