Continued momentum in the secondary market

UBS Private Funds Group: 1H 2025 secondary market report

![]()

header.search.error

UBS Private Funds Group: 1H 2025 secondary market report

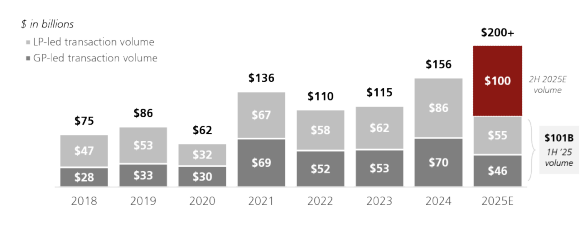

The secondary market experienced a historic first half of the year, with transaction volume of USD 101 billion representing a 42% increase over the prior year period and nearly 90% of full-year 2023 volume.

General partner (GP)-led volume accounted for USD 46 billion in 1H 2025, a roughly 60% uptick compared to 1H 2024, driven by a surge in multi-asset continuation fund volume. Limited partner (LP)-led transactions totaled USD 55 billion in volume, fueled by persistent liquidity pressures and portfolio rebalancing needs amid budgetary constraints and regulatory shifts.

Themes driving secondary market momentum

Methodology: Reference to market analysis refers to a survey that UBS conducted to solicit feedback on secondary market activity in 1H 2025 as well as market intelligence that UBS has gathered from conversations with secondary investors, publicly available information and transaction activity that UBS was involved with in 1H 2025. Certain statistics shown reflect UBS’s estimates based on data gathered from UBS survey respondents and publicly available information.

Interested in learning more about the key trends from 1H 2025? Enter your details below and we’ll be in touch with a copy of the full report. Please note this report is only available for institutional and professional investors.

A global private capital advisor integrating world-class private placement expertise with a leading secondary advisory platform, raising over $93 billion of new money since 2010.