Women and Investing: Reimagining wealth advice

Explore how we believe wealth managers need to reimagine their value proposition to deliver the experience and wealth advice that women are asking for.

Overview

Overview

Women´s wealth is growing, and there is a trend toward women wanting and taking control of their finances. Women are not satisfied with the current advice they receive, and they tend to value the importance of expert advice more than men. A 2022 study by BNY calculated that if women invested at the same rate as men, there could be more than 3.22 trillion of additional capital to invest globally with over 1.87 trillion flowing into more responsible investing.

In this publication, we review the differences between men’s and women’s wealth journeys and focus on how the wealth management industry can best support women in taking control of their finances. We start by looking at women’s wealth and the trend of women investing. We then look at how women tend to make investment decisions along with their needs and preferences. Based on these insights, we identify the key components for a compelling wealth management value proposition for women.

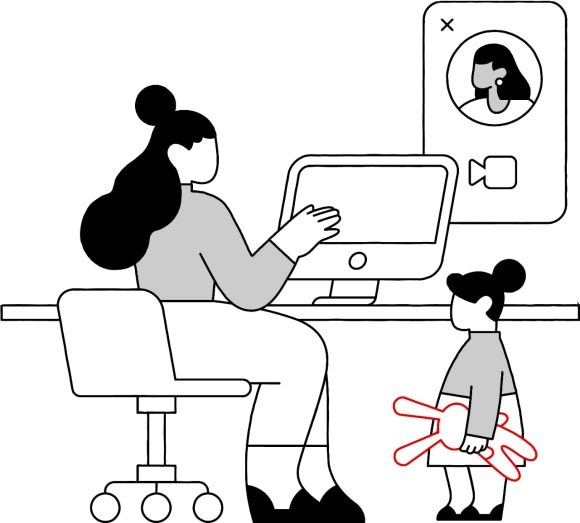

Over the past years, we have seen an increase in the number of women interested in taking control of their finances. However, the arrival of COVID-19 has been a challenge for women, given the higher unemployment rates they experienced during the recent ‘she-cession’ and the added burden of childcare responsibilities many undertook as a result of school closures and lockdowns. But the pandemic has also had a silver lining. Increased precaution has led women to take more action. It has prompted many to review their financial situations and seek control of their destinies.

Furthermore, UBS’s 2021 Investor Pulse survey in 2021 showed that 68% of women had started talking more about finances within their families. However, only a fraction of these followed through with the actions they intended to take.

Nevertheless, financial participation has also increased among married women. A 2020 McKinsey report showed that 30% more married women were making financial and investment decisions than five years previously.

- 0 %

Based on research from Fidelity in 2021, the number of women in the US who say they are more interested in investing has risen by 50% since the start of the pandemic.

- 0 %

The survey also found that 67% of women are now investing outside their retirement plans, compared to 44% in 2018.

- 0 %

This trend was also captured in a 2021 Nutmeg survey, where one in five women said they felt more confident dealing with money matters in light of the pandemic.

- 0 %

Furthermore, UBS’s 2021 Investor Pulse survey in 2021 showed that 68% of women had started talking more about finances within their families. However, only a fraction of these followed through with the actions they intended to take.

- 0 %

Nevertheless, financial participation has also increased among married women. A 2020 McKinsey report showed that 30% more married women were making financial and investment decisions than five years previously.

The current advisory process experienced by women often does not meet their needs. Women often report they are not satisfied with their wealth management arrangements or financial advice, stating that they often feel their wealth managers simply do not understand their needs. Based on EY research, 67% of female investors globally stated that their wealth managers misunderstood their goals. This dissatisfaction is also demonstrated by the finding that 70% of women switch their wealth relationship to a new financial institution within a year of their spouse’s death.

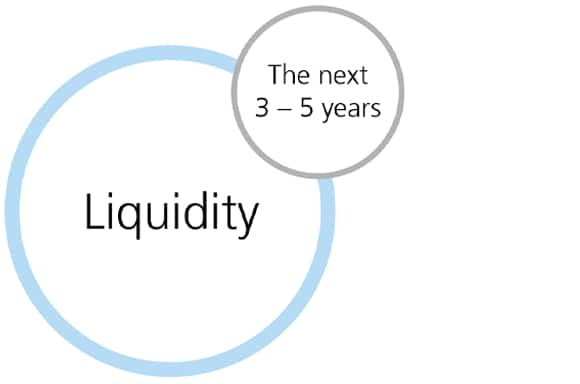

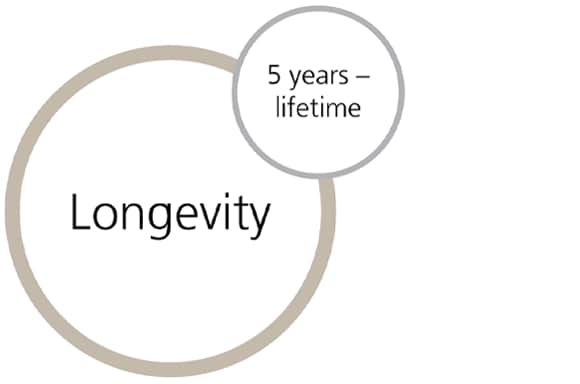

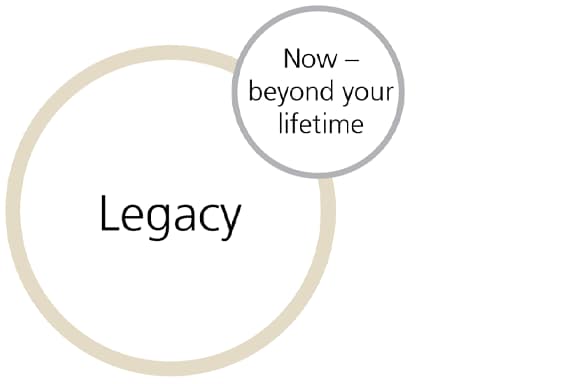

How can wealth managers reimagine their advisory process? What are the key ingredients to help women achieve their goals? In our view, wealth managers need to reimagine their value propositions in the following ways:

Ask for advice

Ask for advice

Would you like to find out how UBS Wealth Management can support your financial journey? Contact us today to start a conversation.

Read the full report

Read the full report

Want to learn more? Download the full report "Women and Investing: Reimagining wealth advice" to dive deeper into this topic.