The Decade Ahead

What will a maturing Chinese economy mean for investors?

Key questions

![]()

header.search.error

The Decade Ahead

Key questions

A new normal is coming into view for China. Constraints on old growth drivers and a new focus on higher-quality growth will likely temper its GDP growth toward a 4–4.5% pace over the next decade. For investors, this means a greater long-term focus on sectors aligned with the country’s efforts to boost its tech self-sufficiency, localize mass consumption, upgrade its high tech and industrial sectors, and lead the global green transition.

What does a maturing China look like?

China is transitioning toward a path of more moderate growth.

Historical drivers of growth, including exports, fixed asset investment in property, and low-cost manufacturing, have slowed. High rates of fixed asset investment have led to rising debt and overcapacity in some segments of the economy. And while rapidly rising GDP per capita and wages have been positive for potential consumption, they have reduced China’s ability to compete for low-cost manufacturing.

Meanwhile, demographic trends are becoming an increasing headwind. China’s population age 60 and older already accounted for nearly a fifth of the total population in 2022. The country is vulnerable to climate risk, with a recent World Bank report suggesting that climate change could lead to losses equivalent to between 0.5% and 2.3% of total GDP per annum as soon as 2030. And geopolitical uncertainties may both dent its market share in global manufacturing and hinder technological innovation and industrial upgrades.

How will China’s economy evolve amid these challenges?

Over the rest of this decade, we expect Chinese GDP growth to be in the 4–4.5% range, after the around 10% rates of the 2000s or the near 8% rates of the 2010s, with a new focus on higher-quality growth.

We think each of the challenges above will be addressed through a mixture of public policy support and private-sector solutions. The latter will likely create compelling investment opportunities tied to the key growth levers: the industrial upgrade cycle, mass consumption, and the green transition.

First, while demographic challenges may prove a headwind for overall growth, we also expect them to enhance focus on higher value-added manufacturing, which is already worth 22% of total exports. An aging population will also spur growth in the “silver” economy, presenting investment opportunities in sectors including elderly care services and facilities, cosmetic surgery, and wealth management. One example is the expansion of China’s pension market, which has doubled in the past six years and totaled CNY 12 trillion by end-2020.

China: A new normal for growth

Real GDP growth, y/y in % average including estimates

Source: IMF, UBS, as of 30 October 2023

Second, China is positioning itself as a leader in decarbonization solutions, and we see opportunity across solar, wind, and nuclear fuels. National targets demand electricity generation from non-fossil fuels to account for 80% of total generation by 2060 from around 50% today. By 2027, China is expected to have 97 GW of new energy storage capacity—a roughly 50% compound annual growth from today’s levels, according to China Energy Storage Alliance. Meanwhile, government incentives aim to cement China’s position as the world’s largest electric vehicle market. And all of the above look set to obtain support from a green financing market that has risen more than threefold in five years to reach CNY 30 trillion in the first half of 2023.

Finally, while geopolitical tensions have risen, they have also spurred China to put a strategic emphasis on self-sufficiency, especially in semiconductors, 5G technologies, AI, and rare earth metals. To this end, China has significantly increased semiconductor-related investment; raised total R&D spending to 2.6% of GDP (from less than 2% a decade ago); and aims to increase this further by at least of 7% each year.

We also expect the trend of self-sufficiency to extend into consumption, allowing for the growth of homegrown brands in fields ranging from sportswear and cosmetics to jewelry and autos, and for the continued growth in e-commerce, particularly for companies that succeed in increasing penetration in rural areas and improving payment infrastructure.

Investment implications

The rebalancing of China’s growth will mean a changing investment opportunity set.

Within China, we favor investments aligned with the country’s long-term priorities, including self-sufficiency, decarbonization, and higher value-added manufacturing. Specifically, we like cloud software and hardware companies poised to take advantage of China’s total AI market size growing more than 20% annually over the next few years, while China’s leading internet portals should benefit from integrating AI functions into their platforms. We also find opportunity in leading electric vehicle producers given strong domestic growth and rising exports to the Eurozone and Southeast Asia. Finally, we expect the country’s focus on high-value manufacturing to support the supply technology and automation industries.

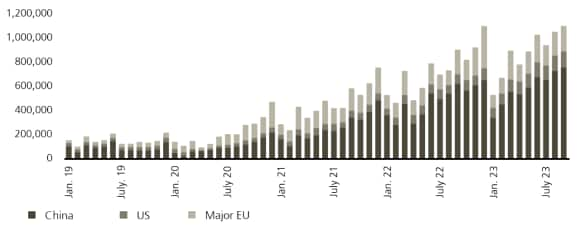

China is the world's largest electric vehicle market

Global EV sales (units)

At a broad market level, it may be argued that just as China’s period of high growth did not prove very helpful for Chinese equity market returns, a period of lower growth will not necessarily be negative, either. Lower but higher-quality growth could even be positive for market returns if the country’s economic transition creates greater opportunities for companies to innovate successful and high-margin products and services.

Elsewhere in Asia, we see strong economic and market growth potential in both India and Indonesia. As China’s overall growth slows, we believe India could attract increasing investor flows. Indian equities look set to benefit from comprehensive reforms, India’s expanding role in reordered global supply chains, and favorable demographics, with a working-age population set to grow 82 million a year until the end of this decade. Meanwhile, we expect Indonesia to benefit from its positioning as a regional hub to support China’s higher tech industries, including supplying components for electric vehicle batteries.

Looking beyond Asia, China’s rapid growth has been an important driver of demand for sectors around the world, including materials, energy, consumer goods, auto, and industrials. Looking ahead, we do not expect these markets to become suddenly less important, though Chinese demand growth is likely to slow over the coming years.

In materials, while we expect exporters of raw materials to China to benefit from the country’s overall growth, investor money may start to shift toward infrastructure investments in fields such as greentech. Similarly, while China will remain a key source of demand for European consumer and industrial companies, a rising share of future growth could accrue to emerging Chinese companies focused on mass consumer and high value-added industrial activity.

Can China escape the middle-income trap?

Historically, countries that have experienced rapid growth and lifted their populations to the middle-income segment have often faltered in the next step of their development. A lack of competitiveness in manufacturing, an inability to innovate, or institutions that failed to keep pace with economic development have held back countries like South Africa and Brazil.

A few countries in Asia, including South Korea and Japan, broke through this trap, although after becoming high-income, Japan faced significant challenges that resulted in close to three decades of zero growth.

In our view, China is unlikely to share this fate. It is at a much lower stage of economic development than Japan was in the 1990s, with a current GDP per capita of USD 12,720 versus Japan’s USD 25,371 three decades ago. This means China still has higher potential growth. It also has a much larger domestic consumer market with its near 400 million strong middle class. In addition, while the Plaza Accord contributed to a sharp yen appreciation, an export slump, and some manufacturing shifting to the US, China is prioritizing self-sufficiency and reducing its overreliance on strategic sectors and maintaining supply chain stability.

Other chapters

This report has been prepared by UBS AG, UBS AG London Branch, UBS Switzerland AG, UBS Financial Services Inc. (UBS FS), UBS AG Singapore Branch, UBS AG Hong Kong Branch, and UBS SuMi TRUST Wealth Management Co., Ltd..