Webinar

Webinar: Climate Aware Active Investing

Active climate aware investing can provide many opportunities in a growing universe of sustainable investments

UBS has a long history in sustainable investing, notably on the environmental front. We have been a part of the UN Global Compact since 2000 and one of the first signatories to the UN Environment Programme. We proudly take a leading position on climate aware thought leadership and engagement. We also heavily collaborate with Climate Action 100+ and within this group have taken the lead on 8 company engagements.

Barry Gill, Head of Investments, UBS Asset Management, joined with experts Bruno Bertocci, Head of Global Sustainable Equities at UBS-AM and Martine Wehlen-Bodé, Head of EUR Corporate Strategy, UBS-AM in a webinar focused on active climate aware investing.

Key webinar takeaways

Key webinar takeaways

- Climate action is everyone’s responsibility, UBS-AM seeks to makes a difference through private sector investment

- The climate aware investable universe is expanding, presenting a large opportunity set for investors and borrowers

- UBS-AM believes that active engagement is vital to unlock potential returns and partner with companies to support the transition to a lower carbon economy

- There are many opportunities for active engagement through proxy voting within equities and refinancing of bonds and new issues within fixed income

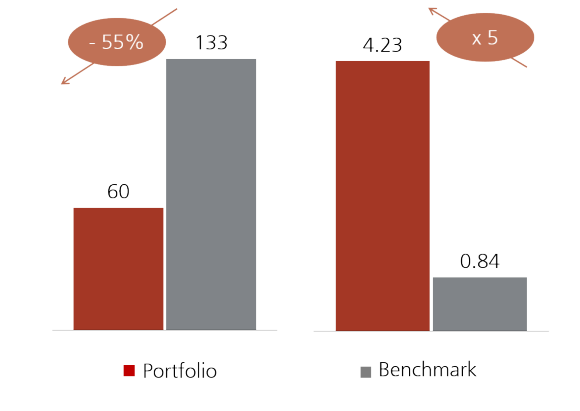

- UBS-AM provides climate aware equities, fixed income, active and passive strategies that strive to enable clients to reduce climate exposure and risk of their portfolios while aiming for a positive portfolio return

Q&A:

Q&A: