Every convenience can make a difference in your life. When you consolidate your finances with UBS, you'll gain a more holistic view of your financial picture.

Setting up direct deposit is a great way to gain greater insight and get personalized advice on cash-flow management. Here's what you need to know to get started.

Frequently asked questions about direct deposit

Frequently asked questions about direct deposit

Direct deposit is a secure service that automatically deposits recurring income including income received from your employer, Social Security benefits, pension and retirement plans, military pay, and annuity payments.

Flexibility. Use direct deposit for more than payroll checks. You can receive expense reimbursements from your employer, build retirement savings, receive income tax returns, and other benefit payments.

Quicker access to funds vs. depositing a physical check.

A safer, worry-free alternative to protect against lost, delayed or stolen checks.

Easy-to-track history via UBS Online Services and the mobile app.

Direct deposit may take two pay cycles, but this may vary. Please check with your employer/government agency for specific timing. You can confirm the deposit each pay cycle by logging in to ubs.com, or the UBS Financial Services app, or by reviewing your UBS account statement.

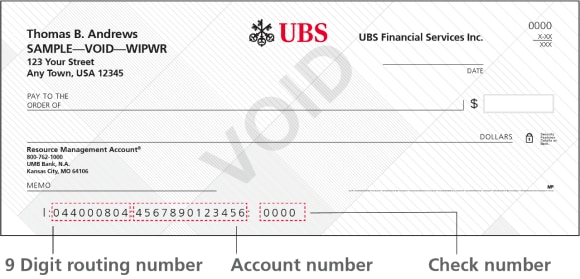

To sign up for direct deposit, you must have a UBS Resource Management Account (RMA) or Business Services Account BSA enrolled in checking services. Your checking account is a 10-digit number that begins with 8 and appears after the bank Routing Number: 044000804.

For government payments

To arrange to have your Social Security benefits, military pay or other government payments directly deposited into your UBS account, visit fiscal.treasury.gov/GoDirect or call the U.S.Treasury Electronic Payment Solution Center at (877) 874-6347.

For payroll checks

Please visit your employer’s HR web portal or you may contact your employer directly. You may be asked to deliver a direct deposit form with a voided check.

You can access your checking services routing and account number on your UBS checks or on OLS under Banking Services > Direct Deposit or reach out to your Financial Advisor or call the UBS Client Service Experience Center(CSEC) at 800-762-1000.

To order new checks, you can call your FA or CSEC or on OLS under Banking Services > View Checking Services

How to qualify1

Receive a total of $5,000 in direct deposits per month†

Other ways to qualify†,*

- Use bill pay or electronic funds transfer inflows

- ACH credits and debits

- Send or receive money with Zelle®,2

- Use mobile or branch check deposits

- UBS Visa debit card purchases

- ATM and CashConnect3 withdrawals

- Check writing (branch-issued checks do not qualify)

†All qualifying transactions must occur per month for three consecutive months within your non-advisory brokerage accounts (retirement account and advisory accounts excluded).

*Five transactions per month required

1 For details on up to $500 in annual account service fee waivers within a Marketing Relationship, please visit the "Fees and Charges" section of the Agreements & Disclosures addendum booklet available on ubs.com/disclosuredocuments.

2 To send or receive money with Zelle, both parties must have an eligible checking or savings account. UBS Financial Services Inc. maintains an arrangement with an unaffiliated bank to provide its clients with access to checking account services through their UBS Resource Management Account.

Zelle® and the Zelle® related marks are wholly owned by Early Warning Services, LLC and are used herein under license.

3 There must be sufficient funds to repay the cash advance that night or you will incur applicable cash advance fees and interest charges. The automatic transfers used to pay off your CashConnect cash advances will reduce the available funds in your UBS Resource Management Account (RMA) or Business Services Account BSA that is linked to your UBS credit card and as a result could affect other transactions dependent on cash, such as fee payments, investment purchases, online bill pay, debit card usage and outstanding checks. Please make sure that you have sufficient available funds (up to your Withdrawal Limit) in your UBS Financial Services Inc. account linked to your UBS credit card to cover these items, as well as the CashConnect cash advance. The CashConnect feature is available only for cardholders who have the UBS credit card connected to a RMA or Business Services Account BSA.

About UBS Financial Services Inc.

The Resource Management Account (RMA), Business Services Account BSA and International Resource Management Account (IRMA) are brokerage accounts with UBS Financial Services Inc., a registered broker-dealer and a Member of the Securities Investor Protection Corporation (SIPC), which protects securities customers of its members up to $500,000 (including $250,000 for claims for cash). An explanatory brochure is available upon request or at sipc.org. The RMA, Business Services Account BSA and IRMA provide access to cash management products and services through arrangements with affiliated banks and other third-party banks, and provide access to insurance and annuity products issued by unaffiliated third-party insurance companies through insurance agency subsidiaries of UBS Financial Services Inc. UBS Financial Services Inc. is not a bank.

Investment, insurance and annuity products: Not FDIC insured • Not a deposit • No bank guarantee • May lose value

UBS Financial Services Inc. is a subsidiary of UBS Group AG. Member FINRA. Member SIPC.

This information is not provided based on your particular financial situations or needs and does not take into account individual investors' circumstances. You should not consider this information to be a "recommendation" by UBS or your UBS Financial Advisor.

About UBS Bank USA

UBS Visa credit and debit cards are issued by UBS Bank USA with permission from Visa U.S.A. Inc.

UBS Bank USA is a subsidiary of UBS Group AG. UBS Bank USA, Member FDIC, NMLS no. 947868.

Important information about brokerage and advisory services.

As a firm providing wealth management services to clients, UBS Financial Services Inc. offers investment advisory services in its capacity as an SEC-registered investment adviser and brokerage services in its capacity as an SEC-registered broker-dealer. Investment advisory services and brokerage services are separate and distinct, differ in material ways and are governed by different laws and separate arrangements. It is important that you understand the ways in which we conduct business, and that you carefully read the agreements and disclosures that we provide to you about the products or services we offer. For more information, please review the client relationship summary provided at ubs.com/relationshipsummary, or ask your UBS Financial Advisor for a copy.

© UBS 2025. All rights reserved. The key symbol, UBS, Resource Management Account, RMA, Business Services Account BSA, International Resource Management Account and IRMA are among the registered and unregistered trademarks of UBS. VISA is a trademark and registered trademark of Visa International Service Association and used under license.