Macro Monthly Managing risk in a time of war

Russia’s unprovoked war on Ukraine is aggressive and expansive in scope, adding another vector of volatility to financial markets.

Highlights

Highlights

- As Russia’s invasion into Ukraine deepens, the distribution of economic and market outcomes widens, and the skew becomes more negative.

- Ultimately, we see the negative economic impacts as manageable. The global economy is on strong footing, with robust private sector balance sheets and China’s stimulus supporting growth.

- In response to elevated geopolitical risks, we are keeping space available to add exposure if markets overshoot to the downside, maintaining or adding to hedges, and rotating capital into opportunities where we see a more attractive risk-reward, like Chinese equities

Russia’s unprovoked war on Ukraine is aggressive and expansive in scope, adding another vector of volatility to financial markets. This is a broad invasion, not a limited incursion. Russia’s goals appear to be the demilitarization of Ukraine as well as the removal and replacement of its governing class. The breadth of these ambitions means that the potential consequences are also significant. Meaningful global sanctions have been levied against Russia – hitting its central bank, companies, and some powerful citizens and politicians. These moves are aimed at bringing Russian President Vladimir Putin to heel – but also raise the risk of a disorderly economic retaliation or military escalation. This war is widening the distribution of economic and market outcomes, and the skew has become more negative.

The war and the economy

The war and the economy

It is important to remember the economic fundamentals before this invasion: the US labor market was adding jobs at a rapid clip, even during the worst of the Omicron outbreak. European service-sector activity was also bouncing back in February as the public health situation improved. And Chinese monetary and fiscal stimulus were poised to start showing more signs of stabilizing the domestic economy, in our view. We believe this foundation remains largely intact.

The primary channel through which this war will drag on economic growth is through higher energy prices. According to UBS Investment Bank, a USD 10/barrel rise in oil prices sustained over six to 12 months would be expected to weigh on consumption and crimp global growth by 0.1 percentage points. If oil prices were to rise to USD 110/barrel and stay there, this would be a roughly 0.3 percentage point drag on activity relative to the start of the year. All else equal, that would still leave real global growth on track for its second-best year out of the past decade (trailing 2021).

In our view, an even larger spike in oil and/or natural gas prices would not kick off a sustained inflationary spiral. It is more likely that this would result in lower growth, and in turn lower inflation, before too long. Either spending more on energy would cause consumers to cut back in other areas, or central banks would aggressively tighten policy and crush the expansion – and by extension, inflation. In any event, this constitutes a downside scenario, not our base case.

Whether central banks are more preoccupied with downside risks to growth or upside risks to inflation will be an important influence on markets. We do not think monetary policymakers will abandon plans to reduce stimulus, but on the margin, they are likely to proceed more cautiously on tightening.

Different central banks will likely have different reaction functions. For instance, we believe the European Central Bank will be more reluctant to withdraw too much monetary stimulus in the near term, while the Federal Reserve’s tightening plans will be less affected by this ongoing crisis. This informs our more optimistic view on the US dollar.

We are also monitoring for how much this invasion reduces consumer and business confidence, particularly in Europe. Prior episodes of rising geopolitical concerns tend to be accompanied by concurrent slumps in corporate investment. But the potential economic negatives are already partially priced into financial markets. And there is the potential for governments to use subsidies to blunt the pain of higher energy prices for consumers.

These geopolitical-induced headwinds are coming to the fore at the same time as another material drag on activity – the spread of the Omicron variant – fades. A recession is highly unlikely, in our view. What is more likely is another year of above-trend growth given the strong economic foundation in place at the start of the year.

In our view, the key is to manage risk in these turbulent times. Typically, geopolitical strife tends to serve as a source of short-term downside for risk assets that, over time, is overcome by positive underlying fundamentals. The internals of equity markets and sharp drop in long-term bond yields suggest investors are too pessimistic on how big and prolonged the drag on growth will be, in our view. We are much more optimistic on relative value opportunities than beta, where the outlook has become less attractive because of the likely scale of central bank tightening.

There is likely to be considerable volatility across financial markets – in both directions – over the coming weeks as investors react to incoming information regarding the status of this war and actions the international community is taking to either aid Ukraine or punish Russia economically.

Scenarios

Scenarios

We believe the longer the war, the bigger the market and economic impacts. Scenarios in which Ukraine’s leaders resign, flee, or cede control to Russia if overmatched from a military perspective would provide visibility into the end of active warfare. So too would substantive peace talks or Russia unilaterally retreating after achieving certain military objectives. Such developments in the near-term would be more consistent with less severe implications for growth and investor sentiment, in our view.

Conversely, there are milestones that would imply a longer period of warfare or deeper hits to markets and the economy. Restrictions on access to Russian oil and gas – imposed by either the West or Russia – would also serve to amplify the negative economic effects of higher energy prices. Also, the establishment of a government by Ukrainian officials in the west of the country would likely entail a longer period of organized military opposition. It would also increase the odds of a tail scenario in which the theater of combat included NATO member countries. We view that outcome as highly unlikely, but think investors would need to increase the odds of such an event if the fighting endures and conditions devolve further.

Related

Macro updates

Macro updates

Keeping you up-to-date with markets

Asset class attractiveness (ACA)

Asset class attractiveness (ACA)

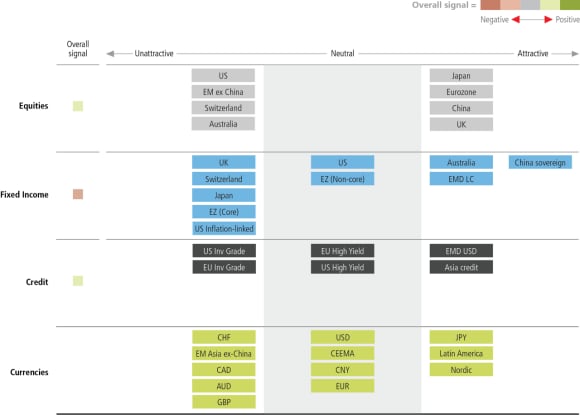

The chart below shows the views of our Asset Allocation team on overall asset class attractiveness, as well as the relative attractiveness within equities, fixed income and currencies, as of 1 March 2022.

Asset Class | Asset Class | Overall signal | Overall signal | UBS Asset Management’s viewpoint | UBS Asset Management’s viewpoint |

|---|---|---|---|---|---|

Asset Class | Global Equities | Overall signal | Neutral | UBS Asset Management’s viewpoint |

|

Asset Class | US Equities | Overall signal | Light red | UBS Asset Management’s viewpoint |

|

Asset Class | Ex-US Developed market Equities | Overall signal | Light green | UBS Asset Management’s viewpoint |

|

Asset Class | Emerging Markets (EM) Equities(ex. China) | Overall signal | Light red | UBS Asset Management’s viewpoint |

|

Asset Class | China Equities | Overall signal | Light green | UBS Asset Management’s viewpoint |

|

Asset Class | Global Duration | Overall signal | Light red | UBS Asset Management’s viewpoint |

|

Asset Class | US Bonds | Overall signal | Neutral | UBS Asset Management’s viewpoint |

|

Asset Class | Ex-US Developed-market Bonds | Overall signal | Light red | UBS Asset Management’s viewpoint |

|

Asset Class | US Investment Grade (IG) Corporate Debt | Overall signal | Light red | UBS Asset Management’s viewpoint |

|

Asset Class | US High Yield Bonds | Overall signal | Neutral | UBS Asset Management’s viewpoint |

|

Asset Class | Emerging Markets Debt - US dollar / Local currency | Overall signal | Dark green / Light green | UBS Asset Management’s viewpoint |

|

Asset Class | China Sovereign | Overall signal | Dark green | UBS Asset Management’s viewpoint |

|

Asset Class | Currency | Overall signal |

| UBS Asset Management’s viewpoint |

|

A comprehensive solutions provider

A comprehensive solutions provider

UBS Asset Management Investment Solutions manages USD 173.9 billion (as of 31 December 2021). Our 100+ Investment Solutions professionals leverage the depth and breadth of UBS's global investment resources across regions and asset classes to develop solutions that are designed to meet client investment challenges. Investment Solutions' macro-economic and asset allocation views are developed with input from portfolio managers globally and across asset classes.

For more information, contact your UBS Asset Management representative or your financial advisor.

Make an inquiry

Fill in an inquiry form and leave your details – we’ll be back in touch.

Introducing our leadership team

Meet the members of the team responsible for UBS Asset Management’s strategic direction.