Green spending and clean energy investment: Exploring the opportunities

Many are dubbing the transition to net zero as the ‘largest investment project in history’.

We spoke to three investment experts from across our business to gauge the pace and scale of developments, as well as understand where the opportunities and risks are emerging.

Imagine outgunning the achievements of more than two centuries in a couple of decades; or completing a life’s work in a few short years. It is a daunting prospect. Yet that, and arguably more, has to happen if the world is to achieve its green energy revolution. Put simply, the transition to a net-zero energy system will be the largest investment project in human history. That might sound dramatic, but it is a reality. Ellis Eckland, research analyst, active equities, Alex Leung, infrastructure analyst in Real Estate and Private Markets, and Andrew Farnell, senior analyst, UBS O’Connor, help explain why.

Over the 200 years between 1800 and 2000, demand for energy – mainly from fossil fuels – grew at a rampant pace. This growth was the result of massive global expansion, as economies industrialized, science and engineering flourished, and the world’s populations grew and urbanized.

However, while newer and more efficient energy sources gradually became dominant – oil displaced coal, which itself displaced wood – we continued to increase our use of existing fuels. Now, we are attempting to make renewables the dominant energy source, and we have to do it by 2050 at the latest if we are to achieve net-zero emissions and win the battle against climate change.

What will our future energy look like?

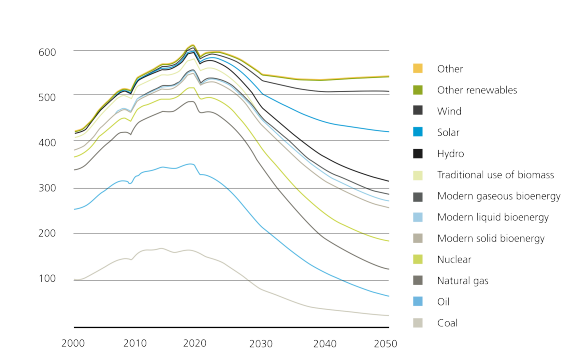

IEA's vision of the future energy system in 2050

Energy supply by source under the IEA Net Zero Scenario

But there are complicating factors. First, we have to do what has never been done before: to dramatically cut our use of fossil fuels. According to the International Energy Agency’s (IEA) view of how the energy system needs to evolve in order to meet net zero, oil and coal usage should already have peaked, and should start to decline rapidly over the next three decades. Furthermore, we have to reduce our overall use of energy, bearing in mind that there is a close correlation between demand and economic growth.

We have to reduce our overall use of energy.

As Ellis Eckland, research analyst in the active equities team at UBS Asset Management puts it: “It took more than 150 years for coal to replace wood as the dominant source of energy. After that it took oil over 50 years to displace coal. If the IEA’s projections are to be met, the world is going to have to effectively replace oil, gas and coal in less than 30 years. To make this challenge even tougher, total energy use is projected to fall during this period, implying that economies will have to contract as part of the process.”

Eckland notes that the economics of the current transition also fly in the face of history. “In the past we replaced coal with oil because it was cheaper and better and that resulted in high growth. Now we are going to replace oil with more expensive renewables in a time of slow growth at best,” he says.

Five key energy investment areas

Five key energy investment areas

There are five key areas where energy related investment will be concentrated, according to analysis by UBS: renewable electricity, advanced biofuels, hydrogen, carbon capture and storage, and grid stability. And each has its own component parts.

Advanced biofuels effectively represent the future of air travel.

The most straightforward is renewable energy. There have already been very significant investments in wind and solar power, but capital also needs to be put into the renewables supply chain. Much more copper, silver and rare metals will be required, as well as lithium, iron and steel.

“I’d argue that the renewables supply chain probably represents the biggest bottleneck in the transition to net zero,” Eckland says. “It is underinvested as a sector but less so for renewables themselves.”

There are issues here as well, including a likely shortage of copper, where it takes 20 years to build a new mine. “Demand for copper is projected to increase by as much as 40%, with some estimates suggesting demand will double by 2035. It is not at all clear where all this copper is going to come from,” Eckland says.

Advanced biofuels effectively represent the future of air travel. Sustainable aviation fuel – which can be produced from recycled animal and vegetable oils – combined with lengthening the lives of existing fleets of planes, is the most sustainable way of continuing to use the air as a means of transport.

Projections for the growth of hydrogen range from “massive to super-massive,” according to Eckland. The world needs hydrogen to decarbonize industrial processes, such as the production of steel or cement, which require high levels of heat but are essential to building renewables.

Carbon capture and storage (CCS) is among the least explored of the five themes. However, given that, for example, air travel and agriculture are likely to remain net carbon emitters, it is going to be crucial in handling some of that CO2 produced. Indeed, the latest IPCC Report confirms the need for CCS, stating “CDR (Carbon dioxide removal) will be needed to “counterbalance” hard-to-abate residual emissions in some sectors, for example “some emissions from agriculture, aviation, shipping and industrial processes.”1

“The most optimistic projections In the IEA’s net zero scenarios and other similar studies imply that by 2050 we are going to need to capture 25% of the carbon we emit today, which is absolutely massive,” says Eckland, who says that equates to an estimated 2.5% of global GDP.

Grid stability is an issue because most renewables, with the exception of geothermal and hydro power, are intermittent and unstable. Eckland says that investment in grid stability will come in areas ranging from batteries and biomass to artificial intelligence and new concepts such as pumped hydropower and gravity storage, which uses the uses the gravitational pull of rock.

Creating scale and certainty

Creating scale and certainty

However, the ways investment in these areas is playing out and being cultivated is changing the landscape, including the dynamics of the relationship between the private and public sectors. Government incentive schemes, particularly in the US, are prompting investors, and asset owners, to locate new projects where the subsidies are the most attractive, sometimes going back to markets they previously left behind.

Alex Leung, infrastructure analyst in the Research & Strategy team in UBS Asset Management’s Real Estate & Private Markets unit, highlights US president Joe Biden’s Inflation Reduction Act (IRA), introduced last year, which he describes as “possibly the most important clean energy legislation in US history”.

He says that the IRA legislation, which runs to 700 pages, contains three key features. The first is that it lasts for at least 10 years, bringing an end to the previous trend of extending existing subsidies year by year. This led to an artificial “stop-start” cycle among developers, which would suspend work on a project, a new wind farm, say, until tax breaks had been renewed.

“It creates a boom-and-bust cycle that’s really not healthy for the growth of any industry – just think about the workforce, the manufacturing capacity, the supply chain capacity, each of which pretty much goes from start to stop each time. This is something we now don’t have to worry about for the next 10 years,” Leung says.

There will be a big increase in the variety of clean energy projects.

“The second feature is the sheer scale of the clean energy tax credits and subsidies that are given to all these different technologies – not just to wind and solar, but to standalone energy storage, to renewable natural gas, to hydrogen and to other sectors,” he says.

The process of financially benefiting from tax credits has also been streamlined, Leung says, meaning there will be a big increase in the variety of clean energy projects, which will be backed by a more efficiency financing market.

Thirdly, the IRA is designed to shore up the US’s domestic clean supply chain and increase the resilience of its manufacturing sector, making it as much as industrial policy as an energy programme. As a result of the IRA, the US will spend at least an additional $1 trillion over the next 10 years on clean energy investments, according to Princeton University’s Net-Zero America Project.

Healthy competition

Healthy competition

Although it is essentially a US policy, the IRA is having a global impact, prompting other countries worldwide to come up with their own policy response, equally designed to attract inward investment, and in competition with their counterparts in America.

The boldness of the US policy has caused tensions in areas such as Europe, which has previously criticized the US for being too profit-motivated while neglecting the climate issue. However, attacking the most important US clean energy legislation for not being free trade friendly would also appear hypocritical, which is why the EU is now pursuing similar industrial policies.

Leung says the EU is trying to find ways of introducing policies that benefit all of its member states, rather than simply boosting the industrial powerhouses of France and Germany. “One idea is to create an EU sovereignty fund that provides finance for clean energy projects across all member states,” he says.

Andrew Farnell, a senior analyst at UBS O’Connor, agrees that government regulation is helping to unlock a powerful investment response from the private sector. The White House has estimated that some $300bn of investment capital has returned to the US since the IRA was passed, he notes, which is meaningful in comparison to base manufacturing capital expenditure (capex) of roughly $700bn.

“If you look at all of the proposed onshoring schemes that are coming forward over the next four to five years, that equates to 4% to 5% growth in capex alone, and that is without the standard increases,” Farnell says.

“The themes that I would identify to explore as an investor around this include capital equipment, the obvious one being semiconductor capex, automation – as we see manufacturing buildout in the US with electric vehicles and batteries, for example – and construction, including building materials, but also equipment rental.”

The sheer scale of investment and the size of projects being undertaken is transforming some markets, Farnell adds, “With equipment rental serving the construction industry, there are only two or three companies that can provide the level of equipment needed for these mega projects. So you go from a highly fragmented and competitive industry to one where you’ve basically got two major players that are likely to take a disproportionate share of the market.”

Commercial property is a further case in point, given that buildings account for 40% of global emissions. In a recent report the European Commission (EC) classified 75% of the EU building stock as inefficient, implying that the rate of energy-related renovation needs to double from current levels in order to meet future emission targets. In response, the EC produced harmonized legislation to encourage funding for renovations at a local level and remove bureaucratic hurdles.

Buildings account for 40% of global emissions.

The most powerful signals are coming from the markets, which motivates the private sector to respond alongside government support. We see clear evidence of this in property values for buildings renovated to the most energy efficient standards, with premiums of 25% in London and 35% in Paris observed by MSCI. Given the increasing emphasis on decarbonization in government policy and the considerable bifurcation of market values the renovation of the building stock is likely to accelerate in the coming years.

Ultimately, the scale of disruption in moving to a low carbon economy being squeezed into a relatively short time period is creating opportunities (which are not always obvious). And will likely continue to do so for investors that want to be on the right side of change, as an albeit accelerated history plays out in front of us.

About the authors

-

Ellis Eckland

Portfolio Manager Climate Action

Ellis Eckland, lead portfolio manager for UBS Climate Action and UBS Future Energy Leaders strategies. Also a Senior Investment Analyst on UBS AM's Global Equity team, focusing on renewable energy, materials, and conventional energy sectors. Ellis joined UBS AM in 2010. Former Chairman and CIO of Eckland Capital Management. Previous roles at Frontpoint Partners and Putnam Investments as energy and materials analyst. Former US Naval Intelligence Officer awarded Joint Service Commendation Medal.

-

Alex Leung

Infrastructure Analyst, Research & Strategy

Alex Leung, infrastructure Analyst in UBS AM's Real Estate & Private Markets' Research & Strategy team. Alex joined UBS AM in April 2018. Conducts macro and fundamental research on infrastructure investment markets, identifying opportunities. He works closely with the investment team to develop long-term strategies. Previously VP at Sanford C. Bernstein, analyzing investments in global energy, utilities, and industrial sectors. Held positions in research and trading departments in Hong Kong and New York. Holds Series 7 and Series 63 licenses.

-

Andrew Farnell

Research Analyst - O'Connor

Andrew Farnell is a seasoned financial analyst with 13+ years of experience. He holds an MBA from Imperial College London, complementing his first degree in Economics from the University of Liverpool. Andrew has worked at renowned institutions such as Rathbones, Dresdner Bank, Baring Asset management, Morgan Stanley, M&G Investments, and TT International. Currently, he serves as a Senior Analyst at UBS O’Connor. With expertise in investment management and equity analysis, Andrew brings valuable market insights to drive informed decision-making.

PDF

The Sustainable Investing Edition

The Sustainable Investing Edition

The special edition of Panorama is dedicated to sustainable investing and places a marker in the ground for where we should all head next.

Was this article helpful?

Please enable javascript in your browser and retry.

The feedback component cannot be displayed.

Read more

Make an inquiry

Fill in an inquiry form and leave your details – we’ll be back in touch.

Introducing our leadership team

Meet the members of the team responsible for UBS Asset Management’s strategic direction.