When shopping for sugar, we are spoiled for choice. Yet white refined granulated sugar is a commodity, virtually identical across brand names.

At first glance, ESG ETFs can seem the same. However, they can differ from each other materially, with significant variations in selection criteria, tracking error and performance.

The asset management industry is often accused of being commoditized, offering little differentiation between investment products. While we refute the charge, the proliferation of products in recent years makes the conclusion understandable – particularly when it comes to passive investing.

With this in mind, we decided to take a closer look at the major ETFs to see how they differed from their traditional benchmark counterparts in terms of exposure, tracking error and – by inference – performance. And while index funds replicate their benchmark exactly, many active funds use a benchmark index portfolio to identify the investment universe. This analysis is therefore of relevance to both active and passive investors as active funds are often merely subsets of the index.

Tracking the errors

Tracking the errors

Table 1 below shows that many indexes used by popular ETFs tend to have high diversification and a close relationship with their traditional versions. For example, even in the turbulent twelve months ending March 2023, the MSCI USA ESG Select Index had a beta of 1.02 and a correlation of 100% with the traditional MSCI USA Index; its tracking error was also below 2.29%.

The MSCI USA Select has limited exclusion (e.g., cluster weapons manufacturers) and some overweighting of high ESG-rated stocks, but with the objective of matching performance with the traditional index. This makes it what we call a ‘conventional ESG index’; such indexes seem more relevant to investors with a preference to avoid the most common activity-based exclusions and have a slightly higher ESG-rated portfolio profile.

We can also see that the MSCI USA Leaders Index has slightly lower beta, slightly lower correlation and a tracking error close to 3%, compared to 2% for the Select index. This confirms MSCI’s index description, as the index overweights companies with high ESG ratings and excludes most of the laggards.

More negative screening (exclusion) and more positive screening (overweight of highly-rated stocks) leads to higher tracking error and more discrepancy in performance between the ESG and the traditional index. The Leaders index therefore seems more relevant to investors with a preference to have a significantly better ESG-rated portfolio.

Table 1: A comparison of some of the largest US-listed ETFs to their respective traditional indexes

ESG Index Name | ESG Index Name | Traditional Benchmark | Traditional Benchmark | Beta to Benchmark | Beta to Benchmark | Correlation to Benchmark | Correlation to Benchmark | Tracking Error | Tracking Error |

|---|---|---|---|---|---|---|---|---|---|

ESG Index Name | MSCI USA ESG Select | Traditional Benchmark | MSCI USA | Beta to Benchmark | 1.02 | Correlation to Benchmark | 100% | Tracking Error | 2.29% |

ESG Index Name | MSCI USA ESG Leaders | Traditional Benchmark | MSCI USA | Beta to Benchmark | 1 | Correlation to Benchmark | 99% | Tracking Error | 3.10% |

ESG Index Name | MSCI KLD 400 Social | Traditional Benchmark | MSCI USA | Beta to Benchmark | 1.03 | Correlation to Benchmark | 99% | Tracking Error | 3.15% |

ESG Index Name | FTSE US All Cap ESG | Traditional Benchmark | FTSE US All Cap | Beta to Benchmark | 1.05 | Correlation to Benchmark | 100% | Tracking Error | 2.46% |

ESG Index Name | NASDAQ Clean Edge Green Energy | Traditional Benchmark | NASDAQ 100 / MSCI USA | Beta to Benchmark | 1.28 / 1.35 | Correlation to Benchmark | 93% / 90% | Tracking Error | 13.39% / 16.82% |

Calculating ESG exposures

Calculating ESG exposures

For investors with strong ESG preferences it is reasonable to ask: How much ESG exposure is achieved by tracking some of the most popular ESG indexes? For the different ESG dimensions, MSCI provides scores on a scale from 0 to 10, where 0 is the worst and 10 is the best possible score.1

Table 2: US ESG ETFs: Sustainability scores

Index | Index | MSCI ESG Score | MSCI ESG Score | MSCI E Score | MSCI E Score | MSCI G Score | MSCI G Score | MSCI S Score | MSCI S Score |

|---|---|---|---|---|---|---|---|---|---|

Index | MSCI USA ESG Select | MSCI ESG Score | 8.3 | MSCI E Score | 7.08 | MSCI G Score | 6.04 | MSCI S Score | 6.02 |

Index | MSCI USA ESG Leaders | MSCI ESG Score | 7.52 | MSCI E Score | 7.27 | MSCI G Score | 5.69 | MSCI S Score | 5.13 |

Index | MSCI KLD 400 Social | MSCI ESG Score | 7.49 | MSCI E Score | 7.22 | MSCI G Score | 5.7 | MSCI S Score | 5.46 |

Index | FTSE US All Cap ESG | MSCI ESG Score | 6.63 | MSCI E Score | 6.82 | MSCI G Score | 5.53 | MSCI S Score | 5.08 |

Index | NASDAQ Clean Edge Green Energy | MSCI ESG Score | 6.3 | MSCI E Score | 6.42 | MSCI G Score | 5.71 | MSCI S Score | 4.74 |

Index | MSCI USA | MSCI ESG Score | 6.62 | MSCI E Score | 6.72 | MSCI G Score | 5.51 | MSCI S Score | 5.13 |

Index | FTSE US | MSCI ESG Score | 6.62 | MSCI E Score | 6.74 | MSCI G Score | 5.5 | MSCI S Score | 5.12 |

Index | NASDAQ | MSCI ESG Score | 6.66 | MSCI E Score | 6.66 | MSCI G Score | 5.16 | MSCI S Score | 5.27 |

MSCI ESG Score improvements relative to traditional benchmarks

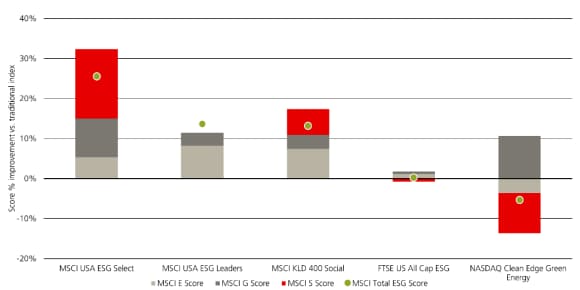

In the following chart we calculate the ESG score improvements of the different indexes relative to the respective traditional benchmark and disaggregate the E, S and G dimensions.

The largest tilt to higher ESG score can be achieved with the MSCI USA ESG Select Index (a 23% improvement relative to its traditional benchmark). Interestingly, according to the MSCI methodology, moving from FTSE US Index to the FTSE US ESG version doesn’t have a positive impact on the overall ESG score.2

A striking result in the following chart is the ESG underperformance of the NASDAQ Clean EDGE Green Energy vs. the NASDAQ. The large NASDAQ index weights in information technology as well as Communication services are excluded, and, in particular, these companies have on average very high ESG scores. Microsoft as an example has an ESG score of 9.8 out of 10. Thus, along the ESG dimension the NASDAQ is a tough benchmark.

There are also discrepancies among the different ESG dimensions if we look at percentage differences.

The biggest improvement in the environmental dimension can be achieved by switching from an MSCI USA equity allocation to an MSCI USA ESG Leaders allocation. From the view of the governance pillar, the MSCI USA ESG Select provides the largest improvement relative to the MSCI USA.

The benefits of moving to a conventional ESG index do seem to outweigh the costs.

Finally, evaluating the social dimension requires a different set of questions and analysis. The MSCI USA Select Index provides the largest improvement here.

All the major ESG indexes provide material sustainability rating improvements to their respective traditional benchmarks on at least one of the major dimensions. Given the large correlation between the ESG and traditional indexes as well as the low tracking error implications of moving to one of the major ESG indexes, the benefits of moving to a conventional ESG index do seem to outweigh the costs. Furthermore, none of our conclusions change when using UBS Global Wealth Management (GWM) or Sustainalytics data, although the scores are slightly lower on average.

The devil is in the detail

Sustainability benchmarks may differ from their traditional counterparts materially, or they may differ very little. Based on their preferences and objectives, investors should carry out due diligence to understand the implications of the benchmark for any investment product they choose.

Ultimately, higher adherence to sustainability principles is likely to bring more tracking error due to both negative screening (exclusion of low-rated assets) and positive screening (overweight of high-rated assets). However, tracking error is not the only metric investors need to consider; factor exposures, country and industry biases, turnover for friction costs, and so on are all important considerations too.

Sustainability principles are also different for all investors and do not necessarily equate to simple tilting on the basis of scores from the providers which, as a starting point, are lowly correlated. The choice of the index provider is how much tracking error (performance discrepancy between ESG and traditional index) to allow when producing a benchmark.

Investors in ESG benchmarks clearly need to study the details before buying.

About the authors

-

Michele Gambera

Co-Head of Strategic Asset Allocation Modeling

Michele Gambera is Co-Head of Strategic Asset Allocation Modeling at UBS Asset Management. Joined UBS AM in 2010 from Ibbotson Associates as Senior Research Consultant and Chief Economist. Formerly Senior Quantitative Analyst and Chief Economist for Morningstar Associates ULC. Previous experience at Federal Reserve Bank of Chicago. Strong academic background, including teaching Master of quantitative finance at the University of Illinois. Frequently quoted by press outlets. Member of the Chicago Quantitative Alliance and CFA Society of Chicago.

-

Ryan Primmer

Head of Investment Solutions

Ryan oversees UBS Investment Solutions, including Asset Allocation, Portfolio Management, Implementation, Analytics, and Modelling teams. Ryan rejoined UBS in June 2018 from KCG Holdings, holding roles like Head of Quantitative and Systematic Trading, and Head of Global Quantitative Strategies. At UBS (1991-2013), he held leadership roles including Global Head of Equities Trading, Global Head of Equities Proprietary Trading, and Head of SNB StabFund Investment Management managing distressed mortgage assets.

-

Alexander Eisele

Quant Analyst - Investment Solutions

Alexander Eisele is a finance professional with diverse expertise. He holds an economics degree from the University of Augsburg and a Master’s degree from Ludwig-Maximilians-Universitat Munchen. He developed analytical skills using Bloomberg and Datastream at Unicredi before earning a PH.D. in Finance from USI Universita Della Svizzera italiana. At Swiss Finance Institute he spent 5 years as a researcher, focusing on asset pricing and alternative investment strategies. Now at UBS-AM, Alexander specializes in analytics and quantitative modeling.

PDF

The Sustainable Investing Edition

The Sustainable Investing Edition

The special edition of Panorama is dedicated to sustainable investing and places a marker in the ground for where we should all head next.

Was this article helpful?

Please enable javascript in your browser and retry.

The feedback component cannot be displayed.

Make an inquiry

Fill in an inquiry form and leave your details – we’ll be back in touch.

Introducing our leadership team

Meet the members of the team responsible for UBS Asset Management’s strategic direction.