Where do we go from here for equities?

Market volatility creates opportunities, but selectivity is key

The COVID-19 outbreak has triggered market turbulence in recent months and seen prompt policy actions around the world. But will the pandemic change long-term views and is it an opportunity to make strategic adjustments within strategies? At a recent webinar, Max Anderl, Head of Concentrated Alpha Equity and Nicole Lim, Equity Specialist gave their views on the current bright spots and the areas to watch out for in the months ahead.

Key takeaways

Key takeaways

- The COVID-19 pandemic has meant that the bull market we have enjoyed over the past decade could finally be coming to an end.

- How and when to navigate the market in the coming months will be crucial, and we will look to continue to implement our buying selectively.

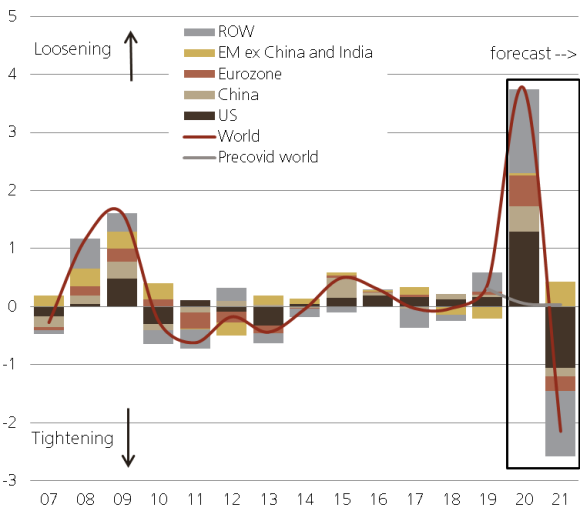

- When comparing an event-driven crisis like COVID-19 with the Great Financial Crisis of 2008/2009, we believe that the swift fiscal and monetary stimulus will be a key differentiator as the economy may be in a better position to recover.

- The shift in consumer preferences will likely come from pent-up demand and record stimulus measures.

- Post-pandemic, deglobalization and greater use of digital options are expected to create new investment risks and opportunities.

The focus around COVID-19 is now largely centered on when businesses will reopen and when governments feel there is a safe enough environment to do so, in the hope that pre-crisis levels of economic activity can resume.

Monetary and fiscal policy has played an enormous role and the response has been faster, and far more comprehensive than during the Great Financial Crisis of 2008/2009.

Stimulus will help support an economic recovery but we believe there will be a permanent shift in consumer preferences amid a combination of pent-up demand and weakened globalization which will change the investment landscape.

We believe that opportunities exist in quality cyclicals, most notably software companies and healthcare equipment providers, while industrials and semi-conductors stocks have some way to go. Timing remains key.

What does the Pandemic mean for stock picking?

What does the Pandemic mean for stock picking?

Where are we?

- Disease now more understood, recovery a question of time, economic impact uncertain

- Unprecedented low risk free rates, quickest largest stimulus

Side effects

- Liquidity crisis appears solved, bankruptcies and bail-outs likely to follow

- Permanent shifts in consumer preferences

- On the one side of the virus crisis - combination of pent-up demand and record stimulus

- On the other side of the tunnel - heavily indebted governments, weakened globalization, higher inventory

Equity investment implications

- Absolute return proposal: quality yield stocks in defensive sectors – however the most attractive entry point has now passed

- Quality cyclicals: profitable, valuation support

- Semiconductor equipment, software, biggest cloud players, healthcare equipment, industrials

- Working and added to on weakness

- Value ideas: operational or financial gearing, avoid both, as they may be the last leg to recover

- Avoid: deep value with weak balance sheet and structural problems, non profitable speculative business models, most affected industries

Change in cyclically-adjusted primary fiscal balance (% of global GDP)

Change in cyclically-adjusted primary fiscal balance (% of global GDP)

With banks in a better position than in 2008/2009, we are still expecting to see some restructuring but the safety nets in place as a result of fiscal stimulus should certainly be beneficial. Companies that have performed well, for example some of the tech names, have continued to do so through the current extreme environment. But we believe value stocks remain cheap and valuation spreads remain wide. Therefore, we remain selective in this area, either buying operationally geared companies or financially geared companies and avoiding those industries that we think may take longer to recover.

Q&A:

Q&A:

Make an inquiry

Fill in an inquiry form and leave your details – we’ll be back in touch.

Introducing our leadership team

Meet the members of the team responsible for UBS Asset Management’s strategic direction.