Who could be the winners and losers in the world of fixed income?

The ongoing pandemic will have a profound impact on economies for months and possibly years to come. What does that mean for bond investors today?

Authorities around the world have unleashed an unprecedented amount of fiscal and monetary support to offset the economic damage caused by COVID-19. The ongoing pandemic will have a profound impact on economies for months and possibly years to come. What does that mean for bond investors today?

Key webinar takeaways

Key webinar takeaways

- The eventual global economic recovery will be supported by the fast and creative monetary and fiscal support by governments and central banks which has gone well beyond what we witnessed in 2008/2009

- In the absence of a vaccine and effective therapeutics, the recovery will be unlike any we have ever known – investors must tread carefully. There will be growth setbacks and uneven effects around the world

- Just like in 2008, leverage in the financial system is ultimately getting transferred to governments. This will create winners and losers with some companies and industries better supported than others

- Not all regions and sectors are affected by COVID-19 in the same way. This creates some buying opportunities

- Domestic fiscal deficits funded by central bank bond purchases could reduce the flows of capital across borders in future

- Government monetary and fiscal support could set the stage for an eventual increase in inflation. Investors should consider owning inflation protection in portfolios

- We prefer investment grade over high yield credit and see selective opportunities in emerging markets in the medium to long term

Jonathan Gregory, Head of Fixed Income UK

Jonathan Gregory, Head of Fixed Income UK

The COVID-19 market aftermath

The market impacts post COVID-19 present three key pictures. First, nominal yields are much lower everywhere than before the crisis and real yields are generally lower but haven’t rebounded to pre-crisis levels, this could indicate opportunities for real yields to outperform in future. Second, we saw widened spreads across all credit markets, then a retracement which has paused more recently in investment grade and high yield (HY) and more noticeably in emerging markets (EM). EM spreads have not retraced to the same level as HY and Investment Grade

(IG) in developed markets which may present some upside opportunity. Third, the dollar experienced a high level of volatility and is now at a higher level than before the crisis started.

This environment will create winners and losers, and risks and opportunities for active investors. The most successful investors will be those that are flexible, question investment decisions and their own expectations and views.

Global fiscal stimulus in perspective

Global fiscal stimulus in perspective

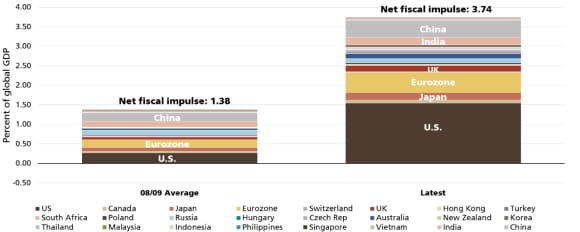

The mantra of governments globally is one of acting quickly and forcefully in response to the market turmoil. Fiscal stimulus today as shown below is almost three times higher than during the 2008/2009 crisis. Furthermore, these figures do not include government guarantee programs and shows just the actual government spending. In reality, the International Monetary Fund has stated that developed market fiscal deficit levels could average at 11% of global GDP by the end of the year or 15-20% if you include the corporate guarantee programs. The figures below, therefore, paint an understated picture of real debt levels.

Fiscal stimulus levels across developed countries

From monetary policy to credit policy

From monetary policy to credit policy

Many central banks have had to go above and beyond in their policies to support their economies. The COVID-19 pandemic and associated lockdowns are causing what will likely be the deepest recession since the Great Depression. The US Federal Reserve (Fed) has introduced facilities well beyond those in 2008. The liquidity facilities are very similar to the previous crisis but the Fed has had to expand to include credit facilities incorporating the primary and secondary credit markets. Main-street facilities – support for small and medium-sized companies – have also benefited from the expansion and are an important part of the monetary policy toolkit today.

The journey to the new world

The journey to the new world

In the absence of a virus vaccine and effective therapeutics the recovery will be unlike any we have ever known – we will need to tread carefully when economies reopen. The path to recovery will be quite uneven across countries. Even with a smooth exit, some countries will face challenges indirectly; for example manufacturers relying on imports from a country which is not as far along the recovery curve creating supply chain disruptions.

The era of 'independent' central banks and inflation targets is ending. For the past 10 years central banks were the dominant actors in markets, even before COVID-19 the heavy reliance placed on monetary policy alone and failure to meet inflation targets was presenting a challenge to central banks and governments to change the approach. For the foreseeable future monetary policy in many countries will be moving away from devotion to a single inflation target to an approach which is much more coordinated with fiscal policy. Governments will need their central banks to act to keep yields low.

Just like in 2008, leverage in the financial system is being transferred to governments. Fiscal deficits are growing this year which will create winners and losers – by accident or design. Companies supported by government schemes are more exposed to scrutiny on how they pay dividends, directors bonuses akin to the banking sector scrutiny during the global financial crisis.

COVID-19 and the policy aftermath will have implications for the movement of goods, people and capital.

The powerpoint slides are available upon request.

Q&A:

Q&A:

Make an inquiry

Fill in an inquiry form and leave your details – we’ll be back in touch.

Introducing our leadership team

Meet the members of the team responsible for UBS Asset Management’s strategic direction.