Le nostre competenze

Affidati a uno dei gestori di ETF di maggior successo al mondo, con le competenze per offrirti un'ampia gamma di soluzioni adatte alle tue esigenze e un’esperienza maturata in oltre trent’anni di eccellenza.

Vuoi saperne di più?

Vuoi saperne di più?

Iscriviti per ricevere direttamente nella tua casella di posta elettronica gli ultimi approfondimenti sui mercati privati in tutti i settori.

Cosa ci distingue

Scelta

Con un'unica transazione, gli investitori possono accedere a numerosi mercati grazie alla nostra ampia selezione di ETF su azioni, obbligazioni, materie prime, metalli preziosi e asset immobiliari.

Competenza

Il vantaggio di avvalersi di uno dei più esperti fornitori di ETF europei. Offriamo strategie di replica di indici di elevata qualità, supportate da un team di gestione del portafoglio esperto e competente.

Riconoscimenti

Il riconoscimento come Gestore passivo dell'anno 2021 agli Insurance Asset Risk EMEA Awards è il più recente di una serie di riconoscimenti ottenuti negli ultimi anni per i nostri prodotti e servizi legati agli ETF.

Prodotti e servizi legati agli ETF

Azionario

Accedi ai principali mercati azionari con un'unica transazione grazie alla nostra ampia gamma di ETF azionari UBS.

Obbligazionario

Investi in segmenti liquidi e ben diversificati del mercato obbligazionario: corporate, titoli sovrani o debito dei mercati emergenti.

Copertura valutaria

Sfrutta la nostra ampia gamma di UBS ETF con copertura valutaria per proteggere il tuo portafoglio dalle oscillazioni dei tassi di cambio.

Materie prime

Diversifica il portafoglio con i nostri ETF convenienti e liquidi sulle materie prime.

Beta alternativo

Scegli gli indici fattoriali sistematici per replicare i mercati in modo più sofisticato rispetto alla sola capitalizzazione di mercato, con vantaggi in termini di diversificazione.

Soluzioni per il clima

Riduci l’esposizione alle emissioni di carbonio e orienta il tuo portafoglio verso un futuro a zero emissioni con le nostre proposte di ETF MSCI Climate Paris-Aligned e Climate Aware, soluzioni convenienti e basate su regole.

Investimenti sostenibili

Il nostro viaggio di sostenibilità è iniziato nel 2011 con il lancio dei nostri primi quattro ETF SRI. Come pionieri del settore, offriamo un'ampia gamma di soluzioni per aiutarti a realizzare i tuoi obiettivi ESG.

UBS ETF Capital Markets Weekly

UBS ETF Capital Markets Weekly

Leggi il commento settimanale sui mercati dei capitali di UBS ETF. Una panoramica sulle attività del mercato primario rilevanti per i nostri ETF e sulle principali operazioni del mercato secondario, con un'analisi del mercato e uno sguardo alla settimana successiva. Buona lettura, e condividi i tuoi commenti!

La negoziazione di ETF

UBS ETF Capital Markets

Il team ETF Capital Markets assiste i clienti nel loro percorso di comprensione della negoziazione degli ETF, insistendo sull’importanza della concorrenza per ottenere la migliore esecuzione. Un’esecuzione non ottimale può rivelarsi costosa e annullare i vantaggi del wrapper di ETF in termini di trasparenza, liquidità e certezza dell'esecuzione.

Il team ETF di UBS, sempre all’avanguardia, è proattivo nel proporre nuove soluzioni passive che si adattino all'ampia varietà di preferenze degli investitori moderni.

Clemens Reuter, Global Head of ETF & Index Fund Client Coverage

UBS ETF Tax Reporting

UBS ETF Tax Reporting

Gli utili realizzati da investitori privati residenti in Italia e derivanti da Fondi di investimento italiani e da alcuni fondi di investimento esteri sono generalmente soggetti a tassazione. Scopri i calcoli di tassazione relativi ai fondi UBS-ETF.

FAQ sugli ETF

Domande frequenti

Un Exchange-Traded Fund (ETF) è un fondo d'investimento che replica la performance del suo indice sottostante e può essere acquistato e venduto in borsa. Al pari di un fondo tradizionale, un ETF è un fondo comune d'investimento, pertanto non è esposto all’eventuale insolvenza del fornitore di ETF. Un ETF consente di beneficiare dei vantaggi di un fondo d'investimento collettivo, ma viene negoziato come un'azione.

Il trading di ETF può essere effettuato in borsa o fuori borsa in qualsiasi momento della giornata. Essendo collegati a un indice sottostante, gli ETF sono strumenti d'investimento passivi che si limitano a replicare la performance dell’asset sottostante. In altre parole, quando l'indice sottostante aumenta di valore, aumenta anche il valore dell'ETF.

I primi ETF sono stati quotati negli Stati Uniti nel 1993 e in Europa dal 1999, e da allora il numero di ETF disponibili ha continuato ad aumentare. Tradizionalmente gli ETF sono fondi indicizzati passivi, ma dalla loro autorizzazione nel 2008 sono entrati in gioco anche gli ETF a gestione attiva, che richiedono una strategia di gestione del portafoglio.

L’investimento in questione riguarda l’acquisizione di quote o azioni in un fondo e non in una determinata attività sottostante quali edifici o azioni di una società, poiché queste sono solo le attività sottostanti di proprietà del fondo.

Gli UBS ETF sono disponibili su un'ampia gamma di asset class sottostanti quali azioni, obbligazioni, materie prime, metalli preziosi e immobili, e consentono agli investitori di accedere a numerosi mercati con un’unica transazione. Gli investitori possono inoltre scegliere il metodo di replica che preferiscono, in quanto UBS offre un'ampia gamma di ETF a replica fisica e sintetica.

Diversificazione

Gli ETF offrono l'opportunità di diversificare il portafoglio in modo economico e con grande efficienza, distribuendo il rischio su più asset class e ottimizzando quindi il profilo di rischio dell’investimento. Poiché gli ETF replicano un indice, con un’unica transazione è possibile coprire un intero mercato.

Flessibilità

Gli ETF possono essere acquistati e venduti con facilità, anche su base intraday, e consentono agli investitori di tradurre in pratica, in pochi secondi, un’opinione relativa al mercato. Grazie a queste caratteristiche, gli ETF trovano molteplici impieghi nell’ambito di una strategia d'investimento: per conseguire una crescita a lungo termine, per cogliere opportunità di trading a breve termine e come copertura parziale di un portafoglio.

Trasparenza

Gli ETF sono strumenti d'investimento particolarmente trasparenti, perché replicano la performance dell'indice sottostante al netto delle commissioni. Tutte le informazioni importanti sulla negoziazione e su altri aspetti possono essere consultate su base intraday o in tempo reale. Durante il normale orario di negoziazione, il valore patrimoniale netto indicativo degli UBS ETF viene calcolato ogni 15 secondi.

Efficienza dei costi

Gli ETF non applicano commissioni di emissione o di rimborso, bensì solo costi di transazione per l'acquisto e la vendita di un ETF. A tali costi si aggiunge solo una commissione di gestione minima.

Sicurezza

Al pari dei fondi tradizionali, gli ETF sono fondi comuni d'investimento e non sono quindi esposti all’eventuale insolvenza del fornitore di ETF o della banca depositaria, poiché il patrimonio del fondo non rientra nella massa fallimentare.

L'obiettivo di un ETF è replicare il più fedelmente possibile l'indice su cui si basa, per fornire agli investitori nell'ETF una performance pari a quella del mercato sottostante.

Gli indici si basano tuttavia su calcoli teorici, il che significa che i costi sostenuti nella pratica, ad esempio per l'acquisto o la vendita dei titoli rappresentati nell'indice, non si riflettono nel calcolo dell’indice, ma vengono addebitati ogni volta che un indice e la sua performance sono replicati per un investimento.

Il grado di fedeltà di un ETF alla performance dell'indice sottostante è quindi fondamentale. Idealmente, la performance dell'ETF differisce da quella dell'indice solo per i costi e le commissioni sostenuti. Poiché, ad esempio, gli indici che replicano solo il mercato azionario di un singolo Paese applicano criteri diversi per la replica dell'indice rispetto a un indice contenente titoli di più Paesi, i criteri per una replica esatta variano da indice a indice. Per questi motivi, gli UBS ETF utilizzano diversi metodi di replica degli indici.

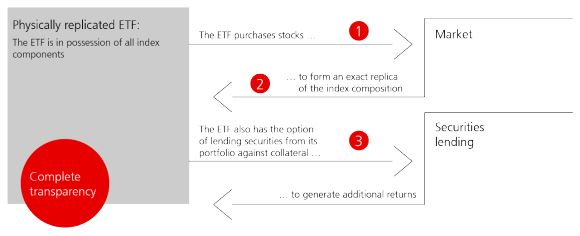

Replica fisica completa

L'ETF investe nei titoli rappresentati nell'indice in base alla loro ponderazione nell’indice stesso.

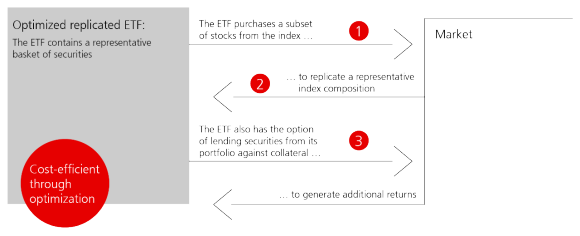

Replica fisica ottimizzata

L'ETF investe solo in quei titoli rappresentati nell'indice che sono necessari per ottenere una performance molto simile a quella dell'indice.

Replica sintetica

L'ETF investe in un portafoglio di titoli e scambia la sua performance con quella dell'indice.

In linea di principio il processo di acquisto è identico per tutti i metodi di replica, tuttavia la consegna fisica dei titoli si applica solo agli ETF a replica fisica.

- L'investitore acquista quote di ETF in borsa, oppure direttamente da un market maker o partner autorizzato (negoziazione OTC)

- Il market maker o partner autorizzato versa mezzi liquidi all’ETF (per gli ETF a replica fisica e sintetica) oppure consegna all'ETF i titoli richiesti (solo per gli ETF a replica fisica)

In caso di replica fisica completa dell'indice, l'ETF acquista tutti i titoli rappresentati nell'indice sottostante in base alla loro ponderazione. Pertanto, l'ETF è materialmente in possesso delle componenti dell'indice e ne rappresenta quindi una replica esatta. Eventuali modifiche dell'indice, quali adeguamenti dell'indice stesso o variazioni nella capitalizzazione dei titoli rappresentati, vengono replicate dall'ETF e richiedono pertanto transazioni periodiche. L'ETF distribuisce regolarmente reddito, ad esempio sotto forma di dividendi o cedole.

Il metodo di replica fisica completa si caratterizza per la semplicità e il tracking error ridotto.

- L'ETF è materialmente in possesso di tutti i titoli rappresentati nell'indice in base alla loro ponderazione nell’indice stesso

- Tutti gli adeguamenti dell'indice e le misure di capitale vengono replicati in modo identico

- Alcuni ETF prestano i titoli in loro possesso a fronte di una commissione

Prestito titoli

Alcuni ETF a replica fisica effettuano operazioni di prestito titoli per generare rendimenti aggiuntivi e ridurre i costi netti per gli investitori, prestando i propri titoli dietro pagamento di una commissione. Le operazioni di prestito titoli degli UBS ETF presentano una sovracollateralizzazione non inferiore al 105%.

Nel caso della replica fisica ottimizzata, l'ETF detiene un campione dei titoli presenti nell'indice sottostante. Con l’ausilio di strumenti analitici e procedure di ottimizzazione matematica si definisce un sottoinsieme dei costituenti dell'indice in grado di ottenere un rendimento simile a quello dei titoli originali rappresentati nell'indice. Il metodo della replica fisica ottimizzata consente di aumentare la liquidità e ridurre al minimo il tracking error.

Il metodo della replica fisica ottimizzata è particolarmente adatto per gli indici molto ampi. L'indice MSCI World comprende ad esempio circa 1.600 titoli di diversi mercati, aree geografiche e zone valutarie, pertanto la replica fisica completa dell'indice comporterebbe elevati costi di transazione. Alcuni di questi titoli non sono molto liquidi o hanno un impatto minimo sulla performance dell'indice a causa della loro bassa ponderazione: escludendo tali titoli è possibile ridurre i costi di transazione.

- L'ETF è materialmente in possesso di un sottoinsieme delle componenti dell’indice. Questo metodo viene utilizzato per indici molto ampi o che comprendono titoli illiquidi

- La procedura di ottimizzazione mira a ridurre i costi di transazione, aumentare la liquidità e ridurre al minimo il tracking error

- Alcuni ETF prestano i titoli in loro possesso a fronte di una commissione

Prestito titoli

Alcuni ETF a replica fisica effettuano operazioni di prestito titoli per generare rendimenti aggiuntivi e ridurre i costi netti per gli investitori, prestando i propri titoli dietro pagamento di una commissione. Le operazioni di prestito titoli degli UBS ETF presentano una sovracollateralizzazione non inferiore al 105%.

Diversi fattori contribuiscono alla determinazione del prezzo degli ETF e incidono sui costi dei singoli ETF. Il costo totale dell’investimento in un ETF dipende in larga misura dalla strategia di portafoglio scelta e dall’asset class in cui investe il fondo. Gli ETF applicano commissioni inferiori rispetto ai tradizionali fondi comuni, tuttavia presentano un'ampia varietà di condizioni di prezzo diverse. Gli spread degli ETF variano anche in relazione all'attività degli ETF.

La “tracking difference” è la differenza tra la performance del fondo e quella dell'indice. La performance del fondo include tutti i costi imputabili al fondo e tutti i flussi di reddito da esso percepiti. Il coefficiente di spesa totale e la “tracking difference” dell'ETF sono pubblicati nella relazione semestrale e annuale del fondo.

Il TER è il rapporto tra i costi complessivi e le dimensioni medie del fondo nell’arco di un anno fiscale. I costi comprendono tutti gli oneri inclusi nel conto economico, comprese le spese di gestione, amministrazione, deposito, revisione e le spese legali e di consulenza (spese operative). Il coefficiente di spesa totale dell'ETF viene espresso retroattivamente come percentuale del patrimonio medio del fondo e calcolato in conformità alle linee guida sul calcolo e la pubblicazione del TER degli organismi d'investimento collettivo.

Nel caso di replica sintetica di un indice, la performance dell'indice sottostante l'ETF è ottenuta tramite uno swap. L'ETF stipula un contratto di swap con una banca d'investimento, la controparte dello swap, il cui oggetto è il trasferimento dei flussi di cassa dell'ETF alla controparte dello swap, che in cambio garantisce all'ETF la performance dell'indice replicato. Il rischio associato alla replica esatta dell'indice viene trasferito dall'ETF alla controparte dello swap. Poiché il possesso materiale dei titoli compresi nell'indice non rappresenta più un prerequisito per partecipare alla performance dell'indice, è possibile replicare in modo efficiente mercati che, ad esempio, sono inaccessibili o difficilmente accessibili a causa di restrizioni alla negoziazione.

UBS si avvale di due diverse strutture di swap per la replica sintetica: lo swap interamente coperto (Fully Funded Swap) e un modello combinato (Total Return Swap e Asset Portfolio con Fully Funded Swap)

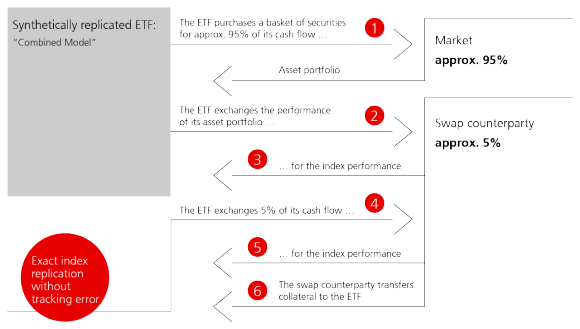

Modello combinato: Asset Portfolio e Total Return Swap più Fully Funded Swap (AP e TRS + FFS)

In questo metodo di replica, le sottoscrizioni dell'ETF sono investite con un rapporto di circa 95:5 in un portafoglio di attività (Asset Portfolio) e in uno swap interamente coperto.

Asset portfolio e Total Return Swap (AP e TRS)

Circa il 95% del patrimonio del fondo viene utilizzato dall'ETF per acquistare un paniere di titoli che costituisce il portafoglio di attività. Il paniere è costituito da un portafoglio diversificato e liquido di azioni dei mercati sviluppati ed è ottimizzato in base a considerazioni di liquidità. L'ETF stipula inoltre un contratto di swap non coperto con la controparte dello swap per scambiare i rendimenti di questo portafoglio con la performance dell'indice replicato. La controparte dello swap genera questa performance investendo in titoli e derivati che replicano la performance dell'indice.

Fully Funded Swap (FFS)

Il restante patrimonio del fondo (circa il 5%) viene utilizzato dall'ETF per stipulare un contratto di swap interamente coperto con la controparte dello swap, in base al quale quest'ultima si impegna a corrispondere la performance dell'indice.

Esposizione verso la controparte dello swap

Per proteggere l'ETF dal rischio di inadempienza della controparte dello swap, la controparte trasferisce all'ETF un collaterale sotto forma di titoli di Stato dei Paesi del G10, obbligazioni sovranazionali e liquidità. L'importo del collaterale trasferito è soggetto a scarti di garanzia (haircut) e le attività del collaterale sono detenute presso una banca depositaria esterna a nome dell'ETF (trasferimento di proprietà). L'ETF ha accesso immediato al collaterale nel caso in cui la controparte dello swap non adempia ai propri obblighi.

- L'ETF acquista un paniere di titoli con circa il 95% della sua liquidità.

- L'ETF garantisce la performance del paniere alla controparte dello swap.

- La controparte dello swap si impegna a fornire in cambio l'esatta performance dell'indice (al netto di una commissione).

- L'ETF stipula uno swap interamente coperto con la controparte dello swap per circa il 5% della sua liquidità.

- La controparte dello swap deve corrispondere l'esatta performance dell'indice (al netto di una commissione).

- La controparte dello swap trasferisce il collaterale all'ETF sotto forma di titoli di Stato di Paesi del G10, obbligazioni sovranazionali e liquidità. L'importo delle garanzie trasferite è soggetto a scarti di garanzia.

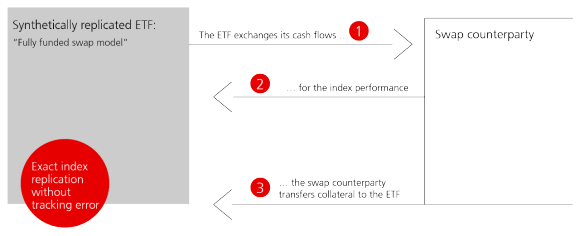

Modello Fully Funded Swap

In questo metodo di replica, l'ETF trasferisce liquidità alla controparte dello swap e riceve in cambio la performance dell'indice tramite un contratto swap. Per proteggere l'ETF dal rischio di inadempienza della controparte dello swap, la controparte trasferisce all'ETF un collaterale sotto forma di titoli di Stato dei Paesi del G10, obbligazioni sovranazionali e liquidità. L'importo del collaterale trasferito è soggetto a scarti di garanzia e le attività del collaterale sono detenute in un conto segregato presso una banca depositaria esterna a nome dell'ETF (trasferimento di proprietà). L'ETF ha accesso immediato al collaterale nel caso in cui la controparte dello swap non adempia ai propri obblighi.

- L'ETF stipula uno swap interamente coperto con la controparte dello swap.

- La controparte dello swap deve corrispondere l'esatta performance dell'indice (al netto di una commissione).

- La controparte dello swap trasferisce il collaterale all'ETF sotto forma di titoli di Stato di Paesi del G10, obbligazioni sovranazionali e liquidità. L'importo delle garanzie trasferite è soggetto a scarti di garanzia.

Per tutti gli UBS ETF sintetici, la controparte esclusiva per tutte le operazioni di swap OTC è UBS Investment Bank. UBS ETF monitora comunque regolarmente il merito di credito della controparte. Il monitoraggio viene effettuato dai membri del Consiglio di amministrazione in occasione delle riunioni trimestrali. Se le circostanze di mercato lo richiedono, la revisione può avvenire anche su base ad hoc. Sebbene UBS Investment Bank sia l'unica controparte dei contratti di swap degli UBS ETF, la determinazione dei prezzi viene verificata almeno annualmente attraverso una serie di banche panel esterne. Se una banca panel offre condizioni più favorevoli, UBS Investment Bank ha la possibilità di stipulare con essa un contratto di back-to-back swap al fine di ottenere prezzi competitivi per gli ETF. Laddove consentito e possibile dal punto di vista operativo, utilizziamo più controparti FX per facilitare la nostra esecuzione FX.

Nel quadro di un’operazione di prestito titoli su ETF, il prestatore (UBS ETF) trasferisce un certo numero di titoli dal portafoglio dell'ETF a una terza parte (mutuatario) per un periodo concordato a fronte di una commissione.

- Gli UBS ETF effettuano il prestito titoli solo per alcuni ETF a replica fisica domiciliati in Svizzera, Irlanda e Lussemburgo.

- L'obiettivo è ridurre i costi netti per gli investitori attraverso un reddito aggiuntivo.

- Le operazioni di prestito titoli di UBS ETF prevedono una sovracollateralizzazione non inferiore al 105%.

- Agli ETF domiciliati in Svizzera viene inoltre applicato uno scarto di garanzia (haircut).

- L'accurata selezione dei mutuatari e la valorizzazione mark-to-market giornaliera del collaterale mirano a ridurre al minimo il rischio.

- Elevata trasparenza grazie alla pubblicazione giornaliera dei collaterali per ciascun comparto.

Sì, alcuni ETF a replica fisica di UBS domiciliati in Lussemburgo, Irlanda e Svizzera partecipano al prestito titoli. Tuttavia, per gli UBS ETF obbligazionari, ESG/SRI e su metalli preziosi, la società di gestione del fondo non effettua alcuna operazione di prestito.

Il prestito di titoli da parte del fondo genera ricavi aggiuntivi (in genere 1-20 pb, a seconda dell'indice). I proventi del prestito titoli si riflettono nel NAV, riducendo direttamente il costo netto per gli investitori.

Il mutuatario paga all'ETF una commissione per la durata del periodo di prestito titoli. Inoltre, tutti i diritti come le cedole o i dividendi pagati sui titoli durante il periodo di validità del prestito vengono trasferiti all'ETF sotto forma di pagamento prodotto. Il prestito titoli consente quindi al fondo di generare ricavi aggiuntivi, che si riflettono nel valore patrimoniale netto (NAV) e riducono direttamente i costi netti per gli investitori.

Ai sensi della direttiva europea sui fondi OICVM e del CISA svizzero, l’ammontare dei titoli prestati può arrivare al 100%. La quota di titoli effettivamente dati in prestito nell’ambito di UBS ETF è notevolmente inferiore. Gli UBS ETF hanno fissato un limite massimo del 50% del valore patrimoniale netto di un ETF per il prestito titoli, mentre alcuni hanno un limite del 25% per soddisfare le esigenze del mercato.

Per ridurre al minimo il rischio legato al prestito di titoli su ETF, i mutuatari sono accuratamente selezionati e monitorati su base giornaliera. Prima di ricevere i titoli, i mutuatari devono fornire un collaterale al prestatore, ovvero l'ETF. Il collaterale serve a garantire gli obblighi del mutuatario nei confronti del prestatore. Il collaterale viene trasferito su un conto di deposito o un conto di garanzia completamente separato e tutelato rispetto al bilancio del prestatore.

Il prestito titoli può essere revocato quotidianamente su richiesta del prestatore. La valorizzazione giornaliera mark-to-market dei prestiti e dei collaterali assicura che il valore del collaterale costituito in garanzia dal mutuatario sia sempre adeguato al livello corretto. Inoltre, le operazioni di prestito titoli degli UBS ETF presentano sempre una sovracollateralizzazione non inferiore al 105%. Per gli ETF domiciliati in Svizzera, viene applicato un haircut aggiuntivo al collaterale sottostante. Il prestito titoli termina quando viene revocato dall'ETF o quando viene soddisfatta la richiesta del mutuatario. La garanzia detenuta viene restituita al mutuatario solo dopo che i titoli sono stati restituiti all'ETF.

L'agente di prestito titoli per gli ETF domiciliati in Lussemburgo è State Street Bank International GmbH, Monaco, Germania, e State Street Bank and Trust Company. Per gli UBS ETF svizzeri, UBS Switzerland AG agisce come unico mutuatario (principale) del programma di prestito.

State Street agisce come agente di prestito. L'elenco dei mutuatari dell'agente di prestito è approvato dai rappresentanti di UBS e corrisponde inoltre all'elenco delle controparti di UBS. Il rischio di controparte è monitorato quotidianamente dall'agente di prestito, State Street. State Street fornisce inoltre un indennizzo per inadempienza nel caso in cui un mutuatario non sia in grado di restituire i titoli. Le operazioni di prestito titoli di UBS ETF sono interamente garantite da collaterale.

UBS Switzerland AG è l'unico mutuatario (principale) rispetto all'ETF e garantisce tutti gli obblighi contrattuali. Per proteggere l'ETF dal rischio di controparte di UBS, UBS Switzerland AG fornisce collaterale in base alle severe disposizioni della FINMA (Ordinanza sugli organismi d'investimento collettivo).

- I termini dell’operazione sono concordati tra l'agente di prestito e il mutuatario e viene fornito il collaterale.

- Una volta che il collaterale è stato ricevuto dall'agente di prestito, i titoli dati/presi in prestito sono trasferiti al mutuatario.

- Il prestatore (cioè l'ETF) rimane il proprietario effettivo del titolo in prestito, pertanto l'agente di prestito incassa tutti i diritti pagati su ciascun titolo durante il periodo di validità del prestito e li ritrasferisce al prestatore come pagamento prodotto. Il prestatore si trova nella stessa posizione economica in cui si troverebbe se il titolo non fosse stato prestato.

- Il mutuatario paga all'agente di prestito la commissione di prestito prestabilita. I pagamenti sono concordati ed effettuati su base mensile.

- Il mutuatario restituisce i titoli una volta soddisfatta la richiesta, o prima se il prestatore liquida una posizione. Tutte le operazioni sono richiamabili quotidianamente su richiesta e non vengono effettuate operazioni a termine.

- Una volta che la garanzia è stata restituita al conto di deposito del prestatore, l'agente di prestito restituisce il collaterale detenuto al mutuatario.

- UBS ETF ha affidato il mandato di prestito titoli a UBS Switzerland AG, che agisce in qualità di fornitore principale di prestito titoli.

- UBS Switzerland AG riutilizza i titoli presi in prestito in linea con la domanda dei mutuatari esterni e delle fonti interne a UBS. UBS tratta con i mutuatari esterni e interni alle normali condizioni di mercato.

- Gli UBS ETF hanno un rischio di credito solo nei confronti di UBS Switzerland AG, ma non nei confronti dei mutuatari esterni.

- Le commissioni ricevute dal mutuatario di mercato vengono suddivise in base a un accordo prestabilito di ripartizione delle commissioni tra l'UBS ETF e UBS Switzerland AG.

- Nel caso in cui un titolo sia in prestito a una data di registrazione, UBS Switzerland AG trasferirà tutte le operazioni societarie all'ETF. Le cedole e i dividendi saranno pagati all'ETF tramite un pagamento sostitutivo che assicura all'ETF una posizione economica almeno pari a quella che avrebbe se i titoli non fossero stati dati in prestito alla data di registrazione.

- UBS Switzerland AG restituirà i titoli all'ETF al termine del prestito, o se l'ETF desidera riottenere i titoli, ad esempio in caso di vendita. Il gestore di portafoglio dell'ETF può vendere i titoli in qualsiasi momento, anche se sono in prestito. Per questo motivo, il prestito titoli non interferisce con il processo d'investimento principale.

Le operazioni di prestito titoli per gli UBS ETF costituiti in Lussemburgo sono interamente garantite. L'autorità di regolamentazione lussemburghese richiede una collateralizzazione minima del 90%, tuttavia gli UBS ETF presentano una sovracollateralizzazione del 105%.

Il collaterale è detenuto in un conto di deposito separato e tutelato rispetto al bilancio dell'agente di prestito. Ulteriori misure di mitigazione del rischio sono l'attenta selezione dei mutuatari e la rivalutazione dei prestiti e delle garanzie su base giornaliera.

Prestito titoli per ETF domiciliati in Lussemburgo e Irlanda

Per gli UBS ETF domiciliati in Lussemburgo e Irlanda che effettuano prestiti di titoli, sono attualmente accettate le seguenti tipologie di collaterale:

- ESono ammessi i titoli azionari dei seguenti indici: AS30, ATX, BEL20, SPTSX, KFX, HEX25, CAC, DAX, HSI, FTSE, MIB, NKY, AEX, OBX, STI, IBEX, OMX, SMI, SPX, INDU, NYA, CCMP, RAY, UKX, SX5P, N100 e E100

- Sono ammessi i titoli di Stato dei seguenti Paesi: Australia, Austria, Belgio, Canada, Danimarca, Finlandia, Francia, Germania, Giappone, Paesi Bassi, Nuova Zelanda, Norvegia, Svezia, SNB Bill, Regno Unito e Stati Uniti (comprese le agenzie)

Fonte: State Street, 04 febbraio 2022

Tipo e livello di collateralizzazione richiesti per gli ETF domiciliati in Lussemburgo e Irlanda

|

| Tipo di collaterale |

| |||

|---|---|---|---|---|---|---|

Tipo di titoli presi in prestito | Tipo di titoli presi in prestito | Titoli di Stato | Azioni internazionali | |||

Azioni internazionali | Azioni internazionali | 105% | 105% | |||

Azioni USA | Azioni USA | 105% | 105% |

Le operazioni di prestito titoli per gli UBS ETF domiciliati in Svizzera sono interamente garantite. UBS Switzerland AG dispone di un solido sistema di garanzie in linea con l'Ordinanza FINMA sugli investimenti collettivi di capitale.

Gli UBS ETF ricevono garanzie con un valore del collaterale pari al 105% del valore di mercato dei titoli prestati. Il collaterale consiste in attività liquide, tra cui titoli di Stato, azioni liquide e obbligazioni con un rating minimo stabilito da una delle agenzie di rating approvate dalla FINMA. Nel determinare il valore collaterale di un titolo, il suo valore di mercato viene ridotto di uno scarto di garanzia (haircut) fino all'8%.

Vari limiti di concentrazione assicurano un'adeguata diversificazione e liquidità del portafoglio di garanzie.

Un processo giornaliero di mark-to-market assicura che il valore del collaterale sia aggiornato per rispecchiare il valore del prestito.

Il collaterale è detenuto a nome del prestatore in un conto segregato per le garanzie, separato dalla massa fallimentare di UBS Switzerland AG.

Prestito titoli per ETF domiciliati in Svizzera

Per gli UBS ETF domiciliati in Svizzera che effettuano prestiti di titoli, attualmente sono accettati come collaterale i seguenti tipi di titoli (esclusi i titoli della controparte mutuataria):

- Titoli di Stato emessi dai Paesi del G10. I titoli di Stato non emessi negli Stati Uniti, in Giappone, nel Regno Unito, in Germania o in Svizzera devono avere almeno un rating "A" o equivalente

- Obbligazioni societarie con rating minimo "A" o equivalente

- Azioni emesse da società rappresentate nei seguenti indici: AEX, ATX, BEL20, CAC, DAX, INDU, UKX, HEX25, KFX, OMX, OBX, SMI, SPI, SPX, SX5EPI, SPX, SX5E

Fonte: UBS Svizzera AG, 20 settembre 2021

Haircut e margine*

Al valore di mercato dei titoli prestati viene aggiunto un margine del 5% per determinare il requisito di garanzia. Il valore collaterale di un titolo è pari al suo valore di mercato meno uno scarto di garanzia (haircut), come indicato nella tabella seguente:

Azioni internazionali | 8% | ||

Titoli di Stato emessi da USA, JP, UK, DE, CH | 0% | ||

Titoli di Stato con rating minimo "A" (esclusi USA, UK, DE, CH) | 2% | ||

Obbligazioni societarie con un rating di almeno "A" | 4% |

UBS ha limitato i prestiti da parte di un singolo UBS ETF al 50% del suo patrimonio gestito. Nella pratica, e di norma, la percentuale effettivamente prestata è notevolmente più bassa