UBS Perspectives

What does it take to be an ally?

In the first of our new quarterly UBS Perspectives series focusing on the key diversity and inclusion issues reshaping the world, we held a lively debate on what it means to be an ally and why allyship is so important right now.

Michelle Bereaux

Michelle Bereaux

In recent years, diversity has moved from being an important aspect of the equality agenda to a business imperative, especially in delivering investment performance. At UBS Asset Management, we want to actively challenge both internal and external mindsets around the business imperative for diversity.

As the world has started speaking more openly about systemic racism, the role of allies has received renewed attention. The Oxford English Dictionary defines ’ally’ as a person or organization that cooperates with others for mutual benefit. In our context, we think about it as fostering a culture of allies in the workforce, helping to drive real change for diversity and inclusion. Our discussion today is about what it means to be an ally, and what each of us can do to help drive positive change.

Kenji Yoshino

Kenji Yoshino

It's fairly well established now that with regard to opportunity, allies have a much greater capacity to move the needle on diversity and inclusion, than the individuals who are directly affected. A recent study1 found that when individuals engaged in diversity and inclusion efforts on their own behalf they were usually either minorities or women, and they were often penalized for that. But if somebody stepped in on their behalf, they were not penalized for engaging in that behavior. It's very intuitive that sometimes we are a better advocate for others than we are for ourselves.

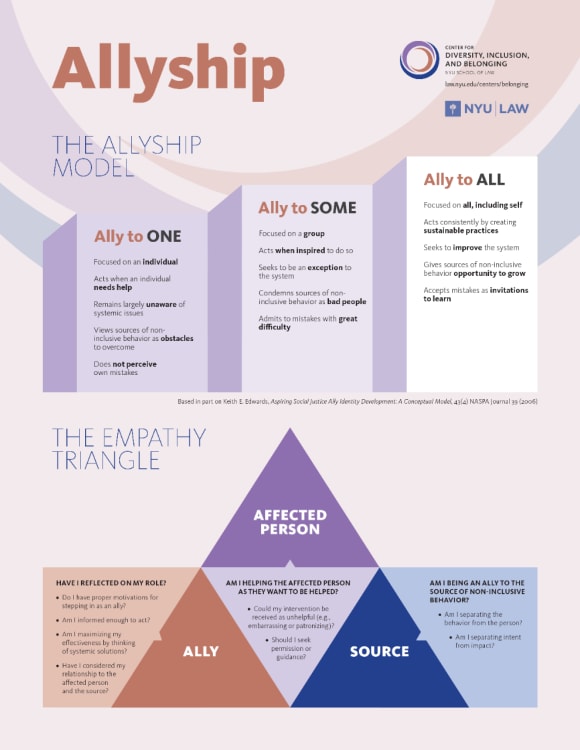

There are three distinct phases of the allyship model that I think of as a maturity curve that people often move through intuitively – from being an ally to one, to an ally to some and finally an ally to all. It involves a shift in mindset where we’re focused on everyone being inclusive to achieve mutual benefit.

Many people ask how to move from one phase to the other. And so we've developed a tool called the empathy triangle representing the three parties involved from the Ally’s perspective. These are questions that you need to ask of yourselves when you step up to be an ally, that will help you empathetically engage and not go barreling in, but also not to be frozen into inaction.

(Click to enlarge)

Suni Harford

Suni Harford

Being an ally to me is fundamental and I think it's something that we all recognize.

One of the old platitudes you always hear is that every decision made about your career opportunities is made when you're not in the room, and that by definition means that you have to have an ally in that room. What that means is someone thinking differently within that group to be the ally to diversity or inclusion. Allyship is absolutely critical to moving an organization forward.

One example that comes to mind is from the trading floor. I managed trading floors for a very long time, and the classic trading floor is centered around a trading desk that is run, almost universally, by a white male, who manages maybe 15 people and tends to like and gravitate to those people most like himself. That's human nature. When this person gets promoted or is moving on, the firm will ask him who his replacement should be. And it's typically going to be the white male that he's most familiar with and most comfortable with. Allyship at that level is breaking that cycle and developing a process where you have diverse panels to broaden out the thinking.

One of the things we are doing is examining systematically all of these systems we have and looking at the areas where unconscious bias or even blatant bias could exist, and looking to bring the light of day to those involved and change the way those processes work. And we're making progress but we certainly have a long way to go.

Q&A

Q&A