Macro Monthly From micro to macro: Lessons from earnings season

We’re approaching the end of earnings season, a period when corporate executives offer assessments of the business climate and how they’re addressing operational challenges and opportunities.

Highlights

Highlights

- Insights from corporate executives during earnings season provide an alternative lens to enhance our understanding of the economic outlook.

- Business leaders have a much more optimistic view on future nominal growth than what is implied by the bond market.

- The better starting point for household balance sheets and prospects for capital spending are key differentiators that we believe will drive superior macroeconomic outcomes in this recovery compared to the one that followed the 2008-09 recession.

- Commentary from corporations reinforces our view that bond yields overstate the risks to activity and also supports procyclical equity positions on a regional and sectoral basis.

We’re approaching the end of earnings season, a period when corporate executives offer assessments of the business climate and how they’re addressing operational challenges and opportunities. Aggregating their bottom-up micro views provides a useful lens through which to augment our top-down analysis.

Collectively, their strategies will play a key role in not just reflecting but also shaping macroeconomic outcomes going forward. Corporate plans are particularly important to watch at this juncture: as fiscal policy becomes less stimulative, a strong handoff from public to private-led growth is needed to keep activity running at robust levels.

The bond market is telling you we are headed for another low nominal growth environment. But when we actually listen to leaders in the private sector, we believe the outlook is much more constructive. Our review of US and European quarterly earnings calls shows executives pointing to a longer runway for above-trend growth – both in terms of increases in real output as well as inflation.

Firms are upbeat about the financial health of their customers. Companies are generally confident in their ability to pass through higher prices, thanks in part to excess household savings. The business-to-business demand pipeline is buoyed by high levels of current activity, a need to replenish inventories drawn down during the early recovery phase, and an inability to do so in some cases due to supply constraints. And while the delta variant is viewed as downside risk, it is not currently crimping activity in developed markets or prompting downgrades to corporate guidance.

The better starting point for household balance sheets, which should underpin consumption, and substantial business investment are, in our view, the key differentiators that will improve macroeconomic results this cycle compared to the relatively sluggish growth following the 2008-09 recession.

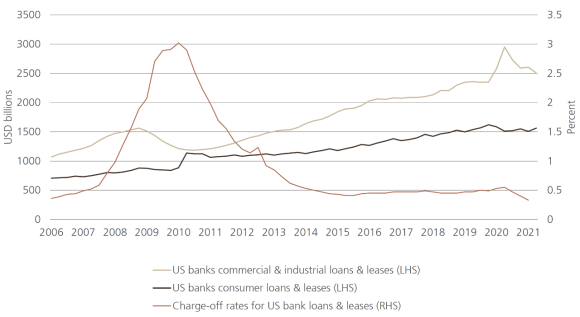

Exhibit 1: Credit quality is strong: weak loan growth a function of private balance sheet strength

Exhibit 1: Credit quality is strong: weak loan growth a function of private balance sheet strength

Better balance sheets

In our view, the starting points for private balance sheets provide a far sturdier foundation for this expansion compared to the aftermath of the 2008-09 recession.

Reports from financial institutions show the degree of fiscal income supports during the crisis is proving a mixed blessing for banks during the recovery phase. Most importantly, mass insolvencies were prevented and credit quality preserved. The share of loans and leases that banks expect will not be repaid is below pre-pandemic levels. This, in turn, has allowed banks to reduce the amount of money they set aside to cover bad loans – a dynamic that contributed to meaningfully higher than expected profits this reporting period. But on the other hand, household and corporate balance sheets are in such a strong position that loan growth has been lackluster.

In 2009, slow credit growth was a function of lingering damage to the financial system that impeded intermediation. Now, it is a reflection of broad financial health.

Inflation has staying power

Commentary from corporate leaders suggests inflation will have staying power as a macro driver, even as bond markets remain sanguine about elevated price pressures. And within the equity market, pricing power will continue to serve as key differentiator of winners and losers. The varied abilities of companies to pass on higher material and labor costs reinforces our view that this environment is more attractive for active management than broad equity market beta.

Some firms are able to pass on higher prices with no impact on demand. Others are unwilling to fully pass higher input costs on to customers, so margins suffer. Because of pre-existing contracts, some firms are unable to immediately implement price increases, but plan to do so with a lag. Others have a strategy to pass along inflation smoothly over time.

It is important to note that in aggregate, US companies are exceeding expectations on earnings by more than on revenues. This suggests that, for now, fears about margin pressure have been overstated. But a more prolonged stretch of price pressures could either challenge profitability, or the longevity of ultra-accommodative central bank policies. Inflation could either continue to remain uncomfortably high, or margin compression could ensue.

The great restocking

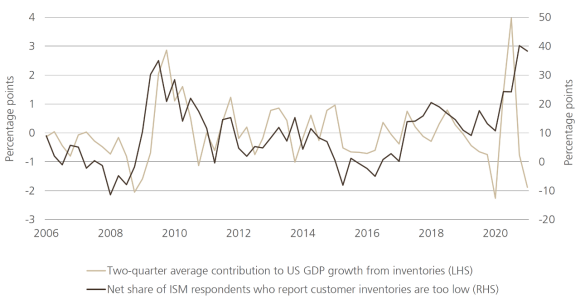

Shortages are the product of a surprisingly quick economic recovery, and also a reason why growth can continue to stay strong. Meeting high levels of current demand and a stated desire to rebuild inventories mean that supply frictions – most notably relating to semiconductors – may linger broadly across different industries for some time, while gradually lessening in intensity. To paraphrase one semiconductor CEO, traffic jams take 15 minutes to start, but an hour to get resolved. Greater capital expenditures to unlock additional production downstream is a virtuous process that allows for pent-up demand to be delayed, then realized, rather than destroyed.

Companies are also planning to use any near-term soft patches in demand, whether seasonal or otherwise, to restock inventories rather than curtail output. Firms that have been able to replenish inventories are talking this point up as a competitive advantage that allows them to grow the top line and market share. Conglomerates are giving business units more leeway to tilt working capital towards inventories, and don’t see any buildup of inventories downstream – a signal of strong end user demand. Similarly, retailers are already concerned about having enough product in stock for the Christmas season.

Companies are indicating that the low hanging fruit for increasing production via current levels of property, plant, and equipment has been picked. Meeting higher levels of demand requires additional capital expenditures. In transportation and semiconductors, two industries with high sensitivity to global trade and activity, executives are signaling business investment will need to stay elevated well into 2022, a major catalyst for the global economy.

Exhibit 2: Inventory drag could soon turn into a tailwind

Exhibit 2: Inventory drag could soon turn into a tailwind

Exhibit 3: Bright outlook for business investment

Exhibit 3: Bright outlook for business investment

Expected capital expenditures in six months' time relative to their five-year average

Delta

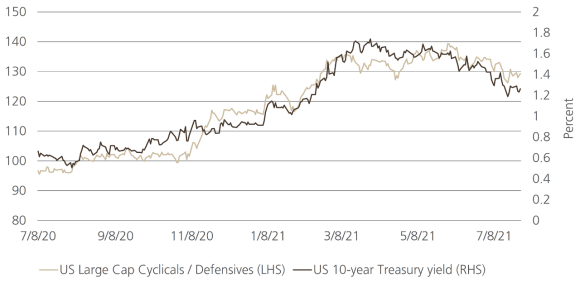

The decline in bond yields and outperformance of defensives relative to cyclical stocks in recent weeks suggests that investors are increasingly concerned about a loss of growth momentum, in part exacerbated by the spread of the delta variant. However, the message from corporates is that delta is not a drag – it’s a risk.

The airline industry was among the most affected by the spread of the pandemic in 2020, and sensitive to changes in sentiment on public health outcomes. So far, the variant is not adversely impacting booking activity or guidance. European carriers expect short-haul flights to continue to improve, just as the US has, and are seeing strong bookings for August and September. Members of the C-Suite have remarked that proof of vaccines has fueled the surge in airline activity, and vaccines remain largely effective against the variants. One airline CEO observed that the typical connection between increases in negative COVID-19 headlines and no shows/cancellations has weakened recently, suggesting that their customers are either vaccinated or sufficiently desensitized to bad news on this front.

Exhibit 4: Bond yields, equity internals point to ebbing optimism on economic outlook

Exhibit 4: Bond yields, equity internals point to ebbing optimism on economic outlook

Conclusion

Bond markets and equity market internal dynamics are hinting at a return to the lackluster cycle of economic growth that followed the financial crisis. But corporate executives appear to be preparing for and shaping a brighter future, one with healthy household balance sheets, shortages and low inventory levels across industries, and capital expenditures needed to meet this growing demand from consumers and businesses.

In our view, bond yields are exaggerating the medium-term risks to both activity as well as inflation and are poised to move higher. Likewise, we believe cyclically-sensitive equity regions such as Europe and sectors like financials and energy are well positioned to outperform in this more vigorous economic expansion.

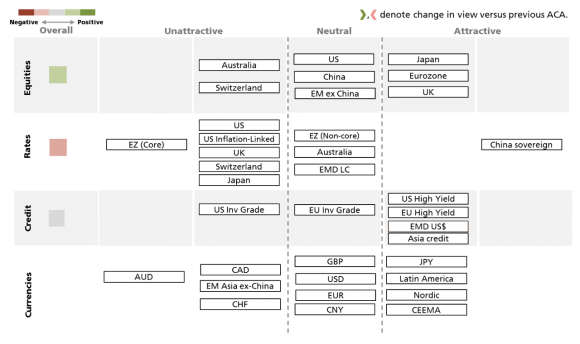

Asset class attractiveness (ACA)

Asset class attractiveness (ACA)

The chart below shows the views of our Asset Allocation team on overall asset class attractiveness, as well as the relative attractiveness within equities, fixed income and currencies, as of 30 July 2021.

Asset Class | Asset Class | Overall signal | Overall signal | UBS Asset Management’s viewpoint | UBS Asset Management’s viewpoint |

|---|---|---|---|---|---|

Asset Class | Global Equities | Overall signal | Light green | UBS Asset Management’s viewpoint |

|

Asset Class | US Equities | Overall signal | Neutral | UBS Asset Management’s viewpoint |

|

Asset Class | Ex-US Developed market Equities | Overall signal | Light green | UBS Asset Management’s viewpoint |

|

Asset Class | Emerging Markets (EM) Equities (ex-China) | Overall signal | Neutral | UBS Asset Management’s viewpoint |

|

Asset Class | China Equities | Overall signal | Neutral | UBS Asset Management’s viewpoint |

|

Asset Class | Global Duration | Overall signal | Light red | UBS Asset Management’s viewpoint |

|

Asset Class | US Bonds | Overall signal | Light red | UBS Asset Management’s viewpoint |

|

Asset Class | Ex-US Developed-market Bonds | Overall signal | Light red | UBS Asset Management’s viewpoint |

|

Asset Class | US Investment Grade (IG) Corporate Debt | Overall signal | Light red | UBS Asset Management’s viewpoint |

|

Asset Class | US High Yield Bonds | Overall signal | Light green | UBS Asset Management’s viewpoint |

|

Asset Class | Emerging Markets Debt | Overall signal | Light green / Neutral | UBS Asset Management’s viewpoint |

|

Asset Class | Chinese Bonds | Overall signal | Dark green | UBS Asset Management’s viewpoint |

|

Asset Class | Currency | Overall signal | - | UBS Asset Management’s viewpoint |

|

A comprehensive solutions provider

A comprehensive solutions provider

UBS Asset Management Investment Solutions manages USD 167.9 billion (as of 30 June 2021). Our 100+ Investment Solutions professionals leverage the depth and breadth of UBS's global investment resources across regions and asset classes to develop solutions that are designed to meet client investment challenges. Investment Solutions' macro-economic and asset allocation views are developed with input from portfolio managers globally and across asset classes.

For more information, contact your UBS Asset Management representative or your financial advisor.