In an increasingly interconnected financial world, investors routinely allocate capital across borders, seeking diversification and growth opportunities. However, investing internationally and holding assets denominated in currencies other than the home currency exposes portfolios to currency risk.

Fluctuations in exchange rates can either erode, or amplify returns; currency hedging has become an essential tool for mitigating this risk. By using financial instruments to lock in exchange rates, currency hedging can minimize the impact of adverse currency movements and better align portfolio performance to the underlying exposure.

Currency-hedged ETF market overview

Currency-hedged ETF market overview

Demand for currency-hedged ETFs underscores their importance in today’s volatile market environment. Assets under management (AuM) in hedged share classes in the European ETF market has grown from USD 56.8 billion in 2017 to USD 283.8 billion in 2025 (Figure 1). The largest share of flows, 42.2%, has gone into Euro-hedged share classes (EUR), followed by 23.2% in British Pound (GBP), 12.9% in US dollar (USD), and 12.2% in Mexican peso (Figure 2).

Figure 1: AuM in hedged share classes in the European ETF market (USD bn)

Figure 2: % of net flows in hedged share classes in the European ETF market by currency

Investors are choosing to protect their portfolios from currency risk, particularly in asset classes where stability and predictability matter most. Hedged share classes are especially popular within fixed income and commodities, making up 28% of net flows in the former and 21% in the latter. In absolute terms, government bonds, aggregate bonds and core equity attracted the highest net flows.1

Why does currency hedging matter?

Why does currency hedging matter?

Mitigating currency risk

Foreign exchange rates are shaped by a range of factors, including monetary policy, economic conditions and geopolitical events. Figure 3 illustrates how the US dollar spot price and other major currencies can move rapidly and unpredictably, highlighting the importance of managing currency risk in international portfolios.

Figure 3: USD spot price and FX rates over last 20 years

Example 1: Weakening USD

Between November 2022 and November 2025, the US dollar has depreciated against the Euro, British Pound and Swiss Franc. As illustrated in Figure 4, for European investors with unhedged US equity investments, this currency depreciation significantly reduced the returns when converted back to their home currencies. Investing into a currency-hedged version of the exposure during this period would have largely protected investor returns from an adverse downward movement.

Figure 4: MSCI USA Total return, % (November 2022 - November 2025)

Example 2: Strengthening USD

It is important to note that currency hedging can also limit the upside potential in certain market environments. During the period from June 2014 to December 2014, the US dollar experienced significant appreciation.

As illustrated in Figure 5, this strengthening of the USD resulted in enhanced returns on US equities for European investors when converted into their local currencies. Holding a currency-hedged exposure in this scenario kept the portfolio returns aligned with the underlying portfolio, but it also meant investors would have missed out on additional gains from favorable currency movements.

Figure 5: MSCI USA Total return, % (June - December 2014)

Alignment to the underlying portfolio

Currency hedging helps ensure investment returns mirror those of the base portfolio. As illustrated in Figure 6, unhedged indices are exposed to currency swings, which can cause a higher tracking error relative to the base currency.

In contrast, hedged indices actively mitigate the currency risk, resulting in returns that are more consistent with the base portfolio. They exhibit a lower tracking error relative to the base exposure, which mainly reflects the cost of maintaining the hedge.

Figure 6: 12-month rolling Tracking error vs MSCI USA, in %

Reducing volatility in fixed income

Currency hedging can also play an important role in reducing volatility for fixed income investments.2

As shown in Figure 7, the 12-month rolling volatility of unhedged exposures in foreign currencies is typically higher than that of hedged exposures, which tend to align more closely with the base currency. This occurs because the currency component introduces additional volatility to an asset class that is otherwise considered more stable. By removing the currency effect, hedging helps restore volatility to levels consistent with the underlying exposure.

Figure 7: 12-month rolling volatility, in %

Summary box:

The outcome of currency hedging is highly dependent on the specific currency pair, the asset class, the investment time frame and, ultimately, the investor’s outlook on future currency movements. Investors should carefully consider whether they seek to keep the returns aligned with the underlying asset exposure, or if they are ready to run the risk of potential losses or capture potential gains from currency fluctuations.

How does currency hedging work?

How does currency hedging work?

Currency hedging in investment portfolios typically uses FX forward contracts – agreements to exchange a set amount of one currency for another at a predetermined rate on a future date. The contracts are rebalanced at regular intervals, ensuring that the value of the hedge remains aligned with the underlying investment exposure.

The performance of a hedged investment is influenced by hedging costs, primarily inte

rest rate differentials as well as trading costs, hedge ratio, investment ratio and any lag in reinvesting proceeds. Currency-hedged ETFs automate the hedging process for investors, offering a transparent and cost-effective solution.

The key driver of the hedging cost or benefit is interest rate differentials (“cost of carry”), i.e., the difference between the interest rates of the two currencies involved in the hedge. The higher the interest rate differential between two currencies, the greater the cost (or benefit) of hedging to the investor. Hedging from a lower-yielding to a higher-yielding currency (currently, JPY to USD) results in positive carry and boosts returns, while hedging from a higher-yielding to a lower-yielding currency (currently, GBP to CHF) leads to negative carry, reducing performance.

Other factors include transaction costs for the foreign exchange (FX) forward where market spreads are incurred on both the near and far leg of the FX forward contract. As a rule of thumb: the more illiquid the currency pair, the higher the cost of hedging. While the target hedge ratio is 100% and regularly rebalanced, it may fluctuate between adjustments due to movements in the underlying exposure, resulting in periods of over- or underhedging and their associated costs or benefits.

Similarly, the investment ratio, which measures the value of the underlying exposure relative to total assets, including any FX profit & loss (P&L), is aimed at 100% and regularly readjusted. Movements in FX P&L can cause temporary under- or over-investment with the corresponding positive or negative impact.

What is UBS’ approach to currency-hedged ETFs?

What is UBS’ approach to currency-hedged ETFs?

UBS applies the currency hedging methodology specified by the index providers. This approach provides transparency for investors and allows for a clear performance attribution. Foreign currency exposures in tracked indices are hedged into the chosen reference currency using 1-month forward contracts. At the end of each month, the hedged amount is set based on the market capitalization of the underlying exposure, valued one day before the last trading day. This amount remains constant throughout the month. Hedging at a monthly frequency strikes a balance between transaction costs and tracking error; more frequent adjustments increase turnover and trading costs, which typically outweigh any reduction in tracking error.

Currency hedging at UBS is almost exclusively implemented through the share class framework. In this model, there is a subdivision of ownership within a single sub-fund, where all classes invest in the identical underlying portfolio of assets. The performance of a share class is tied to the main sub-fund’s returns, adjusted only for class-specific features such as fees or hedging costs.

In contrast, the sub-fund model treats each local currency or hedged currency share class as a separate sub-fund, effectively creating multiple portfolios that all invest in the same underlying exposure in isolation.

Figure 8: Currency-hedged share class frameworks

Features of the multi-share class framework

- One common portfolio, rebalancing only once for all

- Netting opportunities on P&L investment activities

- Replication process with larger asset portfolio results in smaller cash drag and tracking error risk

- Conversion between different share classes is cost efficient

The share class model offers some key advantages for investors compared to the sub-fund model (Figure 8).

All share classes invest in one underlying portfolio, making rebalancing more efficient than in the sub-fund structure, which requires adjustments of multiple identical portfolios. It also allows investors to switch between unhedged and hedged share classes or different currency hedges at minimal cost, with netting of flows and P&L within the sub-fund, thereby reducing trading expenses. Because the replication process involves a larger portfolio than the sub-fund model, it results in lower cash drag and reduced tracking error risk. Similar to the sub-fund model, the share class structure isolates hedging within each class, preventing performance in one class from affecting another. Hedging costs are assigned directly to the relevant hedged share class, ensuring accurate cost allocation.

Why UBS currency-hedged ETFs?

Why UBS currency-hedged ETFs?

UBS has over a decade of experience in currency-hedged ETFs, having launched its first sub-fund in 2013, with the share class model following in 2014. The offering now includes 70 funds, 185 share classes, and 344 listings, and with USD 38.3 billion in assets under management, UBS is the second-largest provider of currency-hedged ETFs in the European ETF market.3 The currency-hedged shelf spans across asset classes and a variety of currencies, including USD, EUR, CHF, GBP, AUD and JPY.

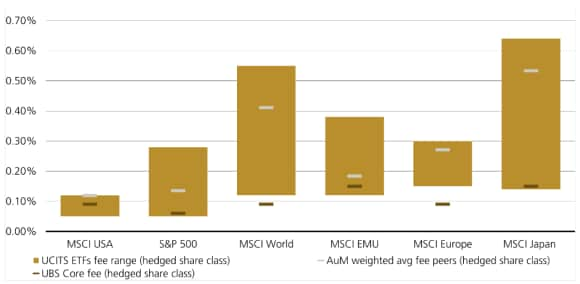

UBS aims to deliver competitive pricing through tight bid-ask spreads and low total expense ratios (TER) in equity (Figure 9) as well as fixed income (Figure 10) currency-hedged ETFs.

Figure 9: Hedged share class fee – UBS Core equity vs market

Figure 10: Hedged share class fee – UBS Core fixed income vs market

The share class structure enhances cost efficiency by allowing seamless switches between unhedged and hedged share classes or different currency hedges at minimal cost. Transparency is a core feature, with clear disclosure of holdings, hedging strategies and costs to support informed decision-making.

Case study 1: International equity investment

Case study 1: International equity investment

In this case study, we will consider a UK-based investor, investing in US equity exposure via the MSCI USA Index.

Figure 11: 12-month performance of MSCI USA and GBP/USD4 exchange rate

Figure 12: 12-month index total return

Over the past 12 months, the unhedged MSCI USA Index (light grey bar) in Figure 12 delivered a total return of 14.31% in USD terms. Due to the depreciation of the US dollar against the British Pound (bronze dashed line in Figure 11), GBP-based investors in the unhedged index (dark grey bar) only had a return of 9.66%. Had a GBP-based investor selected the GBP-hedged version of the MSCI USA index (red bar), they would have achieved a total return of 14.43%.

The 0.12% performance difference between the MSCI USA Index in USD and the MSCI USA hedged to GBP Index was due to positive interest rate carry. Over this time frame, the GBP interest rate was slightly higher than that of the USD and hedging USD to GBP generated roughly +0.12% in performance. In other words, you earned by hedging a lower yield currency into a higher yield currency.

Summary box:

In this example, an investor choosing the currency-hedged version of the index would have experienced a positive impact on performance compared to the underlying unhedged index. It is important to understand that the opposite can also be true when hedging a higher yielding currency into a lower yielding currency, which could have a negative impact on performance.

Case study 2: International fixed income investment

Case study 2: International fixed income investment

Let us examine an example relevant to Euro-based investors with an exposure to US corporate bonds. Over the past 12 months, the unhedged Bloomberg US Liquid Corporate Bond Index delivered a return of 6.23% in USD terms (light grey bar) in Figure 14.

However, due to the depreciation of the US dollar against the euro during this period (bronze dashed line in Figure 13), EUR-based investors who remained unhedged would have experienced a negative return of -3.32% (dark grey bar) when converting their investment back into euros. This illustrates how currency risk can significantly erode the performance of an asset class that is typically considered more stable than others.

Figure 13: 12-month performance of BBG US Liquid Corporate and EUR/USD5 exchange rate

Figure 14: 12-month index total return

By implementing a currency hedge, investors can shield their returns from adverse exchange rate movements. In this scenario, the hedged exposure would have resulted in a positive return of 4% (red bar) for EUR-based investors, effectively offsetting most of the negative impact of USD depreciation. The difference between the unhedged and hedged returns is primarily attributable to the cost of carry, which arises from the difference in interest rates between the two currencies. Because Euro interest rates are currently lower than those in the US, hedging USD exposure back to EUR results in an additional cost.

Summary box:

Hedging can be especially important for investors seeking to preserve the stability typically associated with bonds, as adverse currency movements may otherwise erode returns. However, the decision to hedge should always take into account the specific currency pair involved, the investor’s belief about the future currency movements and the current interest rate environment.

Key points & practical considerations

Key points & practical considerations

Currency risk is an inherent aspect of global investing. As demonstrated throughout this article, currency hedging is not merely a technical detail but a strategic tool that can influence portfolio outcomes. It helps investors keep portfolio performance aligned with the underlying asset exposure, offering protection during adverse currency shifts, but also potentially limiting gains when currency trends are favorable.

The importance of hedging is particularly pronounced in fixed income, where the asset class's inherently lower volatility makes the preservation of returns even more vital. The cost of hedging, driven primarily by interest rate differentials between currencies, is one of the key factors of the overall outcome.

Currency-hedged ETFs provide a transparent and efficient solution for managing currency risk. The share class structure enhances operational efficiency and cost effectiveness, allowing investors to switch between hedged and unhedged exposures with minimal friction. Real-world examples across both equity and fixed income asset classes underscore the importance of considering currency effects – not only to mitigate downside risk, but also to understand the potential opportunity costs in different market environments.

Ultimately, the choice to hedge is up to the investor who must consider the specific currency pair, asset class, investment horizon and their own expectations for currency movements. There is no universal answer; hedging should be integrated into a holistic portfolio strategy. By applying robust hedging approaches, investors can better manage volatility and pursue their long-term investment goals.

References:

- Sialm, C., & Zhu, Q. (2024). Currency Management by International Fixed‐Income Mutual Funds. The Journal of Finance, 79(6), 4037-4081.

Risks summary

Currency hedging can help reduce FX volatility, but it also introduces its own set of risks. Hedges are rarely perfect, so “basis risk” may arise if the hedge and underlying exposure don’t move in lockstep, and changes in interest rate differentials (“cost of carry”) can turn a historically cheap hedge into an expensive one.

Hedging also involves transaction and roll costs, operational and counterparty risk (for derivatives-based strategies), and can lead to opportunity cost if the investor’s home currency subsequently weakens and unhedged returns would have been higher. As a result, currency hedging should be seen as a portfolio management decision with trade-offs, not a free source of risk reduction.

Marketing Communication