Our award-winning, multi-asset class global research team's primary goal is to support you in analyzing the pivotal questions that drive your investment decisions. As a market-leading investment bank research house, we bring you differentiated content on global financial markets and securities with coverage of ~3,800 stocks in over 50 different countries.

Our award-winning, multi-asset class global research team's primary goal is to support you in analyzing the pivotal questions that drive your investment decisions. As a market-leading investment bank research house, we bring you differentiated content on global financial markets and securities with coverage of ~3,800 stocks in over 50 different countries.

- 0Analysts, strategists and economists

UBS internal data

- 0Company stocks

- 0Markets

Featured topics

Our capabilities

Latest research insights

Market insights and commentary from our global thought leaders

UBS Global Research Pod Hub

Tune in to our episodes for insights on the topics that matter from our global economics, strategy and industry thought leaders at UBS

04 Feb 2026

Food by 2040: The personalised Nutrition Revolution

Charles Eden, European Chemicals Analyst at UBS Investment Bank, joins Paul Schneider, Head of Markets Focus, to unpack the forces transforming the global food system and the shift toward personalised nutrition. *(This information is subject to a disclaimer at the end of this podcast. Please ensure that you listen to the disclaimer and go to www.ubs.com for further information about UBS).

Transcript

20 Jan 2026

Analyst Playbook: The evolving role of data and statistics in research

In this episode, Christopher Clarke sits down with Josh Stone, Head of Energy at UBS, to discuss how analysts use data, and how the value of data is changing in 2026 and beyond. *(This information is subject to a disclaimer at the end of this podcast. Please ensure that you listen to the disclaimer and go to www.ubs.com for further information about UBS).

Transcript

02 Jan 2026

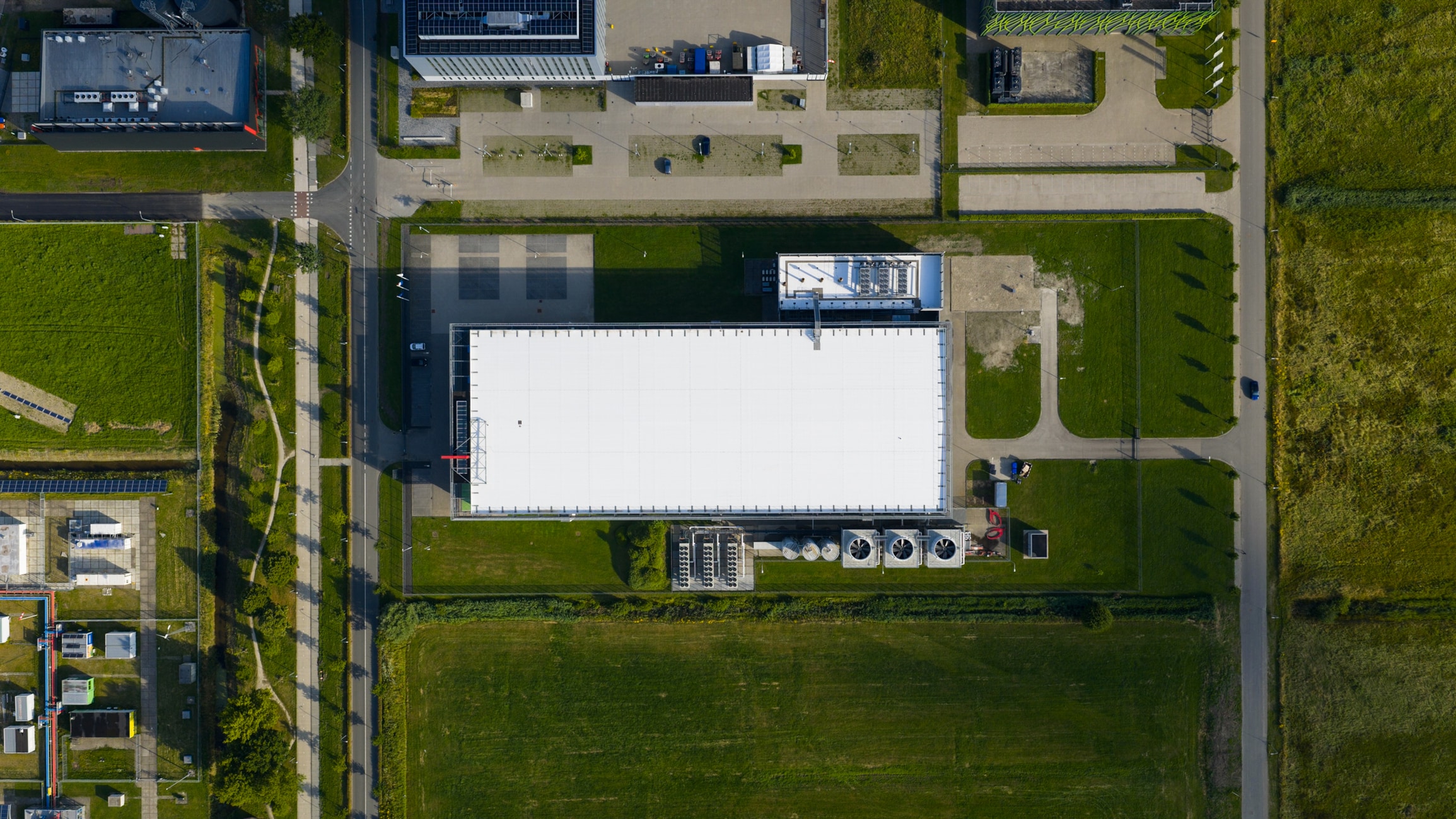

AI, Data Centres and the Energy Transition: What Investors Need to Know

Paul Schneider speaks with Vicki Kalb, Global Head of ESG and Sustainability Research, about the critical role of data centres in powering AI. From power and water constraints to the accelerating energy transition and nuclear’s potential role, they explore what this means for markets and investor portfolios. *(This information is subject to a disclaimer at the end of this podcast. Please ensure that you listen to the disclaimer and go to www.ubs.com for further information about UBS).

Transcript

27 Nov 2025

Global Economics and Market Outlook 2026-2027

In this episode of the Global Research Pod Hub, Bhanu Baweja, Chief Strategist at UBS, sits down with Arend Kapteyn, Chief Economist for UBS, to break down the annual Outlook for the year ahead. They look at the key economic themes for 2026-2027 and market investment ideas. *(This information is subject to a disclaimer at the end of this podcast. Please ensure that you listen to the disclaimer and go to www.ubs.com for further information about UBS).

Transcript

06 Nov 2025

Uncovering China’s Healthcare Boom

Caroline Li, Deputy Product Manager, sits down with Chen Chen, Head of China Healthcare, to explore the forces driving China’s Healthcare surge, regulatory dynamics and the investment opportunities shaping the sector’s future. *(This information is subject to a disclaimer at the end of this podcast. Please ensure that you listen to the disclaimer and go to www.ubs.com for further information about UBS).

Transcript

Access via UBS Neo

Your access to informed macro and local market insights direct from our economists, analysts and strategists available across regions, companies and asset classes.