China fixed income: low correlation - why and for how long?

Hayden Briscoe, Head of Fixed Income, Asia Pacific, explains why China’s onshore bond markets have low correlation and how long he expects it to continue.

China fixed income and low correlation: in 60 seconds

China fixed income and low correlation: in 60 seconds

- China fixed income has low correlation to overseas markets because of low foreign ownership, a buy-to-hold mentality within China's banking system, and China's independent monetary policy.

- It is likely that China's markets will slowly move more in line with global markets as investors make more use of the new market access channels, foreign investors become more influential, and pension funds and asset managers grow in size.

- But the advantage of low correlation is unlikely to disappear in the next three-to-five years, since the trends mentioned above will take time to fundamentally change the nature of China's onshore market.

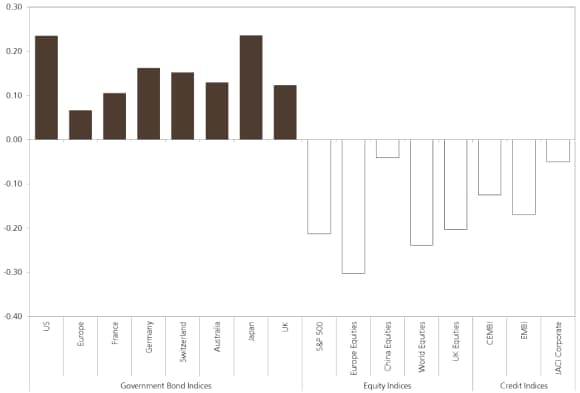

One of the standout features of China's fixed income market is the low correlation it has to global markets, exemplified by the comparison across asset classes in Exhibit 1. The low correlation of China bonds is seen as an important diversification benefit for global investors.

Exhibit 1: Correlation between Bloomberg China Aggregate Index (USD Unh) & Global Asset Classes, Sep 2015-Aug 2020

But why is this the case? We see three main reasons:

#1 Overseas investors' onshore holdings remain low

#1 Overseas investors' onshore holdings remain low

Access reforms like the opening of Bond Connect and index inclusion have opened up investing channels and brought foreign capital into China's onshore fixed income markets.

For example, overseas investors' onshore China bond holdings more than tripled from RMB 0.8 trillion to RMB 2.57 trillion between January 2017 and the end of June 2020, according to the People's Bank of China.

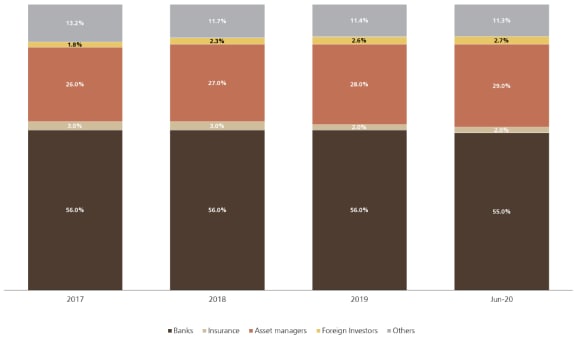

But as Exhibit 2 shows, the influence of foreign investors hasn't increased that much.

Their market share rose from 1.8% in 2017 to 2.7% by June 2020, mainly due to the domestic bond market expanding rapidly at the same time.

Between Jan 2017 and June 2020, overseas investors' holdings of onshore China fixed income have more than tripled from RMB 0.8 trillion to RMB 2.57 trillion, according to the People’s Bank of China

Exhibit 2: China's onshore fixed income market: ownership composition (%), 2017-Jun 2020

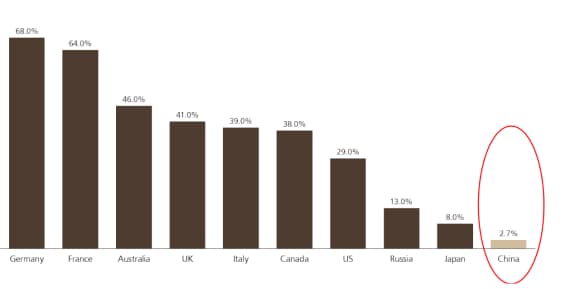

In contrast, Exhibit 3 shows that foreign investors are more influential in Germany, France, UK and the US than they are in China, partly explaining why China fixed income is less affected by trends in global markets.

Who buys China onshore bonds?

According to data from the end of June 2020, the main buyers of China onshore bonds are:

- Banks - mostly domestic China banks – (55.0% of the onshore bond market).

- Asset managers (29.0%).

- Others, i.e. state entities & corporates, (11.3%).

- Foreign investors (2.7%).

- Insurance companies (2.0%)

Exhibit 3: Global markets compared: foreign investor participation, June 2020

#2 Banks with 'buy-and-hold' mentality dominate the onshore market

#2 Banks with 'buy-and-hold' mentality dominate the onshore market

The make-up of market players in China's onshore markets also matters.

Banks dominate - holding 55% of all outstanding bonds as of June 2020 - and have a buy-and-hold mentality.

Bank investment behavior tends to factor in holding periods based off repo rates, central bank liquidity and projected funding costs, thus skewing their holdings to highly liquid government and government related bonds.

Credit related securities have a lot less liquidity, and accrual-based bank investors have credit spread buffers to compensate carry costs.

#3 China runs a very different monetary policy to the rest of the world

#3 China runs a very different monetary policy to the rest of the world

How does China manage monetary policy?

China's monetary policy borrows from the quantity-led model of the past, where banks lend against money supply targets and 'window-guidance' to favor specific industries.

This means investors have to assess both changes in government direct lending policies and interest rates interacting together, rather than just a pure monetary policy view which guides us in more developed countries.

Additionally, China moved its currency off the USD peg in 2005, allowing China's monetary policy to diverge from the US and other G7 countries.

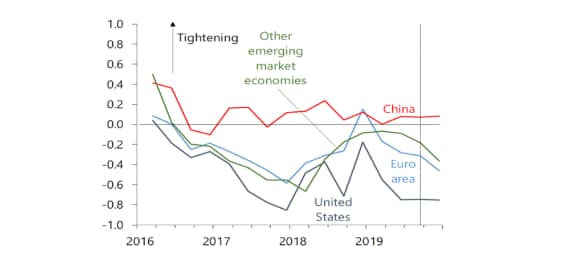

Between 2016 and mid-2019, China's monetary policy approach has clearly differed from that in the US, Euro area, and other emerging market economies.

And that's also been particularly true in 2020. G7 central banks cut their policy rates to near zero or negative levels. In contrast, China's central bank, (PBoC), have been cautious, leaving room to cut rates if the economic outlook worsens.

Additionally, China still has tight capital controls in place and manages its currency, which limits the inflow and outflow of capital to a degree.

Between 2016 and mid-2019, China's monetary policy approach has clearly differed from that in the US, Euro area, and other emerging market economies.

Exhibit 4: Monetary policy trends compared (tightening vs. easing): China, US, Euro area, other emerging market economies, Jan 2016-Jun 2019

Can we expect low correlation to last?

If greater foreign ownership was the deciding factor in raising onshore vs offshore correlation, we might expect stronger correlation as foreign investors become more influential in the market. However, as discussed above, this is a slow process.

However, we believe increased foreign ownership is not a sufficient factor to change the low correlation. We'd need to see a fundamental change in both China's monetary policy and the structural make-up of the onshore bond market.

Just relying on the monetary policy side we see this as unlikely. Yes, China is changing its policy, but it is unlikely that the government will give up its influence due to political reasons.

We think of China like Europe - there are 34 provinces with different cultural and economic dynamics. In a country as large and complex as China we sense it'd be a huge mistake to disband a blended approach of supply economics and monetary policy. Plus, the effectiveness of a pure monetarist approach as we see in the west, is questionable at best these days.

As to structural factors, these are changing – but at a very slow pace. For example, reforms are opening up the market to both local and overseas pension funds and asset managers, who we expect will become more influential and boost turnover and liquidity. However, the rate of growth of these constituencies remains slow in the context of the overall market, as demonstrated in Exhibit 2.

In summary, we acknowledge that China's bond market is both growing and changing rapidly. The low correlation demonstrated historically will be subject to the pressures discussed here: increasing foreign ownership, structural market change, and the evolution of China's monetary policy approach.

However, we doubt that these factors will meaningfully increase the correlation of China's bond space with global markets over the next three-to-five years, and expect the previously discussed diversification benefits of China bonds to last for the foreseeable future.

Fixed Income

Fixed Income

A globally oriented service for a globally integrated world

Make an inquiry

Fill in an inquiry form and leave your details – we’ll be back in touch.

Introducing our leadership team

Meet the members of the team responsible for UBS Asset Management’s strategic direction.