Artificial intelligence is reshaping the investment landscape, but the most meaningful applications in multi-asset investing are not the ones making headlines.

While generative AI has captured public attention for its ability to create content and mimic human language, the true value for institutional investors lies in non-generative techniques such as natural language processing, machine learning and advanced optimization algorithms. These methods are already embedded in critical stages of the investment process, delivering tangible benefits in terms of efficiency, precision and insight. UBS-AM applies AI across the multi-asset investment process, and we believe non-generative approaches matter most, and that robust governance ensures transparency and trust.

AI across the multi-asset investment process

AI across the multi-asset investment process

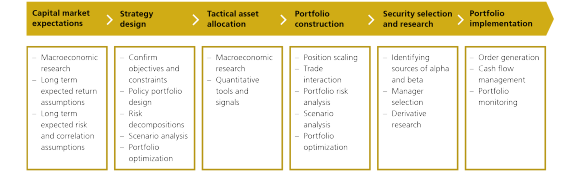

The multi-asset investment process can be divided into six key steps: capital market expectations, strategy design, tactical asset allocation, portfolio construction, security selection, research and portfolio implementation.

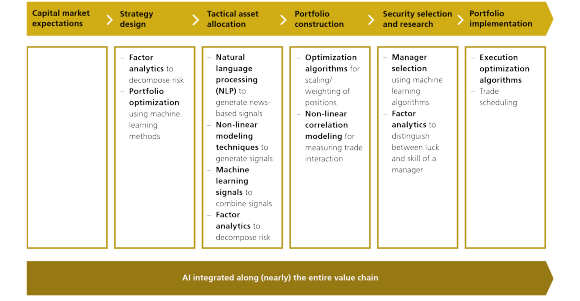

UBS has integrated AI into five of these steps, focusing on techniques that are expected to enhance decision-making while maintaining interpretability and compliance.

The multi-asset investment process

The first step, setting capital market expectations, remains largely untouched by AI. This stage involves forming long-term assumptions about risk and return, which depend on structural economic views and scenario planning. Data scarcity and the need for human judgment make this area less suitable for automation. However, from strategy design onward, AI plays a significant role.

In strategy design, AI helps confirm client objectives, design policy portfolios and analyze risk. Factor analytics allow for granular risk decomposition, while machine learning optimization techniques enable portfolio construction under complex constraints. These tools improve precision and ensure portfolios align closely with client mandates.

Tactical asset allocation is another area where AI adds considerable value. Short-term market dynamics require rapid interpretation of macroeconomic, fundamental and behavioral indicators. UBS employs natural language processing to extract sentiment from news and macro commentary, non-linear modeling to estimate recession probabilities and machine learning ensembles to combine diverse inputs into actionable insights. This approach enhances responsiveness and reduces noise in signal interpretation.

Portfolio construction benefits from optimization algorithms that determine position sizing and weighting. Non-linear correlation modeling captures complex trade interactions, while linkage algorithms such as dendrogram clustering improve diversification by identifying hidden relationships between positions. These techniques create portfolios that may be more resilient to shocks.

Security selection and research leverage machine learning for efficient manager screening and factor analytics to distinguish skill from luck. This improves due diligence and strengthens confidence in active management decisions.

Finally, portfolio implementation uses execution optimization algorithms and automated trade scheduling to minimize market impact and reduce transaction costs, in order to seek operational efficiency.

Where we integrate AI into the investment process

Why non-generative AI matters

Why non-generative AI matters

Generative AI excels at creating text and images, but multi-asset investing demands predictive accuracy, interpretability, and robustness–qualities that non-generative techniques deliver. Machine learning models can process vast datasets, uncover non-linear relationships, and optimize portfolios under strict constraints, all while maintaining transparency for regulatory and fiduciary requirements. Unlike generative models, these techniques are designed for precision and accountability, making them indispensable for institutional investors.

Governance and explainability at UBS

Governance and explainability at UBS

AI adoption in finance must be accompanied by strong governance. UBS applies rigorous standards seek to ensure that all models are transparent, well-understood and reliable. Every model undergoes independent validation before deployment, with stress testing and bias checks to confirm robustness. Documentation of model design and assumptions is mandatory, and comprehensive audit trails provide traceability for regulators and clients. Continuous monitoring helps models remain accurate and aligned with evolving market conditions. This governance framework reflects UBS’s commitment to accountability and client trust.

Client impact and future outlook

Client impact and future outlook

Integrating AI into the multi-asset investment process has yielded tangible benefits. Enhanced factor and risk analytics allow for deeper understanding of portfolio exposures, while automation in execution and optimization streamlines workflows and reduces operational complexity. Data-driven signals complement human judgment, improving tactical agility and decision-making.

At the same time, the use of AI and quantitative models involves important risks and limitations. Model outputs are dependent on the quality, completeness, and timeliness of underlying data and assumptions, and may be subject to error, bias, or overfitting. AI-driven signals may not perform as expected across different market environments, particularly during periods of structural change. Automated processes may require human oversight and intervention, and the use of quantitative tools does not eliminate the risk of loss or guarantee investment outcomes.

Looking ahead, UBS aims to create a seamless AI ecosystem that links macro insights, tactical signals and execution strategies into a unified, adaptive system. This vision looks to help clients benefit from cutting-edge innovation without compromising governance or transparency. However, there can be no assurance that these capabilities will be fully realized or that they will deliver improved investment results. The effectiveness of such systems will depend on ongoing model governance, validation, and risk controls, as well as regulatory, technological and market developments.

Partnership Solutions integrates UBS's expertise in AI and quantitative analytics as a part of its Outsourced Chief Investment Officer (OCIO) advisory services. These tools are intended to support, not replace, investment judgement, and should be considered alongside other qualitative and quantitative inputs. Clients remain exposed to market, liquidity, and strategy risks inherent in multi-asset investing.

Conclusion

Conclusion

AI is already embedded in most stages of the multi-asset investment process, and its role will continue to expand as techniques mature, and data sources evolve. By prioritizing non-generative methods, such as natural language processing, machine learning and optimization algorithms, UBS applies AI in ways that are transparent, auditable and aligned with regulatory expectations. These capabilities aim to enhance precision, efficiency and risk awareness without displacing the human expertise that remains central to investment decision-making.

As the AI ecosystem becomes more integrated, UBS seeks to translate these advancements into disciplined, data-driven insights for clients. The focus remains on applying innovation responsibly and ensuring that technology serves as a durable enabler of better investment outcomes.

Related content

Related content

Partnership Solutions

Our mission is to create lasting value for our clients and stakeholders by offering seamless access to UBS’s full range of capabilities and services.

Disclaimer

Disclaimer