Your credit cards are managed under card accounts. We generate a separate tax certificate for each card account. You can find the tax certificates as follows:

- Log in to E-Banking.

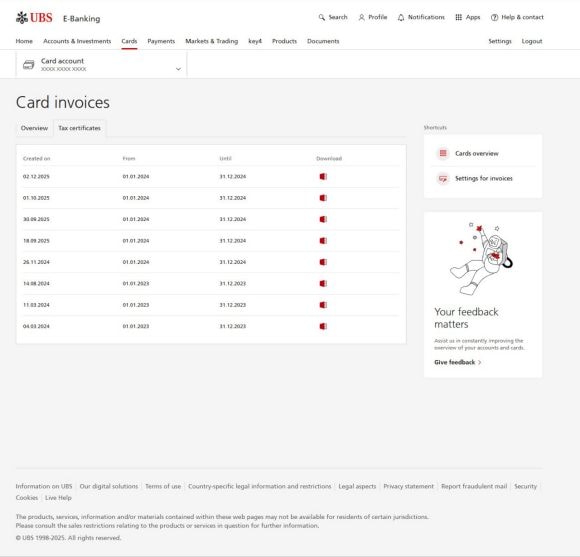

- Select Cards and then Card invoices.

- Select the card account for which you want to download the tax certificate.

- Select Tax certificates and click on the red PDF symbol on the right to access the tax certificate.

- Download the desired tax certificate.

The tax certificate shows the interest paid on your card. In Switzerland, this can be deducted from taxable income. Additionally, the account balance is relevant for wealth taxation; it must be declared either as an asset or a liability, depending on whether you had a credit balance or an outstanding balance as of December 31. Keep the certificate for your tax return. For further questions regarding your tax return, please contact a professional or visit the website of your canton of residence.