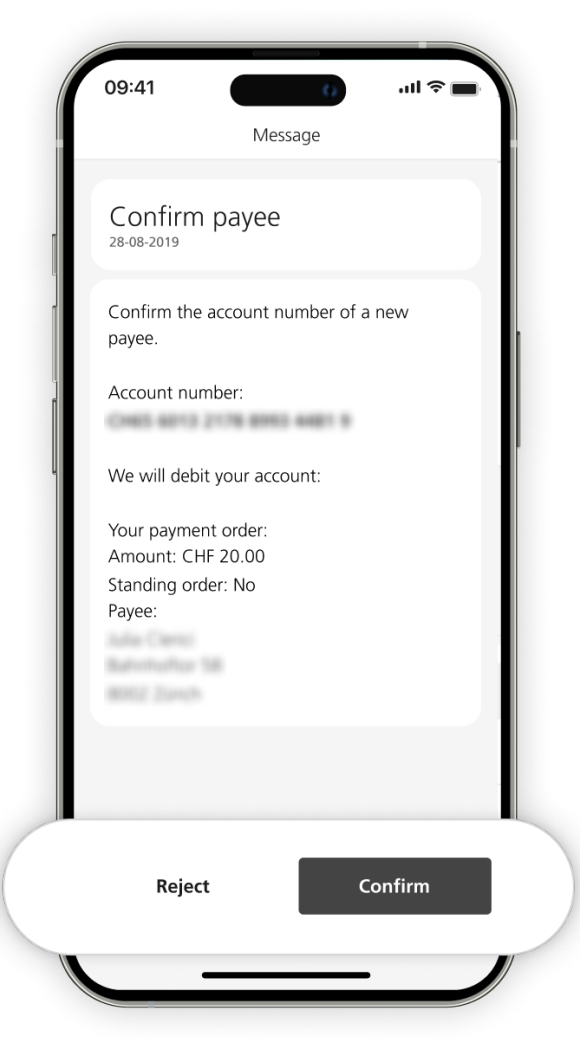

To protect your account, new payees must be confirmed once in E-Banking or the Mobile Banking App using the Access App or Access Card. This extra step helps prevent fraud and keeps your transactions safe.

Key points about confirming payees

Why confirm a payee?

A confirmed payee is someone you authorize to receive payments.

- You confirm the payee when making the first payment.

- Future payments to the same payee don’t require confirmation.

- This ensures only trusted recipients can receive your funds.

Why review your payee list?

Check your confirmed payees regularly to stay in control. This reduces the risk of unauthorized transactions.

Why am I asked to assess the payment for potential fraud?

This step is an important layer of protection for your account. Fraudsters often use persuasive tactics to trick people into making payments to unauthorized recipients. The Access App also provides specific tips based on the payment purpose to help you identify potential fraud quickly.

Can I pay someone without confirmation?

You can set a limit for payments that don’t require confirmation. Payments above this limit will still need to be confirmed.

Important: Payees to whom you have made a payment within this limit must also be confirmed once.

How do I set up a confirmation limit?

What if I see an unauthorized payee?

Act fast:

- Revoke the confirmation

- Check your payment history

- Contact UBS Digital Banking support immediately

Do I need to confirm health insurance?

Some payees, such as health insurance companies or telecommunications companies, have already been confirmed by UBS.

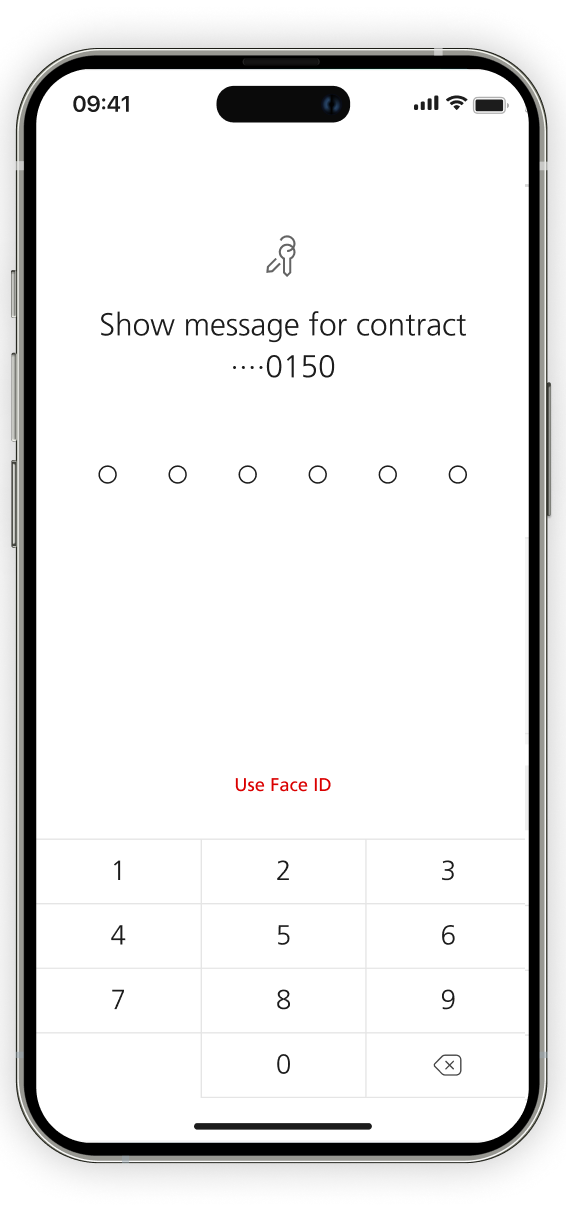

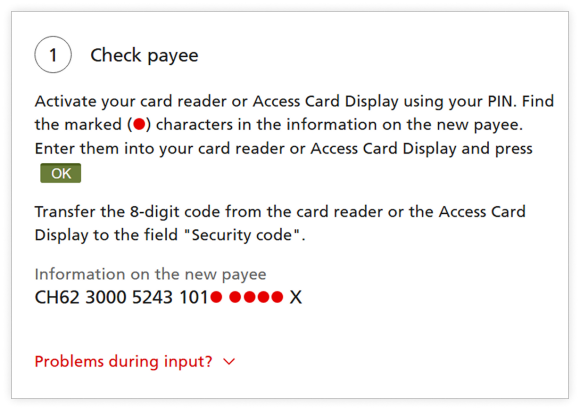

How to confirm a payee?

Was this page helpful?

Please enable javascript in your browser and retry.

The feedback component cannot be displayed.