Economics China Economic Perspectives: CFOs' take on COVID-19 impact

The negative impact of trade war & tech restrictions has persisted. CFOs are more worried about geopolitical risks & US-China tensions; about half of all respondents see US-China relationship as a key external risk factor.

The latest CFO survey showed improving business activities

The latest CFO survey showed improving business activities

The 7th UBS Evidence Lab China C-Suite B2B Survey was conducted between 18th-29th September 2020 with 518 senior executives. The survey results suggest business operations have been recovering from the Covid-19 hit, and corporate outlooks are improving. However, the levels of operation for most businesses are not yet back to pre-Covid-19 levels. In response to the Covid-19 shock, many firms chose to delay or cut capex spending, and more respondents than the March survey have also cut wages. The findings are consistent with our view that consumption and corporate capex may take longer to recover to their normal pace of growth.

US-China tension remained a key headwind

US-China tension remained a key headwind

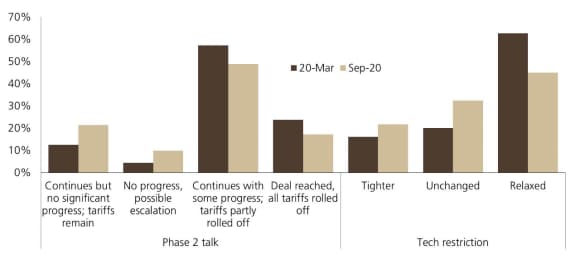

Three quarters of the manufacturing exporters reported negative impact from trade war and 73% reported a hit from tech restrictions. Not surprisingly, about half of all respondents rank US-China relationship as a top external risk. Expectations of trade war have also become less optimistic with more CFOs now expecting no roll-off of tariffs or even further escalation than before. Our current baseline forecast assumes no change in US policy on China regardless of the upcoming election outcome, even though a Biden administration (if elected) may choose a more multilateral approach.

Policy has been supportive but is expected to tighten

Policy has been supportive but is expected to tighten

Thanks to the monetary and credit easing in H1, 2/3 of the firms saw relaxed credit conditions although not a drop in credit costs. Firms have also reported a somewhat lower tax and fee burden, thanks to the tax and fee cuts earlier this year. Looking ahead, as the economy continues to recover, more respondents than before expect tighter access to credit and rising credit costs. Respondents also expect tax and social security contribution to increase as many tax/fee cuts are scheduled to expire by end-2020. At the macro level, we think policy easing has already peaked though credit growth may peak in October or November.

Covid-19 increased the desire for supply chain shifts

Covid-19 increased the desire for supply chain shifts

71% of the manufacturing exporters plan to move or continue to move some production out of mainland China, higher than 60% in April and 57% last year. 45% of respondents said Covid-19 increased their intention to move despite China's success in containing the virus. Meanwhile, 30% of respondents have moved or plan to move some production overseas back to China, and another 54% said they may consider such a move in the future. These findings are consistent with our view that supply chain shifts will be accelerated by Covid-19, and that the moves will be in both directions, as China's large and growing market and further opening up should attract more investment. In the short-term, the finding is consistent with our view of a depressed manufacturing capex outlook.