Are small caps taking big strides?

Small-cap stocks have historically led the market coming out of a recession, so can investors expect bigger opportunities from smaller companies in the year ahead?

24 Nov 2020

3 min read

Viara Thompson

Research Analyst, Pan-European Small & Mid Cap Equities

David W. Sullivan

Investment Analyst, US Small Cap Growth Equities

Kevin Barker

Head of Equity Specialists

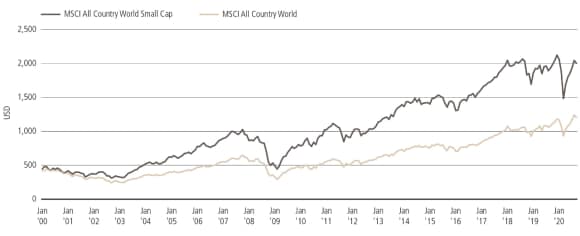

Small cap stocks underperformed large cap stocks in the turbulent period around COVID-19.1 This reaction is in line with the last global market correction in 2008 when small caps dropped further than large caps and rebounded more strongly in the recovery (see first chart below). Over the long term smaller companies have provided better returns and over a 20-year period the MSCI All Country Small Cap index outperformed the MSCI All Country World index by 2.3%2 per annum.

As markets and economies enter recovery post COVID-19, we believe it is an opportune time for investors to consider increasing their commitment to small cap strategies.3

Why invest in small caps?

Why invest in small caps?

According to Bloomberg, there are on average four sell side analysts per company covering small caps versus an average 16 analysts per large cap. This could provide well-resourced portfolio management teams with a substantial information advantage and enable them to identify attractive investment opportunities.

Small cap indices are less concentrated than large cap indices, with the largest 10 stocks in the MSCI ACWI Small Cap Index representing only 2.0% of the index’s total market cap, while the top 10 companies in the MSCI ACWI Index accounting for 15.7%.4 This means that small cap managers typically have a higher active share than large cap managers.

MSCI All Country World and MSCI All Country Small Cap (USD)

MSCI All Country World and MSCI All Country Small Cap (USD)

Over the past five years, the median small cap manager outperformed their benchmark by nearly 1.9% in Europe and 0.6% in the US, while the median large cap manager outperformed their benchmark by 1.4% in Europe and underperformed by 0.7%5 in the US.

Potential small cap investment pitfalls

Potential small cap investment pitfalls

Small cap indices often have a larger weight in cyclical sectors such as Materials and Industrials, while large cap indices typically have a larger weight in Information Technology and Communication Services. This is especially the case in the US and less so in Europe.

Small cap stocks also typically have a higher beta. This greater cyclicality has been a negative in 2020, but on a longer-term basis the higher cyclicality and beta is a positive for delivering better returns.

Environmental, social and governance issues are of increasing importance to investors and data for smaller companies can often be more difficult to access due to the relatively low coverage of these companies by data providers but this may begin to change with new regulation in 2021.

An attractive entry point

An attractive entry point

Clearly, the current earnings environment is very difficult for companies. This makes looking at short-term metrics such as price/earnings (P/E) ratios more challenging. The forward P/E ratio of 21.7 for small caps against a P/E of 19.2 for the MSCI ACWI reflects the higher cyclicality of earnings for smaller companies and the depressed earnings delivered so far during the pandemic-induced global recession. However, as economies move into recovery phase we should see the greater cyclicality lead to faster earnings growth, thereby justifying the higher shorter-term P/E ratio.

We expect the current disruption to accelerate certain structural changes in how we work and consume. While a few US mega caps are seen as beneficiaries of these changes, there are many investment opportunities in small caps, which are either niche champions or more strongly exposed to structural growth themes than their larger peers.

As the level of public information on small companies is lower, knowledge built up by investors over a long period and through numerous interactions with management teams is hard to replicate and extremely valuable in building sustainable long-term performance. Hence, a manager with greater depth of resources and experience may have a clear competitive advantage.