Uniquely positioned to help you navigate market uncertainty

Uniquely positioned to help you navigate market uncertainty

Each situation is unique, each client is different, and the marketplace is always changing. One constant is our goal to offer the best possible advice, tools and execution to help you succeed – whatever your goals.

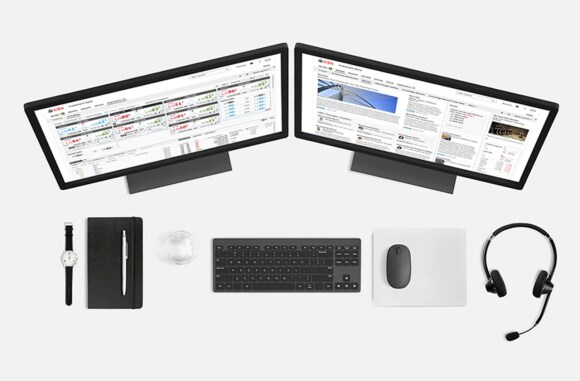

UBS Neo

UBS Neo

Built to seamlessly optimize the way you work; from traders looking to access liquidity and execute across asset, to Portfolio Managers consuming research and market expertise across our global trading floors. UBS Neo is an open-platform and firmwide ecosystem that empowers UBS communities to create, discover and consume investment capabilities via mobile, desktop, web and API channels.

Best Global Bank for Financial Institutions

Best Global Bank for Financial Institutions

Global Finance, 2023

Best House, Structured Retail Products, Switzerland

Best House, Structured Retail Products, Switzerland

SRP Europe Awards, 2023

Top 3 Global Equity Research Team

Top 3 Global Equity Research Team

Institutional Investor, 2016 - 2023

We believe our culture is the single most important factor to our success. It shapes policy and processes, informs what it is like to work here, and delivers long-term value to our stakeholders. Everyone from our President to our newest employees are equally responsible for owning and protecting our culture, and everyone can influence it.

Fraud Alert

Fraud Alert

Please be aware that the integration of Credit Suisse and UBS creates a unique opportunity for fraudsters to contact our clients purporting to be from our organisation or selling fake investment schemes from our entities. This could be a means to get information from our clients or to trick clients into sending money to a new account. Please be vigilant if you are contacted by an unknown party. UBS and Credit Suisse entities will never contact you by email or telephone with new bank account details. Before transferring money or sharing personal details, please contact UBS (or relevant bank) by telephone. If you are already a client, please contact your UBS or Credit Suisse advisor.

Further advice on staying safe online can be found at www.ubs.com/cybersafe.