2Q 2020 Quarterly Investment Forum

Seizing opportunities in the current market environment

UBS Asset Management investment experts discuss the current market environment, and the risks and opportunities they see over the next quarters.

Speaker summaries:

Speaker summaries:

Macro outlook-asset allocation

Macro outlook-asset allocation

Evan Brown, Head of Multi-Asset Strategy

The COVID-19 pandemic and associated lockdowns are causing what will likely be the deepest recession since the Great Depression. Still, this recession will probably also be one of the shortest in history, due to the extraordinarily fast and powerful policy response in the US and globally. The Fed has gone from monetary policy to outright credit policy, touching many areas of credit flow into the economy and introducing facilities well beyond those in 2008. Globally, the speed and scale of fiscal stimulus has dwarfed that provided during 2008/2009. And unlike the period following the financial crisis, we do not expect fiscal retrenchment given the populist pressures facing many governments.

A closer look at active equities

A closer look at active equities

Joe Elegante, Senior Portfolio Manager – Global Intrinsic Value Equities and Global Sustainable Equities

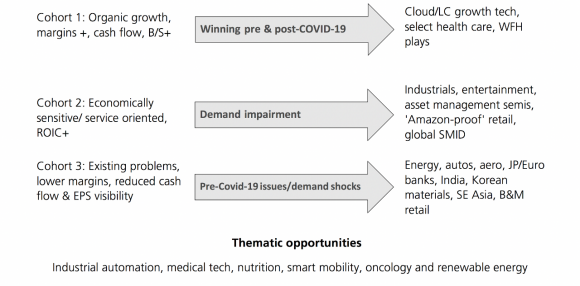

The current stock market drawdown and volatility creates an opportunity set for stock pickers. In order to look at where these opportunities may be, we start by separating stocks into three distinct cohorts.

The case for global fixed income

The case for global fixed income

Jonathan Gregory, Head of Fixed Income UK, Senior Portfolio Manager

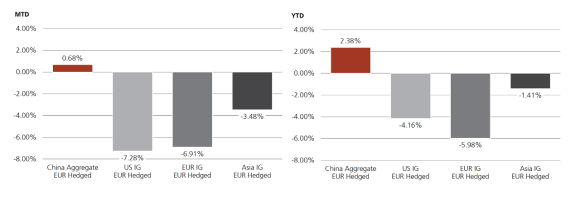

We have three trades we like in global fixed income right now; two are driven by the recent price dislocation and the third is a long term structural story we still like.

Global real estate is a lagging asset class

Global real estate is a lagging asset class

Matthew Johnson, Head of Real Estate US, Real Estate & Private Markets

Private market real estate pricing hasn't moved much yet, but the threat of reduced rent collections/top-line revenue resulting from a prolonged nationwide shelter-in-place order could cause operating deficits and mortgage delinquencies (beyond any initial forbearance lenders may provide). Senior mortgage financing may retract from traditional leverage levels.

Securitized credit will need a careful approach

Securitized credit will need a careful approach

Joseph Sciortino, Head of Credit Investments, UBS Hedge Fund Solutions

Coming into the COVID-19 crisis, the collateralized loan obligation (CLO) replaces housing and consumer loans which were the over-levered asset classes during the Global Financial Crisis. This has been fueled by the growth of the CLO market which has accounted for 70% of primary issuance of levered loans over the past two years. The growth of the single-B and below market has had a really dramatic impact on the overall quality of the loan market. The default rate in past cycles for that level is significantly higher. So you see the big jump in default rate that the distribution is much higher and the actual size of the loan market is significant.

The Fed has created a floor for investment grade spreads

The Fed has created a floor for investment grade spreads

Casey Talbot, Head of Fixed Income, O'Connor

The goal of the US Fed’s programs announced on March 23 was to quickly inject liquidity into a market that was overwhelmed by sellers due to redemptions/liquidations without a ballast of market makers or buyers. The Fed unveiled several facilities from the Global Financial Crisis period (PDCF, TALF, MMMLF, FX swap lines) along with a few new seminal programs to also address the CP, Muni, and credit markets.

Make an inquiry

Fill in an inquiry form and leave your details – we’ll be back in touch.

Introducing our leadership team

Meet the members of the team responsible for UBS Asset Management’s strategic direction.